Amplify ETFs issued a report suggesting Ripple’s Mastercard pilot program could boost XRP demand. The report indicates the integration of traditional finance with blockchain technology, emphasizing regulatory compliance.

What to Know:

- Amplify ETFs issued a report suggesting Ripple’s Mastercard pilot program could boost XRP demand.

- The report highlights the integration of traditional finance with blockchain technology, emphasizing regulatory compliance.

- Institutional adoption and real-world utility could drive XRP demand, distinguishing it from speculative activity.

A recent report by Amplify ETFs is making waves among institutional investors, reinforcing the narrative of real-world demand for XRP. The report highlights Ripple’s ongoing pilot program with Mastercard, suggesting it could be a significant driver for XRP adoption. The analysis focuses on how Ripple’s strategic moves, particularly in regulated payment systems, could translate to increased utility and demand for XRP. As institutional interest in digital assets grows, understanding these dynamics becomes crucial for informed investment decisions.

Inside the Ripple, Mastercard, and WebBank Pilot

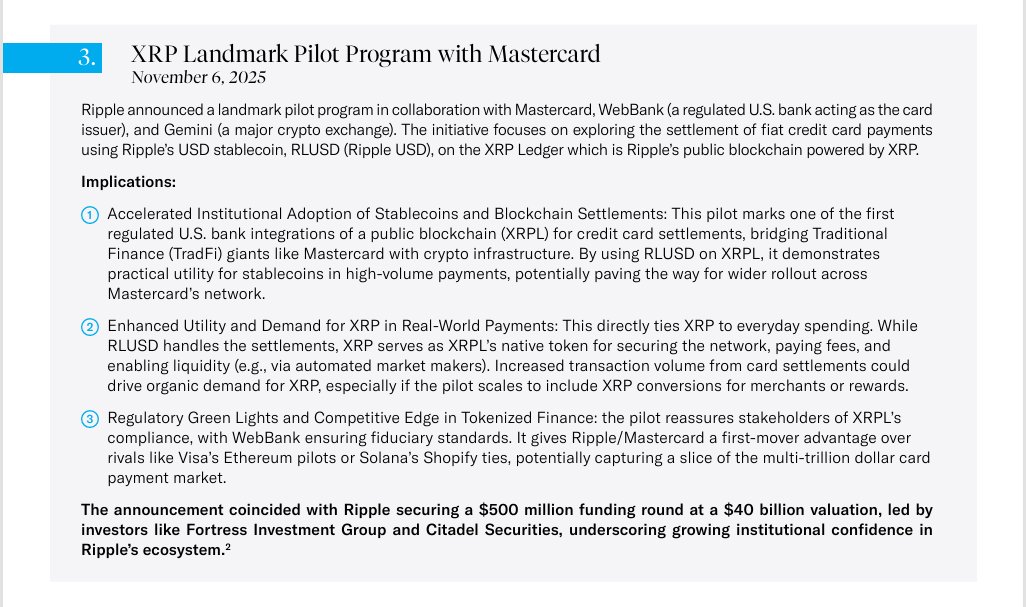

The Amplify ETFs report delves into the details of the pilot program launched in November, involving Ripple, Mastercard, WebBank, and Gemini. This initiative is focused on settling fiat credit card payments using Ripple’s USD stablecoin, RLUSD, on the XRP Ledger (XRPL). WebBank, as a regulated U.S. bank issuer, ensures the pilot operates within established financial and regulatory frameworks. The use of XRPL for settlement represents a significant convergence of traditional finance and public blockchain networks, potentially streamlining payment processes and reducing costs.

How the Pilot Connects to XRP Demand

While RLUSD is used for settlement, XRP remains integral to the XRPL ecosystem. XRP secures the network, covers transaction fees, and supports on-ledger liquidity through automated market makers. Amplify ETFs suggests that increased transaction volumes from credit card settlements could lead to organic XRP demand. This demand could be further amplified if the pilot expands to include merchant conversions, rewards programs, or other payment flows. The key here is that XRP’s role grows in tandem with network usage, shifting away from purely speculative drivers.

Compliance Edge Over Visa and Solana Rivals

The report emphasizes Ripple and Mastercard’s compliance positioning as a competitive advantage. With WebBank ensuring regulatory adherence, the pilot stands out as one of the first regulated U.S. bank integrations of a public blockchain for credit card settlements. Amplify ETFs posits that this gives Ripple and Mastercard a head start over competitors like Visa’s Ethereum-based pilots and Solana’s Shopify-linked payment initiatives. The potential to capture a portion of the multi-trillion-dollar card payments market could significantly bolster XRP’s utility and value proposition.

OCC Licensing and Institutional Confidence Build the Case

Beyond payment solutions, Ripple’s provisional bank licensing from the U.S. Office of the Comptroller of the Currency is cited as another positive signal for the ecosystem. This regulatory endorsement, combined with Ripple’s $500 million funding round at a $40 billion valuation led by Citadel Securities and Fortress Investment Group, underscores growing institutional confidence. These developments support the argument that Ripple’s expanding institutional footprint is becoming more tangible, with its growth in payment infrastructure increasingly tied to XRP’s utility and demand.

Broader Implications for Crypto Markets

This report arrives at a pivotal time for the crypto market, as institutions seek clarity on regulatory frameworks and sustainable use cases. The integration of blockchain technology into traditional finance, as demonstrated by Ripple’s initiatives, offers a glimpse into the future of digital asset adoption. While challenges remain, including regulatory uncertainties and market volatility, the potential for XRP to play a key role in global payment systems is gaining traction among institutional investors. As always, due diligence and a balanced approach are essential for navigating this evolving landscape.

Related: XRP Price: Korean Scientist Predicts $1,000 Target

Source: Original article

Quick Summary

Amplify ETFs issued a report suggesting Ripple’s Mastercard pilot program could boost XRP demand. The report highlights the integration of traditional finance with blockchain technology, emphasizing regulatory compliance. Institutional adoption and real-world utility could drive XRP demand, distinguishing it from speculative activity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.