XRP has demonstrated strong early performance in Q1 2026, outperforming the previous two years, but faces resistance. A viral story about a “Satoshi whale” making a substantial Bitcoin purchase has been debunked, highlighting the importance of verifying on-chain data.

What to Know:

- XRP has demonstrated strong early performance in Q1 2026, outperforming the previous two years, but faces resistance.

- A viral story about a “Satoshi whale” making a substantial Bitcoin purchase has been debunked, highlighting the importance of verifying on-chain data.

- Cardano is showing unusual liquidation dynamics with virtually no short liquidations, suggesting a potential shift in market positioning.

The digital asset market is always ripe with narratives, both real and imagined, that sway sentiment and price action. XRP’s recent surge, a debunked Bitcoin whale theory coinciding with Bitcoin’s anniversary, and unusual liquidation dynamics in Cardano highlight the blend of opportunity and risk facing institutional investors. Navigating this landscape requires a keen eye for both technical signals and fundamental realities.

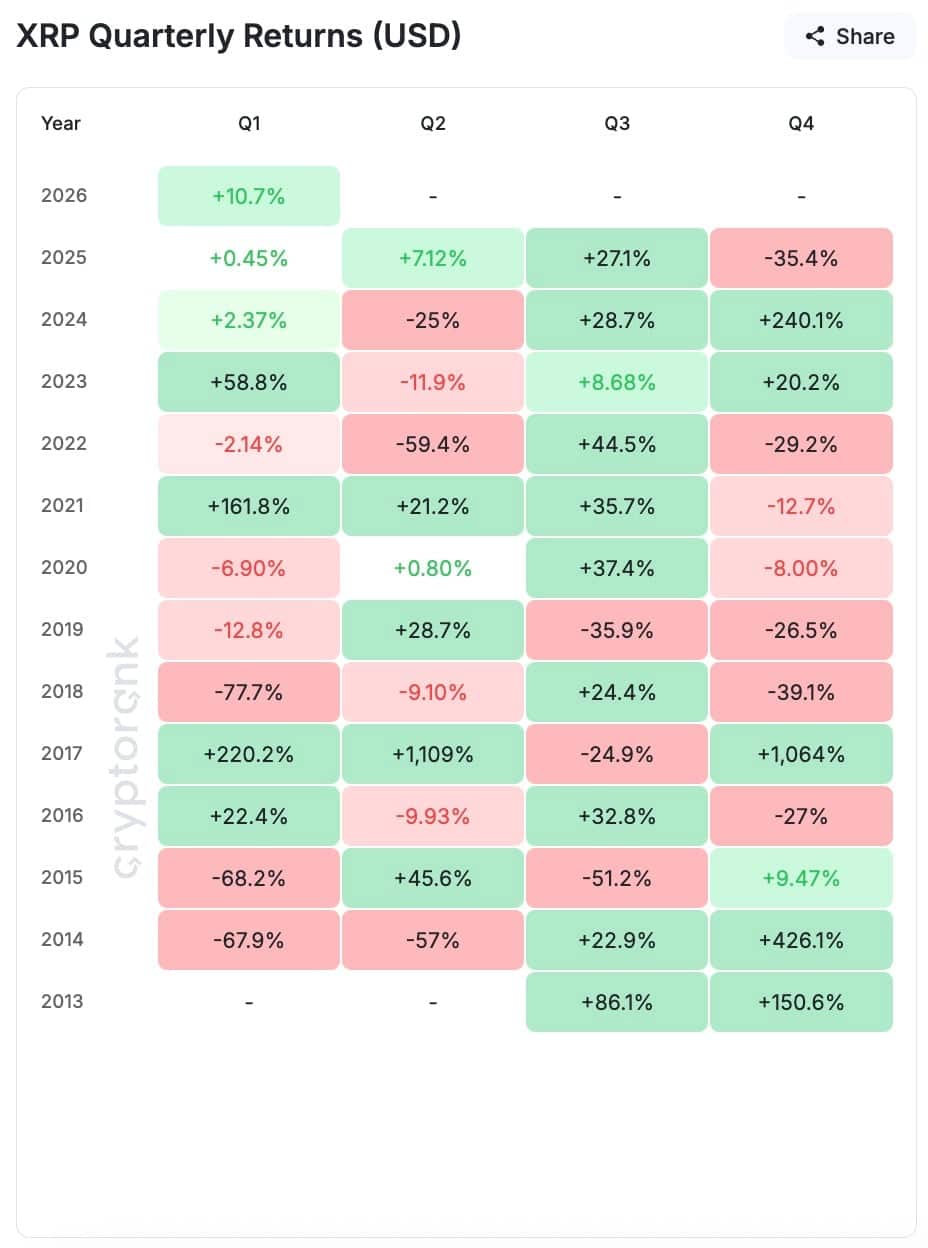

XRP’s Promising Start to 2026

XRP has kicked off 2026 with a notable +10.8% gain in the first 12 days of January, marking its best Q1 start since 2023. This contrasts with more modest gains in the same period of 2025 (+0.45%) and 2024 (+2.37%). While early, this performance indicates renewed interest in XRP, potentially driven by developments in its ongoing legal battles or broader market sentiment.

