An XRP community member has projected significant gains for XRP ETFs, potentially setting Wall Street records by 2026. This forecast arrives amid growing institutional interest and substantial inflows into new XRP ETFs, impacting market dynamics.

What to Know:

- An XRP community member has projected significant gains for XRP ETFs, potentially setting Wall Street records by 2026.

- This forecast arrives amid growing institutional interest and substantial inflows into new XRP ETFs, impacting market dynamics.

- The realization of such gains could dramatically affect XRP’s price, contingent on sustained ETF performance and broader market acceptance.

The launch of XRP ETFs has sparked considerable debate and optimism within the digital asset space. An ambitious forecast from XRP community figure Chad Steingraber suggests that these ETFs could achieve record-breaking first-year percentage gains by the end of 2026. While such predictions warrant scrutiny, the early performance of these investment vehicles and their potential impact on XRP’s price merit a closer look.

XRP ETFs: A Record-Setting Start

XRP ETFs have indeed made waves with their initial inflows, signaling strong institutional interest. Canary Capital’s debut saw a substantial $243 million inflow on its first day, marking a notable event in the ETF market. This impressive start, as highlighted by Bloomberg’s Eric Balchunas, underscores the potential demand for XRP exposure through traditional investment products.

The momentum has continued, with consistent daily inflows across multiple XRP ETFs, including those from Bitwise, Grayscale, and Franklin Templeton. Cumulatively, these ETFs have attracted nearly $900 million, accumulating over 430 million XRP. This rapid accumulation positions XRP ETFs as the second-fastest crypto ETFs to approach the $1 billion inflow mark, reducing liquid circulating XRP and potentially intensifying price discovery.

With additional XRP ETFs anticipated from firms like WisdomTree and 21Shares, the stage is set for further supply absorption. Steingraber’s projection hinges on these ETFs collectively achieving unprecedented first-year gains, a scenario that would require a confluence of factors, including sustained inflows and favorable market conditions.

Potential Impact on XRP Price: A Range of Scenarios

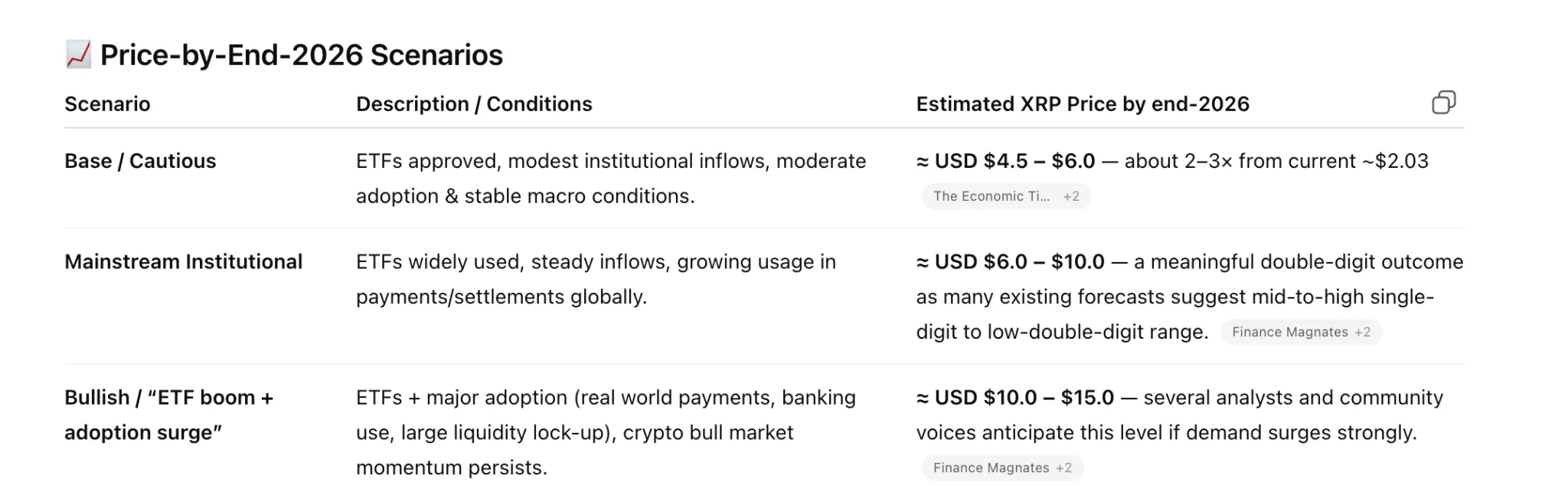

Analyzing the potential impact on XRP’s price requires considering various scenarios. A base case, as modeled by OpenAI’s ChatGPT, suggests that steady ETF adoption, coupled with a supportive macro environment, could see XRP trading in the $4.50 to $6 range by the end of 2026. This scenario assumes a consistent flow of assets under management without necessitating explosive growth.

A more bullish outlook envisions XRP ETFs mirroring the early success of Bitcoin ETFs, combined with increasing utility in payments and cross-border settlements. Under this scenario, prices in the $6 to $10 range become plausible, driven by deeper institutional exposure, reduced exchange liquidity, and broader recognition of XRP’s utility in settlement systems.

The most optimistic scenario, aligned with Steingraber’s prediction, posits that record-setting ETF performance could propel XRP into the $10 to $15 range. This outcome would necessitate intense inflows, global demand, and significant supply compression, potentially absorbing a substantial portion of XRP’s circulating supply. Such a surge would depend on XRP being adopted as a large-scale liquidity asset by global institutions.

Counterarguments and Market Realities

While the potential for XRP ETF-driven gains is enticing, it’s essential to consider counterarguments and historical context. Some market observers have pointed out that first-year ETF records are primarily about assets under management (AUM) rather than percentage gains. Achieving record AUM would require XRP ETFs to compete with established players like gold and Bitcoin ETFs, which have amassed substantial assets.

For instance, Bitcoin ETFs have attracted over $50 billion in a single year, setting a high bar for XRP ETFs to match. Skepticism remains about whether XRP ETFs can reach the $5 billion AUM mark needed to be competitive. Moreover, the performance of Ethereum ETFs has shown that even significant inflows do not always translate directly into substantial price increases.

The recent price action of XRP, which has dipped despite ETF accumulation, further underscores the complexities of market dynamics. External factors, such as regulatory developments, macroeconomic conditions, and broader crypto market sentiment, can all influence XRP’s price independently of ETF inflows.

Conclusion

The launch of XRP ETFs represents a significant step toward mainstream acceptance and institutional adoption. While projections of record-breaking first-year gains should be viewed with caution, the early performance of these ETFs suggests a growing appetite for XRP exposure. Whether these investment vehicles can drive XRP’s price to the levels envisioned remains to be seen, contingent on sustained inflows, market dynamics, and broader adoption. Investors should weigh these factors carefully, considering both the potential upside and the inherent uncertainties of the digital asset market.

Related: XRP Breakout Signals Orders Ready

Source: Original article

Quick Summary

An XRP community member has projected significant gains for XRP ETFs, potentially setting Wall Street records by 2026. This forecast arrives amid growing institutional interest and substantial inflows into new XRP ETFs, impacting market dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.