XRP experienced significant inflows into its investment products in late December, contrasting with outflows from Bitcoin and Ethereum products.

What to Know:

- XRP experienced significant inflows into its investment products in late December, contrasting with outflows from Bitcoin and Ethereum products.

- This shift in capital allocation may be driven by XRP’s proactive approach to post-quantum cryptography, positioning it favorably against potential future security threats.

- The market’s reaction suggests a growing awareness and valuation of crypto assets that are actively addressing long-term technological risks.

XRP is ending the year with a unique ETF flow profile, diverging from the trends observed in Bitcoin and Ethereum. This development, coupled with narratives around advanced security measures, is capturing the attention of institutional investors. The inflows into XRP investment products signal a potential shift in market sentiment, warranting a deeper look into the underlying factors driving this trend.

Flow Discrepancies

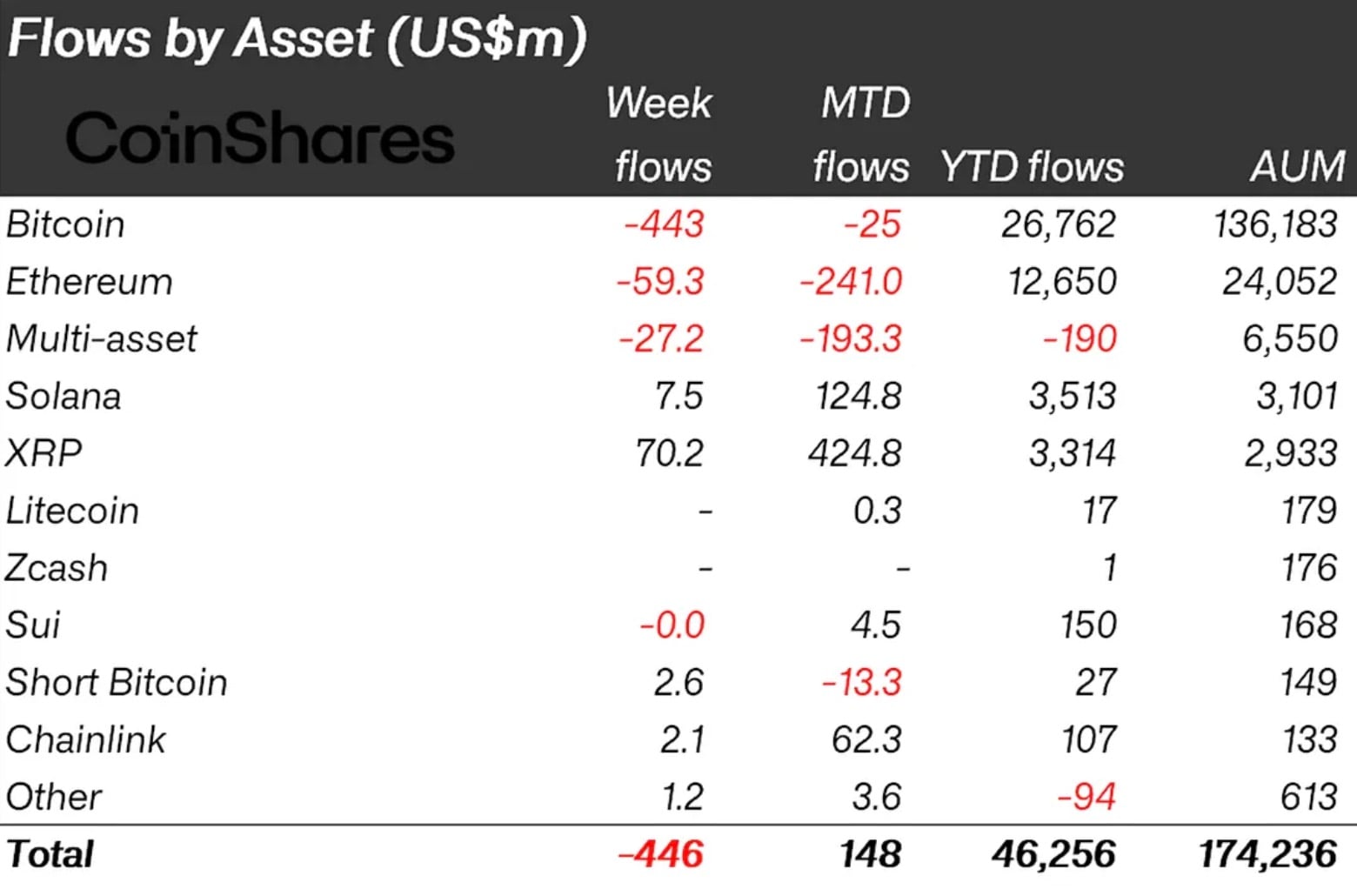

Recent CoinShares data reveals a striking contrast in investment flows. XRP investment products saw inflows of $70.2 million, while Bitcoin products experienced outflows of $443 million. Month-to-date figures further emphasize this divergence, with XRP attracting $424.8 million in inflows compared to Bitcoin’s -$25 million and Ethereum’s -$241 million. This suggests a strategic reallocation of assets, potentially driven by a narrative that resonates with institutional risk committees.

