The United States emerged as a dominant force in crypto, driven by regulatory clarity and strategic policy changes. Spot ETFs for Bitcoin, Ethereum, Solana, and XRP became key institutional on-ramps, attracting significant inflows and reshaping market dynamics.

What to Know:

- The United States emerged as a dominant force in crypto, driven by regulatory clarity and strategic policy changes.

- Spot ETFs for Bitcoin, Ethereum, Solana, and XRP became key institutional on-ramps, attracting significant inflows and reshaping market dynamics.

- Solana, Ripple, and privacy-focused projects like Zcash established themselves as critical components of the evolving crypto landscape.

In 2025, the crypto industry experienced a transformative shift, solidifying its position within the global financial infrastructure. Landmark regulatory developments and significant institutional adoption defined the year, transitioning the narrative from speculative asset to essential market technology. This evolution has paved the way for further growth and integration in the years to come.

The United States took a leading role in shaping the crypto landscape through proactive regulatory measures. The Trump administration’s strategic policy changes, including the GENIUS Act and the “Strategic Bitcoin Reserve” Executive Order, signaled a clear endorsement of digital assets, attracting significant investment and innovation.

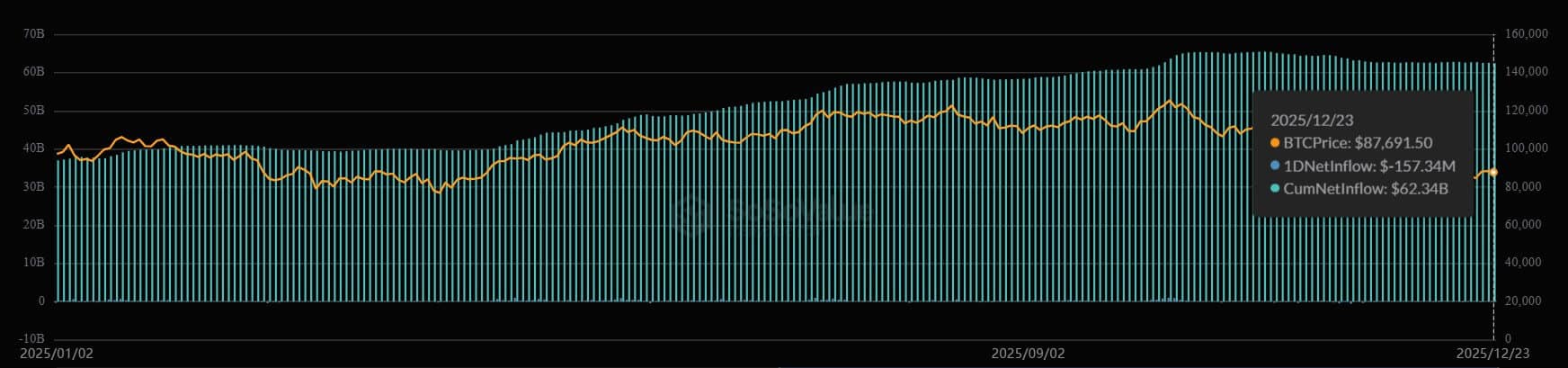

US spot ETFs, including those for Bitcoin, Ethereum, Solana, and XRP, thrived as premier vehicles for institutional access. BlackRock’s IBIT ETF stood out, becoming a top performer in the ETF market, highlighting the growing acceptance of crypto among traditional investors.

Solana distinguished itself as a high-speed liquidity layer, facilitating efficient on-chain trading. Its SOL-USD trading volume surpassed that of major centralized exchanges, underscoring its importance in the digital asset ecosystem.

Ripple achieved a significant milestone with the resolution of its legal battle with the SEC, paving the way for institutional adoption of XRP. The launch of spot XRP ETFs and Ripple’s strategic acquisitions further solidified its position as a key player in the financial technology space.

The privacy sector, led by Zcash, experienced a resurgence as privacy coins gained traction amid growing concerns over surveillance. Regulatory engagement with privacy protocols signaled a shift towards compliant architecture, opening new avenues for innovation in decentralized finance.

Tokenization of Real World Assets (RWAs) advanced from pilot programs to critical infrastructure, supported by a more accommodating regulatory environment. BlackRock’s BUIDL fund and the growth of tokenized money market funds highlighted the increasing integration of traditional finance with the crypto market structure.

Stablecoins solidified their role as essential rails for global fintech, with market capitalization exceeding $300 billion. Legislative clarity in the US and the increasing number of stablecoin holders demonstrated their growing utility as a settlement layer for digital transactions.

In conclusion, 2025 marked a pivotal year for the crypto industry, characterized by regulatory advancements, institutional adoption, and technological innovation. These developments have set the stage for continued growth and integration, positioning digital assets as a fundamental component of the future financial landscape.

Source: Original article

Quick Summary

The United States emerged as a dominant force in crypto, driven by regulatory clarity and strategic policy changes. Spot ETFs for Bitcoin, Ethereum, Solana, and XRP became key institutional on-ramps, attracting significant inflows and reshaping market dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.