ETF filings are becoming less impactful on crypto prices. Listing venues and distribution channels are now more critical factors. Market focus has shifted to fees, liquidity, and distributor readiness.

What to Know:

- ETF filings are becoming less impactful on crypto prices.

- Listing venues and distribution channels are now more critical factors.

- Market focus has shifted to fees, liquidity, and distributor readiness.

The crypto market is showing signs of ETF filing fatigue, as evidenced by the muted response to Bitwise’s recent filing for 11 single-token “strategy” ETFs. These ETFs, tied to various altcoins, were expected to spark interest, but the market barely registered the news. This shift indicates a change in how the market perceives ETF filings.

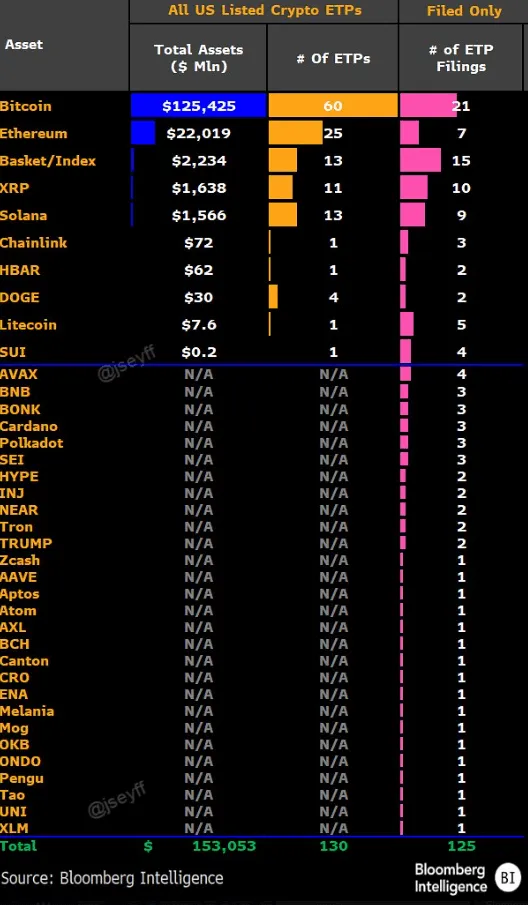

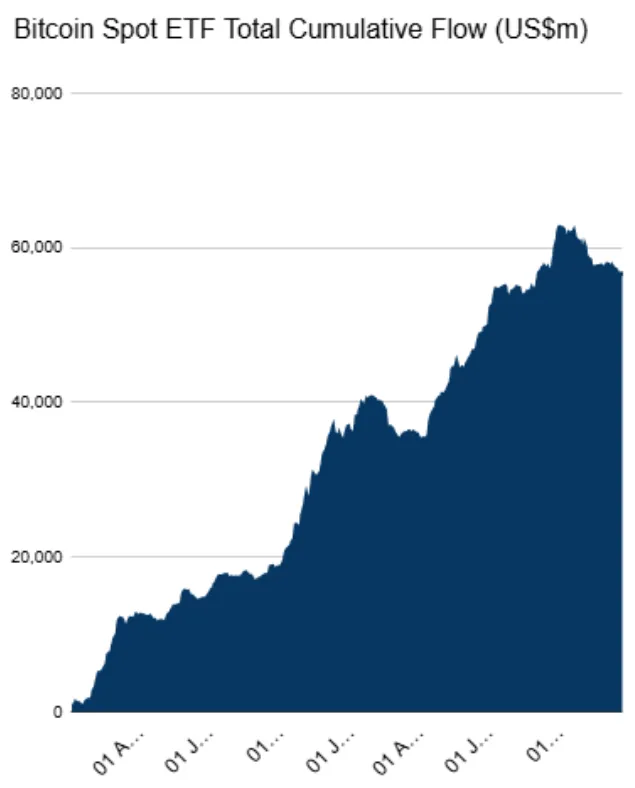

Crypto products have experienced significant growth, with XRP products exceeding $1 billion in net inflows and Bitcoin ETFs adding over $22 billion this year. Ethereum and Solana funds have also seen substantial inflows, but the demand is not spread evenly across all products. Flows tend to concentrate in a few cheap, easily accessible vehicles.

The approval of generic listing standards by the SEC has streamlined the process for exchanges to list commodity-based trust shares. This expedited path reduces the impact of individual filings, as the market now anticipates ETF approvals for straightforward spot crypto products with listed futures and no regulatory issues. The focus has shifted to the specific listing venue and associated fees.

The Solana ETF episode highlights this shift, where the actual listing of Bitwise’s BSOL fund on NYSE Arca drove market reaction, not the initial filing. The fund quickly raised approximately $420 million in its first week, prompting competitors to launch similar products. This illustrates that the go-live date and initial assets under management are more indicative of demand than the filing date itself.

The real drivers of future flows are decisions like Vanguard’s recent move to allow clients to trade third-party crypto ETFs. This indicates a significant change in distribution. The success of Bitwise’s altcoin ETFs will depend on whether major platforms like Vanguard, Schwab, and Merrill are willing to support them.

Related: XRP Supply Signals Potential Turn

Source: Original article

Quick Summary

ETF filings are becoming less impactful on crypto prices. Listing venues and distribution channels are now more critical factors. Market focus has shifted to fees, liquidity, and distributor readiness.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.