Such flow discrepancies often reflect broader market dynamics. For example, during periods of regulatory uncertainty, assets perceived as less exposed to regulatory scrutiny may attract inflows. Similarly, assets with clear technological advantages or unique use cases can benefit from increased investor interest. The current flow pattern suggests that XRP’s narrative is gaining traction among allocators seeking diversification and risk mitigation.

Post-Quantum Narrative

One compelling narrative driving XRP’s inflows is its proactive approach to post-quantum readiness. The XRP Ledger’s AlphaNet has implemented Dilithium-based cryptography, enabling developers to create quantum-resistant accounts and execute transactions secured by the new algorithm. This positions XRP as a forward-thinking asset in addressing potential future security threats posed by quantum computing.

The implications of quantum computing on blockchain security are significant. Quantum computers could potentially break the cryptographic algorithms that secure many cryptocurrencies, including Bitcoin. While a fully functional quantum computer capable of breaking these algorithms is still years away, proactive measures to mitigate this risk are essential. XRP’s early adoption of post-quantum cryptography demonstrates a commitment to long-term security and resilience.

Nuances and Timelines

It is important to note that the Dilithium-based cryptography is currently implemented on the XRP Ledger’s AlphaNet, a test network. While this provides a practical demonstration of the technology, it is not yet deployed on the main ledger. Bitcoin’s path to post-quantum readiness is expected to be longer, with estimates suggesting a network-wide transition could take 5-10 years due to the need for coordinated migration across nodes, wallets, and stored coins.

The timelines for implementing post-quantum cryptography across different blockchains vary significantly. Factors such as the complexity of the blockchain’s architecture, the level of decentralization, and the degree of community consensus required for upgrades all play a role. Bitcoin’s decentralized nature and large ecosystem make it more challenging to implement significant changes compared to more centralized blockchains.

Market Perception

Discussions around older wallets, including Satoshi Nakamoto’s estimated 1.1 million BTC, highlight the challenges of transitioning to new cryptographic rules. Proposals to freeze vulnerable coins have also circulated, underscoring the complexity of the issue. Despite these challenges, XRP has actively pushed back on “Q-Day” alarm framing, and the recent money flow suggests that this perception is resonating with investors.

Market perception plays a crucial role in asset valuation. Assets perceived as being proactive in addressing long-term risks, such as quantum computing, may be viewed more favorably by investors. This can lead to increased demand and higher valuations. The recent inflows into XRP investment products suggest that investors are increasingly valuing the asset’s proactive approach to post-quantum security.

Historical Context

The observed rotation into XRP echoes historical patterns where investors reallocate capital based on emerging narratives or perceived advantages. During the 2017 ICO boom, projects promising innovative solutions attracted significant investment, often at the expense of established cryptocurrencies. Similarly, the rise of DeFi in 2020 led to a reallocation of capital towards protocols offering yield-generating opportunities.

These historical episodes highlight the importance of understanding market narratives and their impact on capital flows. While short-term trends can be driven by hype and speculation, long-term value is often determined by fundamental factors such as technological innovation, regulatory compliance, and market adoption. The current interest in XRP’s post-quantum readiness suggests a growing awareness of the importance of long-term security in the crypto space.

In conclusion, the recent inflows into XRP investment products, contrasted with outflows from Bitcoin and Ethereum, suggest a strategic reallocation of capital driven by XRP’s proactive approach to post-quantum cryptography. This development underscores the growing importance of long-term security and resilience in the crypto market, potentially reshaping investor preferences and asset valuations.

Related: Bitcoin Targets $90,000 as Oil Rises

Source: Original article

Quick Summary

XRP experienced significant inflows into its investment products in late December, contrasting with outflows from Bitcoin and Ethereum products. This shift in capital allocation may be driven by XRP’s proactive approach to post-quantum cryptography, positioning it favorably against potential future security threats.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.