Price predictions for Bitcoin, Ethereum, and other cryptos largely missed the mark in 2025. Predictions around regulatory developments, ETF expansion, and stablecoin adoption proved more accurate. Focusing on structural changes rather than price targets yielded more insightful forecasts.

What to Know:

- Price predictions for Bitcoin, Ethereum, and other cryptos largely missed the mark in 2025.

- Predictions around regulatory developments, ETF expansion, and stablecoin adoption proved more accurate.

- Focusing on structural changes rather than price targets yielded more insightful forecasts.

The crypto market in 2025 was marked by bold predictions, particularly regarding the prices of Bitcoin, Ethereum, and Solana, but the reality painted a different picture. While many forecasts failed to materialize, insights into regulatory shifts, the growth of ETFs, and advancements in payment infrastructure proved more accurate. This divergence between hype and reality offers valuable lessons for understanding the dynamics of the crypto market.

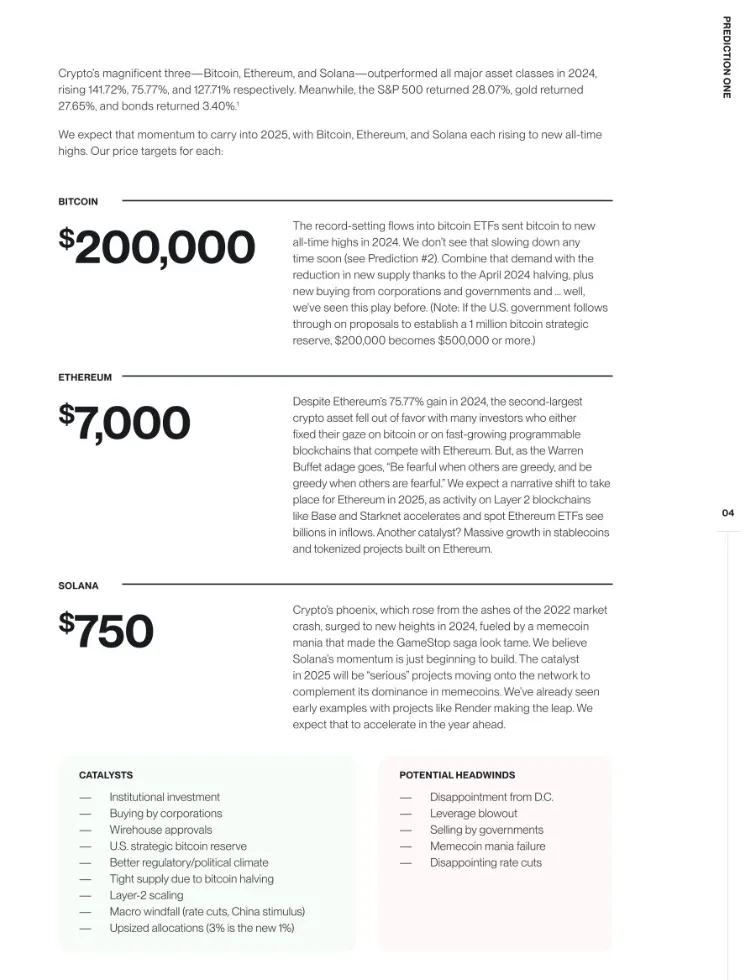

Many firms, including Bitwise, made ambitious price predictions at the start of 2025, anticipating significant gains driven by ETF adoption and institutional momentum. However, Bitcoin, Ethereum, and Solana all fell short of these targets.

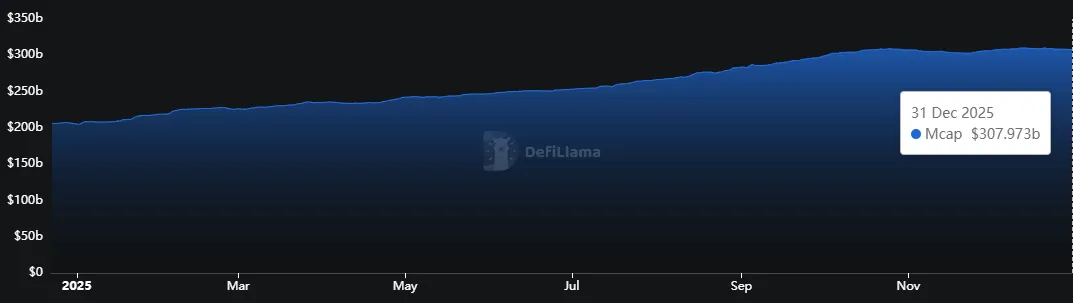

VanEck’s predictions for tokenization and DeFi growth were also overly optimistic in terms of scale, but directionally correct. The firm correctly identified these themes as significant growth areas, even if the pace of expansion didn’t match their expectations.

HashKey Group’s predictions, which included Bitcoin surpassing $300,000 and a total crypto market cap of $10 trillion, served as a sentiment snapshot of bullish expectations. The one prediction that did hold true was the growth in the supply of USD-pegged stablecoins, highlighting their increasing role in the crypto ecosystem.

Galaxy’s forecast, while missing price targets for Bitcoin, Ethereum, and Dogecoin, accurately predicted the pivot of miners into AI and high-performance computing. This shift demonstrates the evolving nature of the crypto industry and the adaptability of its participants.

Gemini stood out for its accurate predictions regarding the establishment of a US strategic Bitcoin reserve and the approval of comprehensive digital asset legislation. Their foresight into the expansion of ETFs beyond Bitcoin and Ethereum, specifically naming Solana and XRP, also proved prescient.

Coinbase and Delphi Digital offered valuable insights by focusing on broader trends such as a more crypto-friendly Congress, the growing use of stablecoins for payments, and the resurgence of DeFi. These predictions highlighted the importance of understanding the underlying structural shifts in the crypto market.

In conclusion, the crypto market’s performance in 2025 underscores the importance of focusing on structural developments rather than relying solely on price predictions. The firms that accurately foresaw regulatory changes, ETF expansion, and the evolution of stablecoins provided the most valuable insights for investors and traders.

Related: XRP: Expert Warns Against Financial Freedom

Source: Original article

Quick Summary

Price predictions for Bitcoin, Ethereum, and other cryptos largely missed the mark in 2025. Predictions around regulatory developments, ETF expansion, and stablecoin adoption proved more accurate. Focusing on structural changes rather than price targets yielded more insightful forecasts.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.