XRP faces technical rejections at key resistance levels, signaling potential downside risk according to market analysts. Bearish sentiment contrasts with optimism fueled by recent XRP ETF inflows and Ripple’s business growth.

What to Know:

- XRP faces technical rejections at key resistance levels, signaling potential downside risk according to market analysts.

- Bearish sentiment contrasts with optimism fueled by recent XRP ETF inflows and Ripple’s business growth.

- Institutional and high net worth investors should weigh technical warnings against fundamental developments in assessing XRP’s outlook.

XRP is currently navigating a complex market environment, with technical indicators suggesting caution while fundamental factors and ETF inflows offer a more optimistic outlook. Recent price action has triggered warnings from seasoned crypto investors, highlighting potential corrections ahead. This divergence of signals presents a challenge for institutional and high net worth investors looking to position themselves effectively in the XRP market.

XRP’s Double Rejection

XRP has recently faced rejection at two critical technical levels, raising concerns among market analysts. A long-standing bearish trendline, coupled with a previous support zone now acting as resistance, has proven difficult for XRP to overcome. This “double rejection” is often interpreted as a sign that sellers remain in control, potentially leading to further price declines. The inability to reclaim former support levels suggests a weakening of bullish momentum, a key consideration for institutional investors evaluating entry or exit points.

Bearish Stochastic Signals

Adding to the cautious outlook is the formation of a death cross on the Stochastic oscillator, a signal frequently associated with increased downside risk. While not a guaranteed predictor of losses, stochastic death crosses often occur when prices struggle to recover after a failed rally. This technical indicator reinforces the need for careful risk management and a strategic approach to positioning in XRP. Savvy investors understand that markets do not always reward bullish sentiment and that contra-market setups can serve as effective hedges when technical signals point downward.

Divergent Sentiment Among Analysts

The market is currently witnessing a divergence of opinions regarding XRP’s future. One prominent investor, ChartFu, recently announced a fully bearish stance, anticipating lower prices ahead. This perspective is echoed by angel investor Mike Alfred, who has suggested a highly speculative scenario where XRP could potentially decline to zero under certain market conditions. Such stark warnings underscore the importance of conducting thorough due diligence and considering a range of potential outcomes when evaluating XRP as an investment.

