Analysts debate whether decreasing exchange balances of XRP could trigger a supply shock. The discussion occurs amid broader interest in crypto ETFs and their impact on asset availability. Institutional investors should consider the debate’s relevance to XRP’s market dynamics and liquidity.

What to Know:

- Analysts debate whether decreasing exchange balances of XRP could trigger a supply shock.

- The discussion occurs amid broader interest in crypto ETFs and their impact on asset availability.

- Institutional investors should consider the debate’s relevance to XRP’s market dynamics and liquidity.

The prospect of a supply shock in XRP markets has sparked debate among analysts, with some arguing that decreasing exchange balances could lead to a sharp price increase. This narrative has gained traction as market participants assess the potential impact of exchange-traded funds (ETFs) on XRP’s availability. However, recent data and expert commentary suggest a more nuanced picture, challenging the notion of an impending supply crunch.

Exchange Balances Remain Substantial

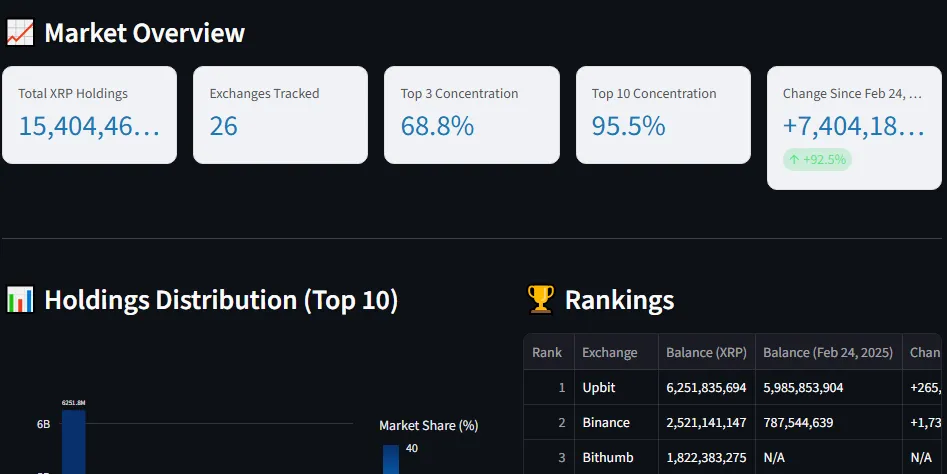

Despite reports of declining XRP holdings on exchanges, data indicates that substantial reserves remain readily accessible. According to a recent update, over 15.4 billion XRP are held across 26 exchanges. Upbit leads with 6.25 billion XRP, followed by Binance with 2.52 billion and Bithumb with 1.82 billion. These figures suggest that ample liquidity exists for traders, countering claims of an imminent supply squeeze.

Expert Skepticism on Supply Shock

Legal expert Bill Morgan has openly criticized the supply shock theory, arguing that current data does not support it. Morgan points out that the 15.4 billion XRP held on exchanges represent a significant portion of the circulating supply. This contradicts the idea of scarcity needed for a genuine supply shock. His analysis suggests that the market is far from experiencing a liquidity crisis, as there are more than enough tokens available to meet trading demand.

Limited Impact from XRP ETFs

The potential for XRP ETFs to trigger a supply shock has also been a topic of discussion. However, current holdings in spot XRP ETFs account for less than 1% of the total XRP supply. SoSoValue data indicates that spot XRP ETFs have a net asset value representing only a tiny fraction of the total supply. In contrast to Bitcoin ETFs, which have absorbed a significant portion of BTC’s supply, XRP ETFs have a negligible impact on overall availability.

On-Chain Data Realities

Critics of the supply shock narrative also point to the ease with which traders can replenish exchange balances. XRP can be transferred to trading platforms within seconds, allowing for rapid adjustments to market conditions. This dynamic further undermines the idea of a sustained supply shortage. The ability to quickly move tokens between wallets and exchanges ensures that liquidity can be maintained, even in the face of increased buying pressure.

Market Structure and Liquidity

Institutional investors should consider the broader market structure and liquidity dynamics when evaluating the potential for a supply shock. While decreasing exchange balances may signal increased accumulation, the overall availability of XRP remains substantial. The presence of active trading platforms, efficient settlement systems, and readily accessible reserves suggests that the market is well-equipped to handle fluctuations in demand. Additionally, regulatory posture and macroeconomic conditions can influence market sentiment and trading behavior, further complicating the supply-demand equation.

In conclusion, while the narrative of an XRP supply shock has gained traction, current data and expert analysis suggest that it may be premature. Substantial exchange balances, limited ETF holdings, and efficient transfer mechanisms all contribute to a market that is unlikely to experience a significant supply squeeze. Investors should remain vigilant, monitor market dynamics, and conduct thorough research before making investment decisions based on the potential for a supply shock.

Related: XRP Signals, Derivatives Data Targets New Highs

Source: Original article

Quick Summary

Analysts debate whether decreasing exchange balances of XRP could trigger a supply shock. The discussion occurs amid broader interest in crypto ETFs and their impact on asset availability. Institutional investors should consider the debate’s relevance to XRP’s market dynamics and liquidity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.