XRP’s profitability has sharply declined, with less than half of the circulating supply now in profit. This downturn reflects broader crypto market weakness and impacts investor sentiment.

What to Know:

- XRP’s profitability has sharply declined, with less than half of the circulating supply now in profit.

- This downturn reflects broader crypto market weakness and impacts investor sentiment.

- Historically, similar drops in profitability have preceded significant price reversals in XRP, suggesting a potential buying opportunity for institutional investors.

A notable crypto analyst has highlighted a significant decrease in the profitability of XRP holdings, suggesting this could set the stage for a major price reversal. The analysis points to a large percentage of XRP tokens now being held at a loss, which historically has been a precursor to substantial price movements. For institutional investors, understanding these on-chain metrics can provide valuable insight into potential market turning points.

Decline in XRP Holder Profitability

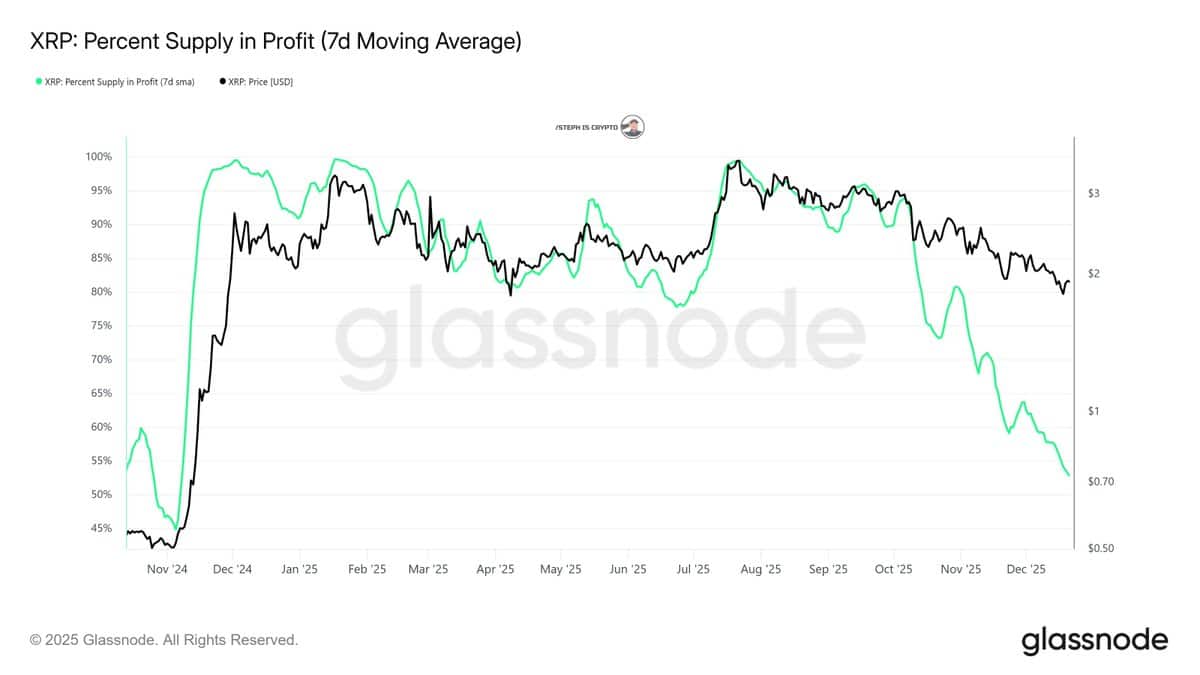

According to analyst Steph Is Crypto, approximately 48% of XRP’s circulating supply, totaling 60.57 billion tokens, is currently underwater. This means these tokens were acquired at prices higher than XRP’s current market value. Data from Glassnode indicates that only about 52% of the circulating supply remains in profit, a figure that has steadily decreased amid recent market-wide sell-offs. This shift in profitability can significantly influence market dynamics and investor behavior.

Impact on Investor Psychology

The decline in profitability directly affects investor psychology. As more XRP holders experience losses, their sensitivity to further price declines increases. This heightened sensitivity can lead to panic selling, especially if prices continue to fall. Underwater holders may choose to exit their positions, exacerbating short-term selling pressure. Understanding this psychological aspect is crucial for predicting potential market volatility and managing risk.

Historical Parallels and Potential Rebound

Drawing on historical data, the analyst notes that a similar level of XRP profitability was observed in November 2024. At that time, around 45% of XRP holdings were profitable, with the price hovering near $0.50. Following this, a post-election rally reversed the trend, pushing profitability to nearly 100% as XRP’s price surged to almost $3 in early December 2024. This historical precedent suggests that the current dip in profitability could be a precursor to a significant upside movement, offering a potential opportunity for strategic investment.

Market Catalysts and Future Outlook

While the historical performance offers a bullish perspective, it’s important to consider the current market context. The previous rally was largely driven by the re-election of Donald Trump, who was perceived as a “Crypto President.” This event spurred significant gains as investors anticipated a resolution to the Ripple lawsuit, which ultimately occurred, driving XRP to a peak of $3.65 in July 2025. Today, market expectations are focused on the potential passage of the CLARITY Act and the increasing demand for XRP ETFs. These factors could potentially catalyze a similar rally, but their impact remains to be seen.

XRP’s Current Market Position

XRP has been trading below the $2 mark since December 16 and is currently around $1.85. While declining profitability might suggest an upcoming rebound, the broader market conditions and regulatory landscape play a crucial role. The approval of XRP ETFs could significantly increase institutional inflows, potentially driving the price higher. However, the timing and impact of these catalysts are uncertain, requiring a balanced and cautious approach.

Concluding Thoughts

The current decline in XRP holder profitability presents a mixed outlook for institutional investors. While historical data suggests a potential for significant upside, the market’s future hinges on regulatory developments and the introduction of new investment vehicles like ETFs. A strategic approach that considers both on-chain metrics and broader market dynamics is essential for navigating the potential opportunities and risks in the XRP market. Prudent risk management and careful monitoring of regulatory progress will be key to capitalizing on any future rallies.

Related: Bitcoin Weakness Signals Altcoin Slump

Source: Original article

Quick Summary

XRP’s profitability has sharply declined, with less than half of the circulating supply now in profit. This downturn reflects broader crypto market weakness and impacts investor sentiment. Historically, similar drops in profitability have preceded significant price reversals in XRP, suggesting a potential buying opportunity for institutional investors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.