ETF Inflows and Fundamental Optimism

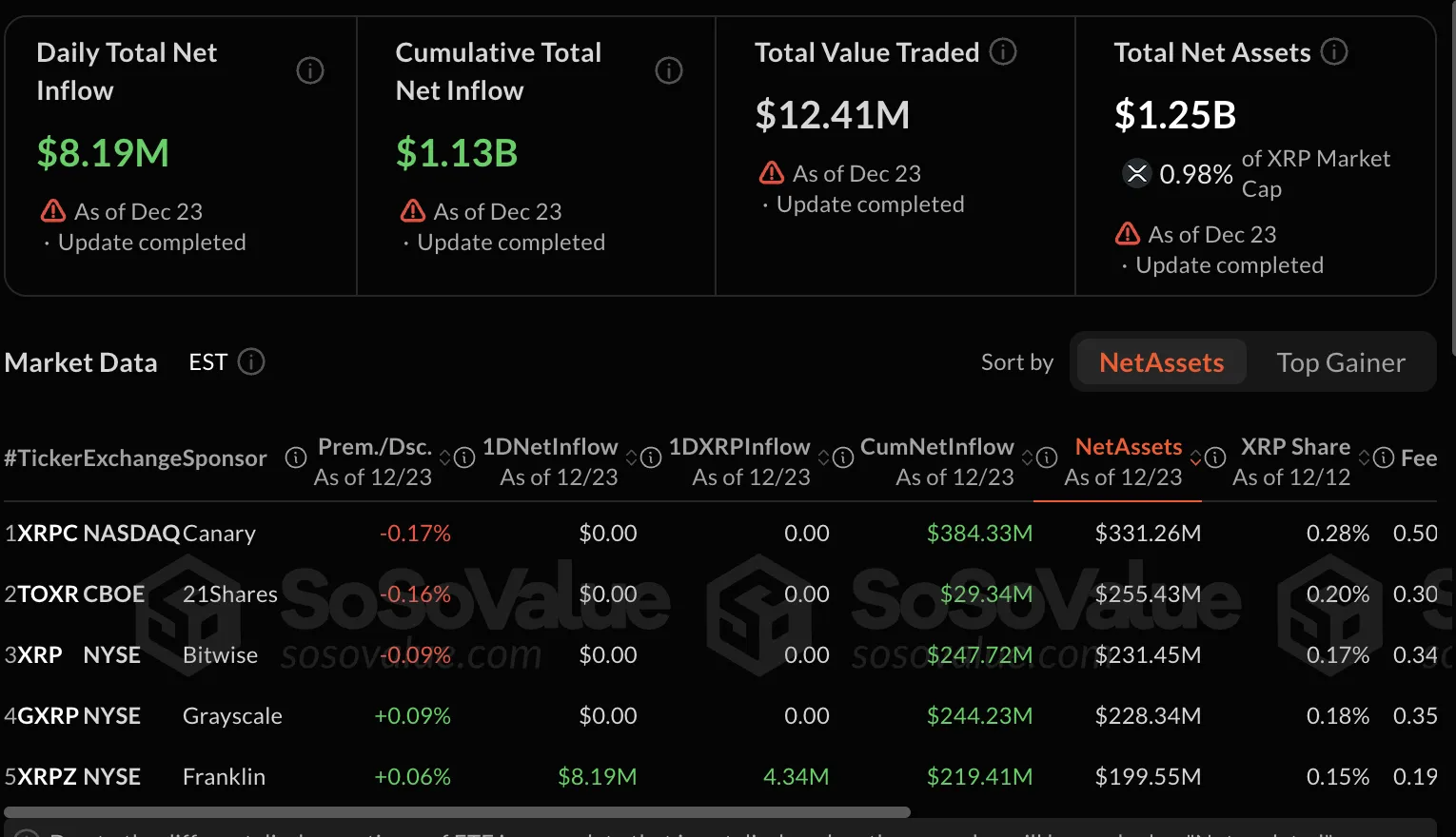

Despite the bearish technical outlook, bullish sentiment persists within the XRP community. The recent launch of XRP ETFs has fueled optimism, with consecutive days of inflows totaling $1.25 billion across five funds since their November debut. These inflows suggest growing institutional interest in XRP, potentially providing a counterbalance to the negative technical signals. Furthermore, Ripple’s ongoing business expansion, including acquisitions, banking partnerships, and new product launches, paints a picture of fundamental strength that may eventually translate into positive price action.

Ripple’s Business Expansion

Oliver Michel, CEO of Tokentus Investment AG, attributes XRP’s recent price drop to temporary market factors, arguing that it does not reflect Ripple’s robust business growth. He likens Ripple’s ecosystem to an “Amazon-style” blockchain platform, emphasizing its diverse range of services and partnerships. This perspective suggests that the market price may eventually catch up with Ripple’s underlying progress, potentially offering long-term value for investors who maintain a bullish outlook. The key will be whether these fundamentals can overcome the near-term technical headwinds.

Looking Ahead to 2026

While the final days of 2025 may not bring a dramatic turnaround, the focus has shifted to 2026, with some projections suggesting XRP could reach $4 to $5 amid Ripple’s business expansion and continued ETF accumulation. However, these projections should be viewed with caution, as they rely on a confluence of positive factors, including favorable regulatory developments and sustained market demand. Institutional investors should carefully weigh these potential catalysts against the existing technical challenges when formulating their investment strategies for the year ahead.

Related: Crypto: Bitcoin, Ethereum Target Key Levels

Source: Original article

Quick Summary

XRP faces technical rejections at key resistance levels, signaling potential downside risk according to market analysts. Bearish sentiment contrasts with optimism fueled by recent XRP ETF inflows and Ripple’s business growth. Institutional and high net worth investors should weigh technical warnings against fundamental developments in assessing XRP’s outlook.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.