A financial commentator has suggested Japan could be the first major real-world use case for XRP. This perspective indicates Japan’s fragile FX environment, yen volatility, and Ripple’s established connections in the region.

What to Know:

- A financial commentator has suggested Japan could be the first major real-world use case for XRP.

- This perspective highlights Japan’s fragile FX environment, yen volatility, and Ripple’s established connections in the region.

- Successful integration in Japan could significantly impact XRP’s adoption and institutional flows.

XRP is at the forefront of discussions about practical blockchain adoption, particularly concerning its potential use in Japan’s financial system. A recent analysis suggests that Japan’s unique combination of FX challenges and existing Ripple partnerships could position it as the first nation to widely adopt XRP. This development could shift XRP from a speculative asset to a functional component of financial infrastructure.

Why Japan Is a Critical XRP Test Case

Japan’s financial system faces increasing pressure from FX volatility and evolving monetary policies. In such volatile conditions, institutional investors tend to prioritize rapid money transfers over slower, traditional settlement methods. XRP presents itself as a viable solution, offering near-instant settlement, real-time FX capabilities, and the elimination of pre-funded accounts, enhancing efficiency during periods of financial instability.

FX and Geopolitical Angle

While market participants often focus on price movements, geopolitical and currency dynamics play a crucial role. Japan, as a central hub for Asian capital flows, could see its yen-related issues impact global markets. XRP’s role isn’t to interfere with monetary policy but to provide a neutral mechanism for efficient cross-border transactions during currency stress. Should Japan increase its reliance on blockchain for remittances and institutional transfers, XRP could transition from a speculative crypto asset to a core element of the financial framework.

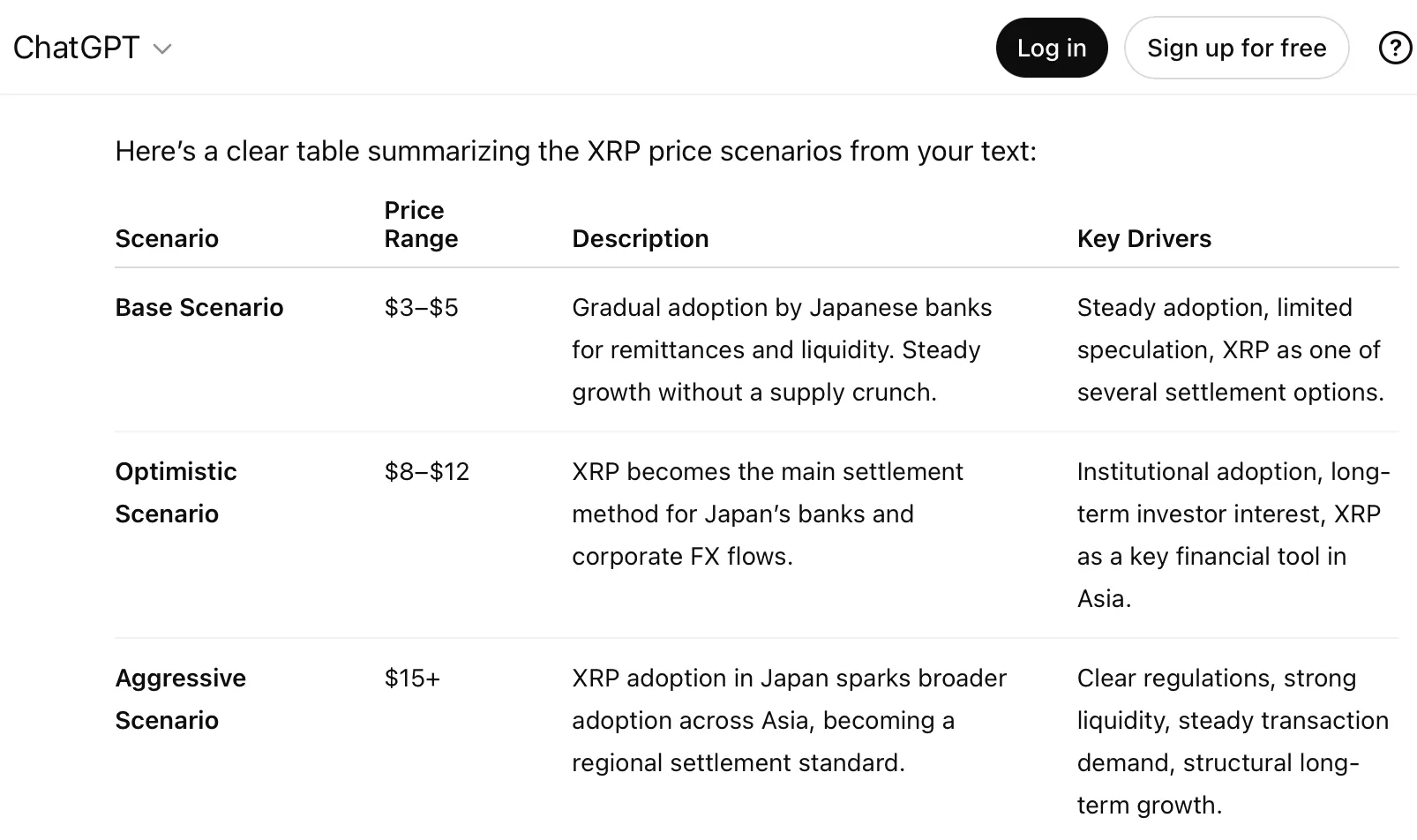

XRP Price Scenarios If Japan Adopts XRP at Scale

Considering the current market structure and XRP’s circulating supply, several price scenarios emerge if Japan embraces XRP for institutional use. These scenarios vary based on adoption speed and the extent of integration within Japan’s financial systems. It’s important to note that these are speculative price predictions based on adoption assumptions, not guarantees.

Base Scenario: $3–$5 XRP

If Japanese banks incrementally adopt XRP for remittances and liquidity management, demand would likely increase without causing abrupt supply shocks. This assumes a measured adoption rate, limited speculative activity, and XRP remaining one of several settlement options. Price appreciation would primarily stem from real-world utility and growing market confidence. Analysts at 24/7 Wall St. have suggested a similar price target, estimating XRP could reach $3 to $4.5 based on Ripple’s RLUSD expansion in Japan.

Optimistic Scenario: $8–$12 XRP

Should XRP become the primary settlement method for Japanese banks and corporate FX transactions, demand could surge significantly. In this scenario, XRP would transition from a speculative asset to a critical financial instrument in Asia, attracting institutional and long-term investors. This could potentially push XRP into the double-digit price range, aligning with forecasts from various analysts.

What This Means for XRP Going Forward

The long-term value of XRP hinges more on its practical applications than on market speculation. Japan’s market offers a unique blend of progressive regulations, substantial financial scale, and established partnerships with Ripple. Successful integration of XRP within Japan’s dynamic FX environment could redefine its value proposition, shifting it from speculative narratives to tangible utility and infrastructural importance. While the potential for XRP in Japan is promising, it remains speculative and contingent on various factors, including regulatory developments and market adoption rates. For now, market participants should closely monitor developments in Japan and their potential impact on XRP’s role in the broader financial landscape.

Related: Bitcoin Flash Crash Signals 2023 Lows

Source: Original article

Quick Summary

A financial commentator has suggested Japan could be the first major real-world use case for XRP. This perspective highlights Japan’s fragile FX environment, yen volatility, and Ripple’s established connections in the region. Successful integration in Japan could significantly impact XRP’s adoption and institutional flows.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.