XRP is showing strong technical indicates, potentially mirroring a Wyckoff reaccumulation pattern. This pattern suggests a period of sideways trading and shakeouts before a significant upward price movement. The analysis points to a possible $8 target by mid-2026, which could drive institutional interest.

What to Know:

- XRP is showing strong technical signals, potentially mirroring a Wyckoff reaccumulation pattern.

- This pattern suggests a period of sideways trading and shakeouts before a significant upward price movement.

- The analysis points to a possible $8 target by mid-2026, which could drive institutional interest.

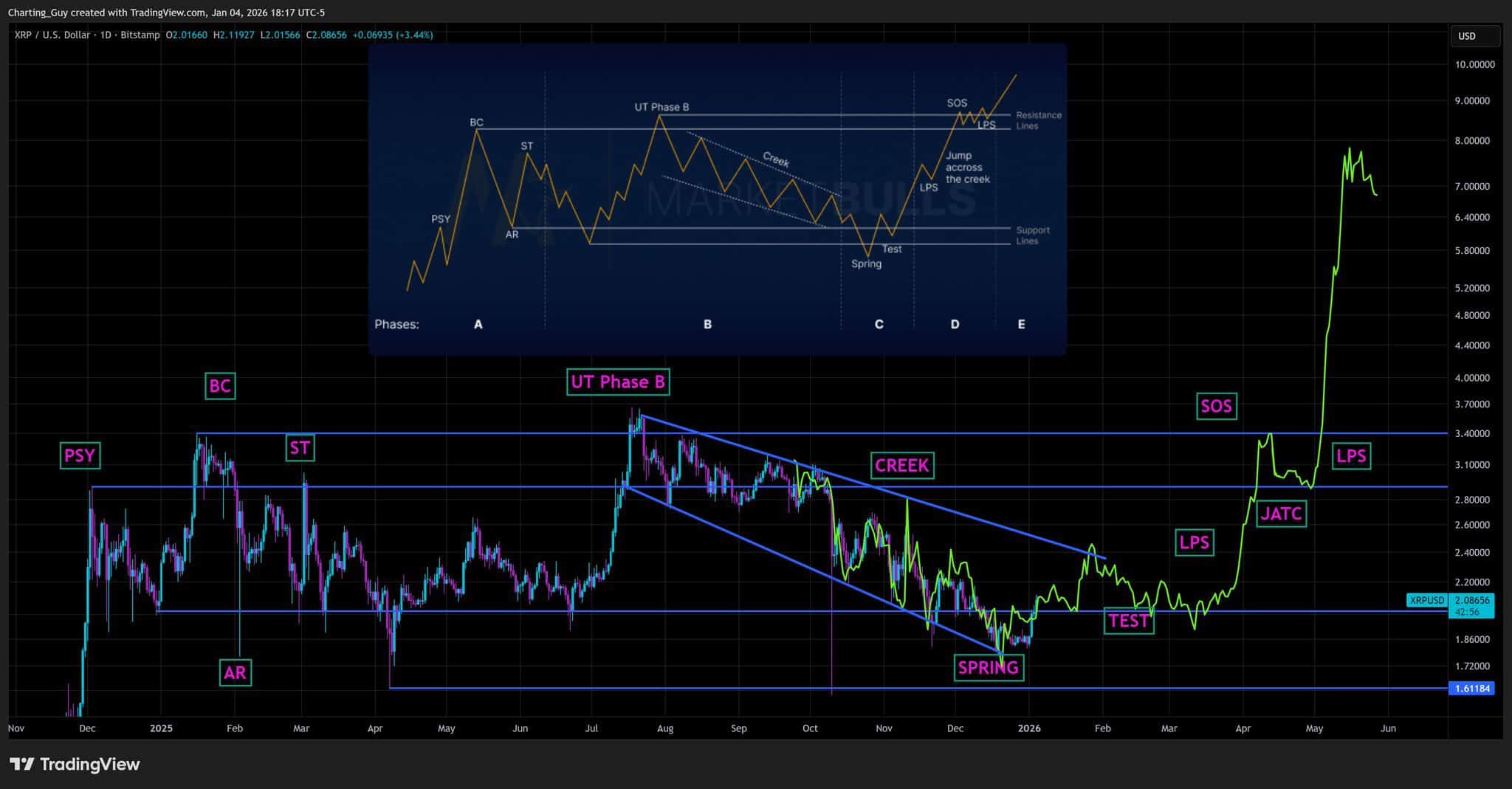

XRP has recently caught the attention of technical analysts, with some suggesting the cryptocurrency is poised for a substantial rally. The analysis hinges on XRP’s adherence to a Wyckoff reaccumulation pattern, characterized by prolonged sideways trading and strategic shakeouts designed to test investor resolve. Should this pattern continue to play out, XRP could see a significant price appreciation, potentially reaching the $8 mark by mid-2026. This prospect is particularly relevant for institutional investors looking for assets with defined technical structures and upside potential.

Wyckoff Reaccumulation in Play

Charting Guy, a well-known technical analyst, highlighted that XRP’s recent price action is closely mirroring a Wyckoff reaccumulation pattern. This pattern typically involves an extended period of price consolidation, marked by false breakdowns and shakeouts to weed out weaker hands. The successful completion of these phases often precedes a strong upward price movement, suggesting that XRP may be entering a more bullish phase. The accuracy of this pattern recognition is crucial for traders and investors looking to capitalize on potential breakouts.

Patience Tested During Consolidation

The sideways trading that XRP experienced throughout much of the past year tested the patience of many investors. After peaking near $3.66, XRP corrected significantly, leading some to anticipate further declines. This period of uncertainty and boredom is a hallmark of the Wyckoff reaccumulation phase, designed to challenge investor conviction. Now that XRP is demonstrating strength above previous resistance levels, the technical outlook has improved considerably, potentially attracting renewed interest from both retail and institutional participants.

Technical Targets and Fibonacci Extensions

