Investor Paul Barron hinted at “big news” for XRP, sparking renewed interest in XRP ETFs. This comes amid strong ETF inflows in the broader crypto market, with Bitcoin and Ethereum leading the way.

What to Know:

- Investor Paul Barron hinted at “big news” for XRP, sparking renewed interest in XRP ETFs.

- This comes amid strong ETF inflows in the broader crypto market, with Bitcoin and Ethereum leading the way.

- Increased ETF activity and potential new entrants could significantly impact XRP’s market sentiment and institutional adoption.

The digital asset space is abuzz with speculation following investor Paul Barron’s hint of “big news” for XRP this week. This has reignited interest in XRP exchange-traded funds (ETFs) and their potential impact on the market. As crypto ETFs continue to attract significant inflows, the focus is now on how XRP ETFs fit into the broader landscape and what further developments might be on the horizon.

Strong ETF Flows in Crypto

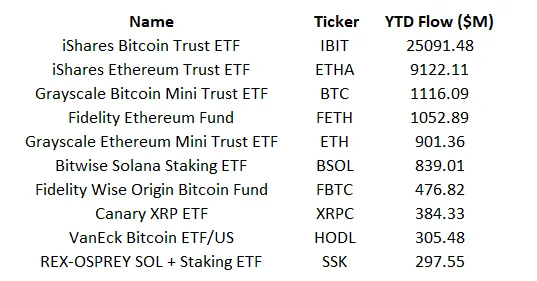

The crypto ETF market has seen robust activity, with Bitcoin and Ethereum ETFs dominating the inflow charts. BlackRock’s IBIT Bitcoin ETF leads with $25 billion in year-to-date inflows, followed by Grayscale’s Bitcoin Mini Trust ETF with $1.11 billion. Ethereum ETFs, particularly those from BlackRock, have also garnered substantial interest, reflecting the growing institutional appetite for these leading cryptocurrencies.

Amidst this, the Canary XRP ETF (XRPC) has quietly amassed $384.33 million in year-to-date inflows. Considering its recent launch in November, this performance is noteworthy, indicating a segment of the market eager to gain exposure to XRP through traditional investment vehicles.

XRP ETF Landscape Keeps Expanding

Several XRP ETFs are already live, including offerings from 21Shares, Bitwise, Grayscale, and Franklin. These funds, launched between November and December, collectively manage approximately $1.24 billion in assets, with cumulative inflows totaling $1.14 billion. This rapid accumulation of assets underscores the demand for XRP exposure via ETFs, despite the broader market’s recent bearish trends.

Teucrium CEO Sal Gilbertie has noted that these figures could have been even higher absent the prevailing market sentiment. Nevertheless, the performance of XRP ETFs, generating over $1 billion in inflows in just 21 days, is a testament to their appeal.

What “Big News” Could Mean

Barron’s cryptic comment has fueled speculation about potential developments in the XRP ETF space. The WisdomTree XRP ETF is one product the community is closely monitoring, as it is among the pending ETFs expected to launch next. The approval and launch of additional XRP ETFs could further broaden access to XRP for institutional and retail investors alike.

WisdomTree is next pic.twitter.com/5hKrdYU02E

Simultaneously, rumors of a BlackRock XRP ETF continue to circulate, although there is currently no formal filing or pending approval for such a product. While the prospect of a BlackRock XRP ETF is enticing, it remains speculative at this stage.

Potential Impact on Market Sentiment

The expansion of the XRP ETF market, coupled with positive developments such as new ETF launches, could significantly boost market sentiment. As more XRP ETFs become available, the increased accessibility could attract a broader range of investors, potentially driving up demand and price. The dynamics of ETF mechanics, including creation and redemption units, can influence underlying asset liquidity and price discovery.

However, it’s essential to acknowledge the uncertainties surrounding regulatory posture and potential market manipulation. Historical market behavior indicates that speculative rallies can be followed by corrections, and the digital asset space is no stranger to volatility. Therefore, while the outlook for XRP ETFs appears promising, investors should exercise caution and conduct thorough due diligence.

Conclusion

The rising interest in XRP ETFs, fueled by hints of “big news” and strong initial inflows, highlights the evolving landscape of digital asset investment products. As the XRP ETF market expands, it has the potential to attract greater institutional participation and influence market sentiment. While uncertainties remain, the current trajectory suggests a positive outlook for XRP and its role in the broader crypto ecosystem.

Related: XRP Liquidity Signals Potential Price Shocks

Source: Original article

Quick Summary

Investor Paul Barron hinted at “big news” for XRP, sparking renewed interest in XRP ETFs. This comes amid strong ETF inflows in the broader crypto market, with Bitcoin and Ethereum leading the way. Increased ETF activity and potential new entrants could significantly impact XRP’s market sentiment and institutional adoption.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.