For institutional investors, this early surge presents both an opportunity and a caution. The ability of XRP to sustain gains above the $1.98 support level will be critical. A sustained uptrend could signal a potential for further appreciation, while failure to hold this level may lead to a correction. The $2.35 level remains a key resistance point.

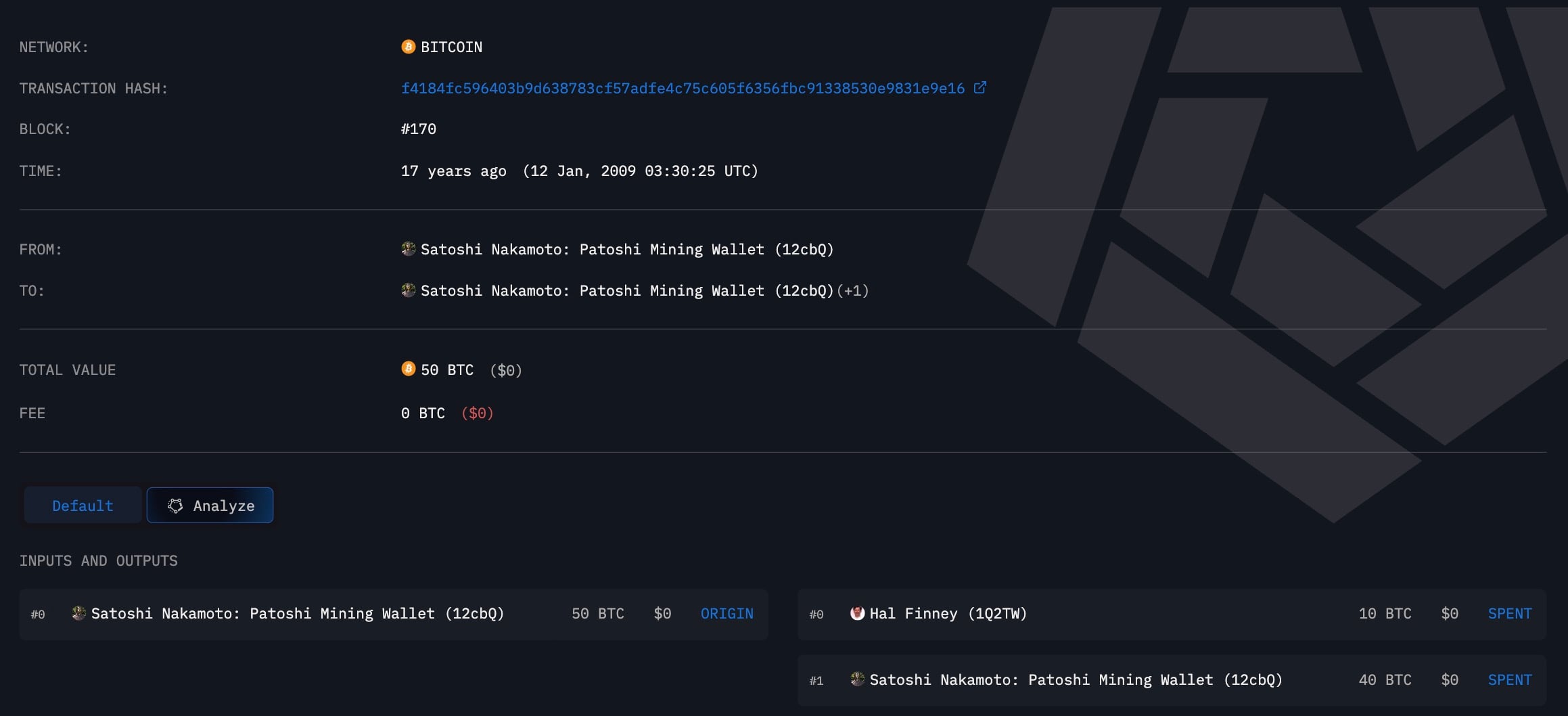

Debunking the “Satoshi Whale” Narrative

On the 17th anniversary of the first Bitcoin transaction, a story emerged about a supposed “Satoshi whale” transferring 26,916 BTC, worth over $2.44 billion. The narrative gained traction after being amplified on social media, including a repost by Binance founder Changpeng Zhao. However, further analysis revealed no evidence of a corresponding purchase on the blockchain.

This incident underscores the importance of due diligence in the digital asset space. While narratives can drive short-term price movements, institutional investors must rely on verifiable on-chain data and fundamental analysis. The “Satoshi stash” of over one million untouched Bitcoin continues to be a source of speculation, but this specific event appears to be a case of misinterpretation or deliberate misinformation.

