Bitcoin experienced significant institutional integration, with ETFs and banks embracing the asset. Regulatory advancements provided a green light for traditional financial institutions to engage with Bitcoin.

What to Know:

- Bitcoin experienced significant institutional integration, with ETFs and banks embracing the asset.

- Regulatory advancements provided a green light for traditional financial institutions to engage with Bitcoin.

- Despite progress, Bitcoin faced volatility and challenges, including a miner solvency crisis and macroeconomic pressures.

In 2025, Bitcoin underwent a dramatic transformation, marked by increased institutional adoption and regulatory clarity, yet punctuated by significant volatility. Despite starting with political momentum and positive policy signals, the year saw a sharp boom-to-bust sequence, ultimately leaving Bitcoin’s price flat. This period highlighted both the opportunities and challenges facing Bitcoin as it navigates the complexities of traditional financial markets.

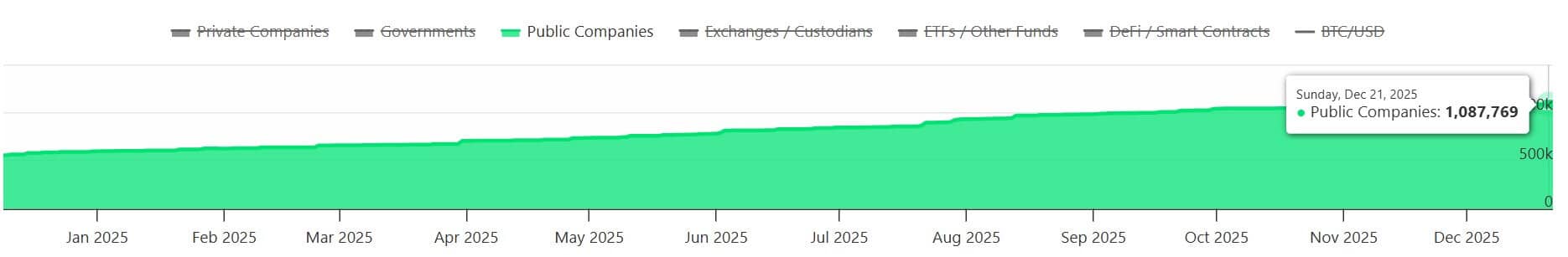

The U.S. government’s move to establish a Strategic Bitcoin Reserve (SBR) signaled a major shift in how Bitcoin is viewed globally. This initiative transformed the U.S. from a net seller to a strategic holder, encouraging other nations and corporations to consider Bitcoin as a legitimate reserve asset. Companies like Strategy further solidified this trend by accumulating substantial BTC holdings on their balance sheets.

Regulatory advancements played a crucial role in integrating Bitcoin into the traditional financial system. The SEC and CFTC made significant strides in accommodating Bitcoin, with the CFTC approving it as valid margin in regulated derivatives markets. The OCC also clarified that national banks could execute “riskless principal” crypto transactions, removing a major barrier to entry for banks.

The approval of Bitcoin ETFs marked a turning point, attracting substantial inflows from institutional investors. BlackRock’s iShares Bitcoin Trust (IBIT) became a dominant player, amassing over $25 billion in inflows. Unlike gold ETFs, Bitcoin ETFs saw continued investment even as BTC’s price stagnated, suggesting a long-term accumulation strategy among investors.

Despite these positive developments, Bitcoin’s price experienced significant volatility, with a sharp correction following a new all-time high. This downturn, combined with rising energy costs, led to a solvency crisis among Bitcoin miners. To adapt, many miners pivoted to Artificial Intelligence (AI) and High-Performance Computing (HPC), signaling a shift towards hybrid energy-compute centers.

In conclusion, 2025 was a transformative year for Bitcoin, characterized by significant institutional integration and regulatory advancements. While the asset faced challenges, including price volatility and a miner solvency crisis, the overall trend indicates a growing acceptance and adoption of Bitcoin within the broader financial landscape.

Related: XRP Price Prediction: 2026 Forecast

Source: Original article

Quick Summary

Bitcoin experienced significant institutional integration, with ETFs and banks embracing the asset. Regulatory advancements provided a green light for traditional financial institutions to engage with Bitcoin. Despite progress, Bitcoin faced volatility and challenges, including a miner solvency crisis and macroeconomic pressures.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.