Charting Guy’s $8 target for XRP is based on a multi-year bullish structure that has been forming since 2023. This target aligns with Fibonacci extension levels, specifically the 1.272 level, which often acts as a significant resistance point in established uptrends. The convergence of historical price behavior and Fibonacci extensions reinforces the credibility of the $8 target. However, it’s important to note that technical analysis is not foolproof, and various market factors could influence XRP’s trajectory.

Analyst Consensus and Market Sentiment

The $8 target for XRP is not an isolated prediction. Several other analysts have echoed similar sentiments, suggesting a broader consensus regarding XRP’s potential upside. This alignment in technical analysis can contribute to increased market confidence and potentially drive further investment into XRP. While some analysts propose even higher long-term targets, the $8 level remains a key focal point for many traders and investors, providing a tangible benchmark for evaluating XRP’s performance.

Implications for Institutional Flows

The potential for XRP to reach $8 by mid-2026 could have significant implications for institutional flows. Institutional investors often seek assets with clear technical structures and defined upside targets. If XRP continues to follow the Wyckoff reaccumulation pattern and successfully breaks through resistance levels, it could attract substantial institutional interest. This influx of capital could further validate the technical analysis and contribute to a self-fulfilling prophecy, driving XRP closer to its projected target.

In conclusion, XRP’s recent price action suggests a potential for significant upside, driven by the Wyckoff reaccumulation pattern and reinforced by analyst consensus. While the $8 target remains a projection, the technical setup and market sentiment provide a compelling case for XRP’s continued appreciation. Investors should, however, remain vigilant and consider broader market conditions and regulatory developments that could impact XRP’s performance.

Related: XRP Signals: Charts Target Bullish Gains

Source: Original article

Quick Summary

XRP is showing strong technical signals, potentially mirroring a Wyckoff reaccumulation pattern. This pattern suggests a period of sideways trading and shakeouts before a significant upward price movement. The analysis points to a possible $8 target by mid-2026, which could drive institutional interest.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.