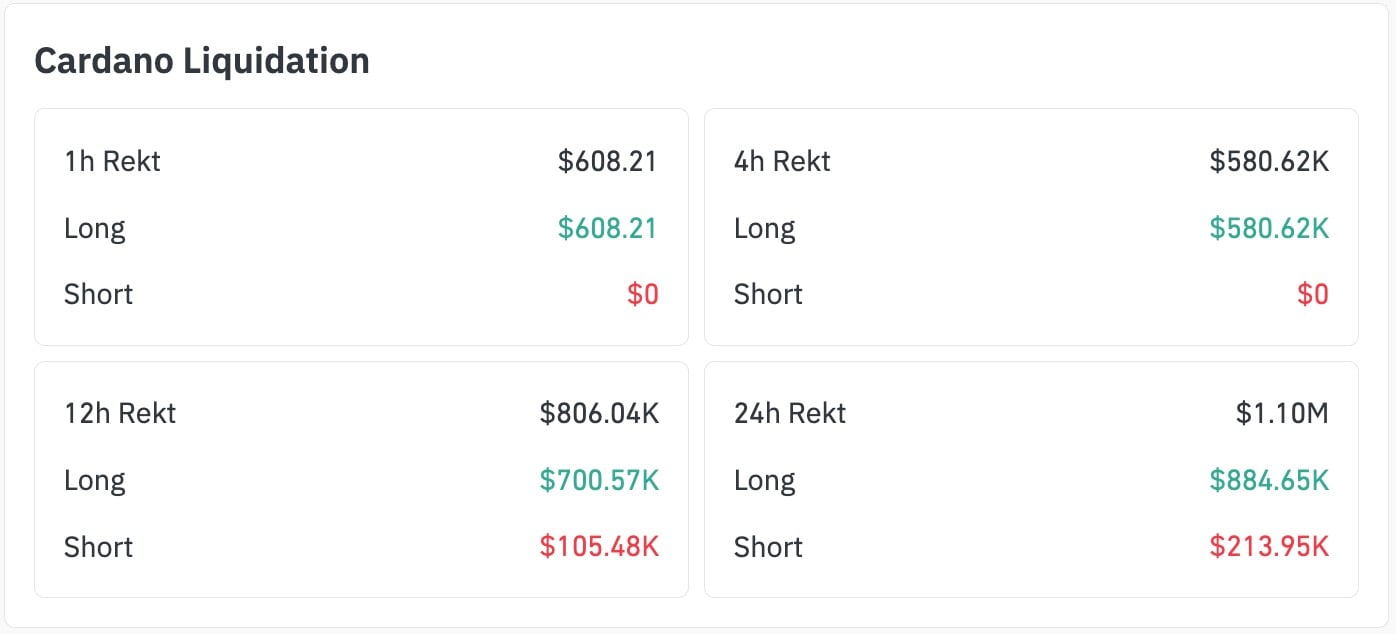

Cardano’s Unusual Liquidation Dynamics

Cardano (ADA) has exhibited unusual liquidation patterns, with zero short liquidations reported over one and four-hour periods, according to CoinGlass data. Meanwhile, long positions saw significant liquidations, totaling $580,600 in four hours and $884,600 over 24 hours. This imbalance suggests a potential shift in market positioning, with bearish sentiment temporarily subdued.

The absence of short liquidations could indicate that bearish positions have been largely cleared out, or that traders are hesitant to bet against Cardano at current levels. For institutional investors, this scenario presents a potential opportunity to assess the risk-reward profile of Cardano, particularly if the price retraces toward the $0.375 liquidity gap, which could trigger further long liquidations.

Navigating a Landscape of Signal and Noise

As the crypto market begins the week, Bitcoin is trading around $90,496, down 0.94% over the last 24 hours, with altcoins struggling to maintain their early January gains. Key levels to watch include Bitcoin needing to reclaim $92,000 to resume its upside trajectory, while support sits near $88,500. For XRP, holding $1.98 is crucial to sustaining its Q1 momentum, with $2.35 remaining a resistance ceiling. Cardano’s key liquidation trigger is at $0.375, with upside potential capped near $0.42 without significant volume.

The upcoming CPI data release will likely play a significant role in determining whether the early optimism of 2026 is justified. The combination of liquidation skews, debunked whale narratives, and evolving Q1 charts highlights the challenge of distinguishing between genuine signals and market noise.

In conclusion, the digital asset market continues to offer both opportunities and pitfalls for institutional investors. XRP’s early Q1 gains, the debunked “Satoshi whale” narrative, and Cardano’s unusual liquidation dynamics underscore the need for rigorous due diligence, reliance on verifiable data, and a clear understanding of market structure. As the market matures, the ability to discern signal from noise will be paramount for success.

Related: XRP Gravestone Doji Signals Bearish Turn

Source: Original article

Quick Summary

XRP has demonstrated strong early performance in Q1 2026, outperforming the previous two years, but faces resistance. A viral story about a “Satoshi whale” making a substantial Bitcoin purchase has been debunked, highlighting the importance of verifying on-chain data.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.