Ripple’s first escrow unlock of 2026 released one billion XRP, valued at $1.84 billion, across three transactions. The releases included a controversial memo falsely attributed to Ripple, stirring debate within the XRP community.

What to Know:

- Ripple’s first escrow unlock of 2026 released one billion XRP, valued at $1.84 billion, across three transactions.

- The releases included a controversial memo falsely attributed to Ripple, stirring debate within the XRP community.

- The event highlights the decentralized nature of XRP escrow releases and their potential impact on market sentiment and institutional perception.

The new year has started with a notable event in the XRP market as Ripple’s first escrow unlock of 2026 has released a substantial amount of tokens. This event, however, was accompanied by an unusual message that has sparked controversy. While the scheduled release itself is part of a predictable pattern, the added commentary raises questions about market manipulation and the influence of external narratives on digital asset valuations.

Ripple’s Billion-XRP Escrow Release

At the stroke of midnight, Ripple executed its first escrow unlock for January 2026, releasing one billion XRP tokens. The tokens, worth approximately $1.84 billion, were distributed across three transactions to designated Ripple wallets. These unlocks are part of a pre-programmed schedule designed to release XRP into the market over time. The Ripple (28) wallet received 500 million XRP, while the Ripple (9) wallet received another 500 million XRP. As of now, the tokens remain unmoved in these wallets, and Ripple has not re-locked any back into escrow.

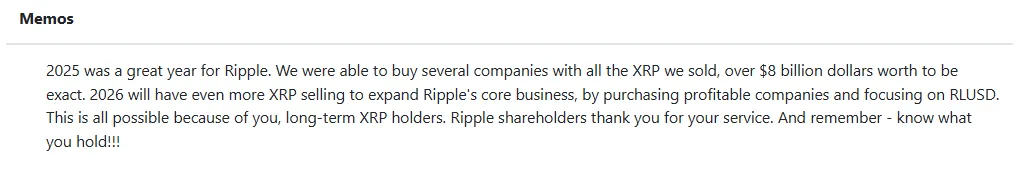

The Controversial Transaction Memo

The releases included a controversial memo designed to mimic official Ripple communications, adding an element of intrigue and potential misinformation. The message sarcastically thanked long-term XRP holders, suggesting that Ripple had a successful 2025 due to significant XRP sales, purportedly totaling over $8 billion, which funded acquisitions and expansion. It further implied plans for even larger sales in 2026 to support growth and the RLUSD project. This messaging was quickly identified as not originating from Ripple, highlighting the risks of misinformation within the crypto space.

Decentralized Release Mechanics

The incident underscores a crucial aspect of the XRP ecosystem: the escrow releases are not directly controlled by Ripple at the moment of execution. While Ripple’s wallets are the designated recipients, any party can initiate the release once the scheduled time arrives. This decentralized mechanic allows for the inclusion of arbitrary transaction memos, as seen in this case. This dynamic can be exploited to spread misleading information, impacting market sentiment and potentially influencing trading behavior.

Market and Community Reaction

The XRP community has reacted with a mix of concern and skepticism. The unauthorized message has prompted discussions about the need for better verification mechanisms and increased vigilance against misinformation. From an institutional perspective, this event serves as a reminder of the inherent risks in digital asset markets, where unverified information can quickly propagate and affect asset values. Investors are advised to rely on verified sources and conduct thorough due diligence before making investment decisions.

Implications for Institutional Flows

Events like these, while controversial, provide valuable lessons for institutional investors navigating the digital asset landscape. Understanding the nuances of token release schedules, the potential for misinformation, and the importance of independent verification are critical for informed decision-making. As institutional interest in XRP and other digital assets grows, a focus on market structure, regulatory posture, and settlement systems becomes increasingly important. Further, the mechanics of ETF-like products are relevant for high net worth investors.

In conclusion, while the Ripple escrow unlock itself is a routine event, the associated controversy highlights the complexities and risks inherent in the XRP market. Institutional and high net worth investors must remain vigilant, relying on credible information sources and robust risk management strategies to navigate these challenges effectively. The incident serves as a reminder of the importance of due diligence and critical thinking in the rapidly evolving world of digital assets.

Related: XRP Price: Bulls Defend $1.77 Fibonacci Support

Source: Original article

Quick Summary

Ripple’s first escrow unlock of 2026 released one billion XRP, valued at $1.84 billion, across three transactions. The releases included a controversial memo falsely attributed to Ripple, stirring debate within the XRP community.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.