Charles Hoskinson argues XRP and Cardano possess architectural and infrastructural advantages over traditional finance (TradFi) attempts to replicate decentralized systems.

What to Know:

- Charles Hoskinson argues XRP and Cardano possess architectural and infrastructural advantages over traditional finance (TradFi) attempts to replicate decentralized systems.

- Hoskinson emphasizes the maturity and real-world deployment of XRP Ledger and Cardano in areas like decentralized settlement, identity, and compliance.

- The analysis suggests institutional capital may eventually integrate with existing Web3 solutions like XRP and Cardano rather than attempting to rebuild them.

The cryptocurrency landscape is witnessing a narrative shift, with Cardano’s Charles Hoskinson asserting that legacy finance is belatedly attempting to replicate functionalities already established by XRP and Cardano. This isn’t mere price speculation, but a commentary on architectural design, infrastructure maturity, and the fundamental differences between Web3-native systems and traditional institutions retrofitting old concepts. For institutional investors, this raises questions about where to allocate capital for genuine innovation versus rebranded legacy systems.

XRP and Cardano’s Head Start

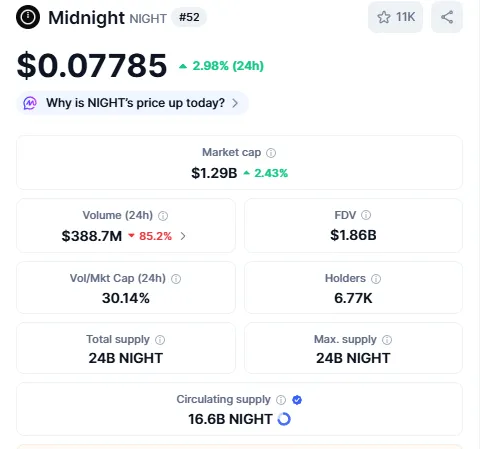

Hoskinson contends that XRP Ledger and Cardano have operationalized key components of decentralized finance, such as settlement, identity management, and compliance, well ahead of TradFi initiatives. XRP’s initial focus was high-throughput, low-cost institutional settlement, while Cardano pursued a regulated-friendly model with its layered design and upcoming Midnight privacy stack. These projects represent years of dedicated development and real-world testing, giving them a significant advantage over newcomers.

The critique centers on TradFi-led projects, like Canton, which Hoskinson views as rediscovering these concepts but with more stringent governance, limited permissioning, and extended iteration cycles. His “100x” framing isn’t about asset prices, but about the depth of development and practical implementation. This echoes a sentiment often heard in tech circles: it’s not just about having the idea, but about building and deploying it at scale.

Cardano’s Technical Superiority

Cardano, according to Hoskinson, surpasses most enterprise chains due to its formal verification stack, extended UTXO model, and on-chain governance. These features enhance security, transparency, and adaptability, addressing critical concerns for institutional adoption. Unlike many enterprise chains that rely on off-chain guarantees and trusted validators, Cardano’s architecture provides inherent advantages in terms of decentralization and trustlessness.

The market structure partially reflects this qualitative difference. XRP and ADA have experienced long compression phases, suggesting a more mature market dynamic compared to assets prone to parabolic excess. These assets have already undergone significant redistribution, drawdowns, and speculative cycles, indicating a level of market testing and resilience often lacking in newer projects. This is a crucial consideration for institutional investors wary of hype-driven assets.

Infrastructure Maturity and Capital Rotation

The behavior of XRP and Cardano aligns with the typical pattern of mature infrastructure awaiting capital rotation. Long cycles, delayed recognition, and eventual repricing, driven by fundamentals overcoming market narratives, are consistent with Hoskinson’s long-term outlook, including his prediction of Bitcoin reaching $250,000 by 2026. This suggests a potential shift in market sentiment, where institutional investors prioritize projects with proven infrastructure and real-world utility over speculative hype.

This isn’t about guaranteeing moonshots for XRP and Cardano, but about recognizing that these projects have already addressed challenges that TradFi is only now beginning to acknowledge. If institutional capital genuinely seeks programmable settlement, privacy with compliance, and global-scale neutrality, it may find greater value in integrating with existing Web3 solutions rather than attempting to reinvent the wheel. The ETF narrative reflects this, where traditional finance seeks to bridge into existing ecosystems rather than create entirely new ones.

Web3’s Core Advantage

Hoskinson’s criticism highlights a fundamental difference in approach: legacy finance often confuses control with innovation. Web3’s advantage was never in marketing, but in surviving chaos, shipping first, and remaining resilient. This ethos resonates with the core principles of decentralization and permissionless innovation. For institutional investors, understanding this distinction is crucial for making informed decisions about long-term investments in the digital asset space.

Ultimately, the evolution of digital assets will likely involve a convergence of TradFi and Web3, where established infrastructure and proven solutions are integrated into traditional financial systems. The success of this integration will depend on recognizing the inherent advantages of Web3-native systems and embracing a collaborative approach rather than attempting to recreate them from scratch.

Related: Gold Ownership Shift Signals Trading Changes

Source: Original article

Quick Summary

Charles Hoskinson argues XRP and Cardano possess architectural and infrastructural advantages over traditional finance (TradFi) attempts to replicate decentralized systems. Hoskinson emphasizes the maturity and real-world deployment of XRP Ledger and Cardano in areas like decentralized settlement, identity, and compliance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.