XRP has recently reclaimed the $2 level, a key psychological threshold for traders. The broader crypto market is watching to see if XRP can sustain this level, given its history of volatility around this price point. Sustained price action above $2 could signal increased liquidity and renewed bullish momentum for XRP.

What to Know:

- XRP has recently reclaimed the $2 level, a key psychological threshold for traders.

- The broader crypto market is watching to see if XRP can sustain this level, given its history of volatility around this price point.

- Sustained price action above $2 could signal increased liquidity and renewed bullish momentum for XRP.

XRP has shown renewed strength, briefly surpassing the $2 mark. This move has caught the attention of market participants, particularly after previous failed attempts to maintain this level. Whether XRP can establish a firm foothold above $2 remains to be seen, with analysts closely monitoring trading volume and key technical indicators for confirmation.

XRP’s Return to $2

XRP has demonstrated resilience, bouncing back from recent lows to reclaim the $2 level. This resurgence, driven by renewed buying interest since late December, suggests a potential shift in market sentiment. The ability to hold above this critical support may pave the way for further gains, with the next target around $2.4, a level that also represents significant resistance.

Volume Concerns

Despite the positive price action, trading volume remains a concern. The current volume is subdued, with lower highs, indicating a lack of strong conviction among buyers. A substantial increase in buy volume is needed to confirm a genuine breakout and sustain upward momentum, particularly beyond the $2.4 resistance level.

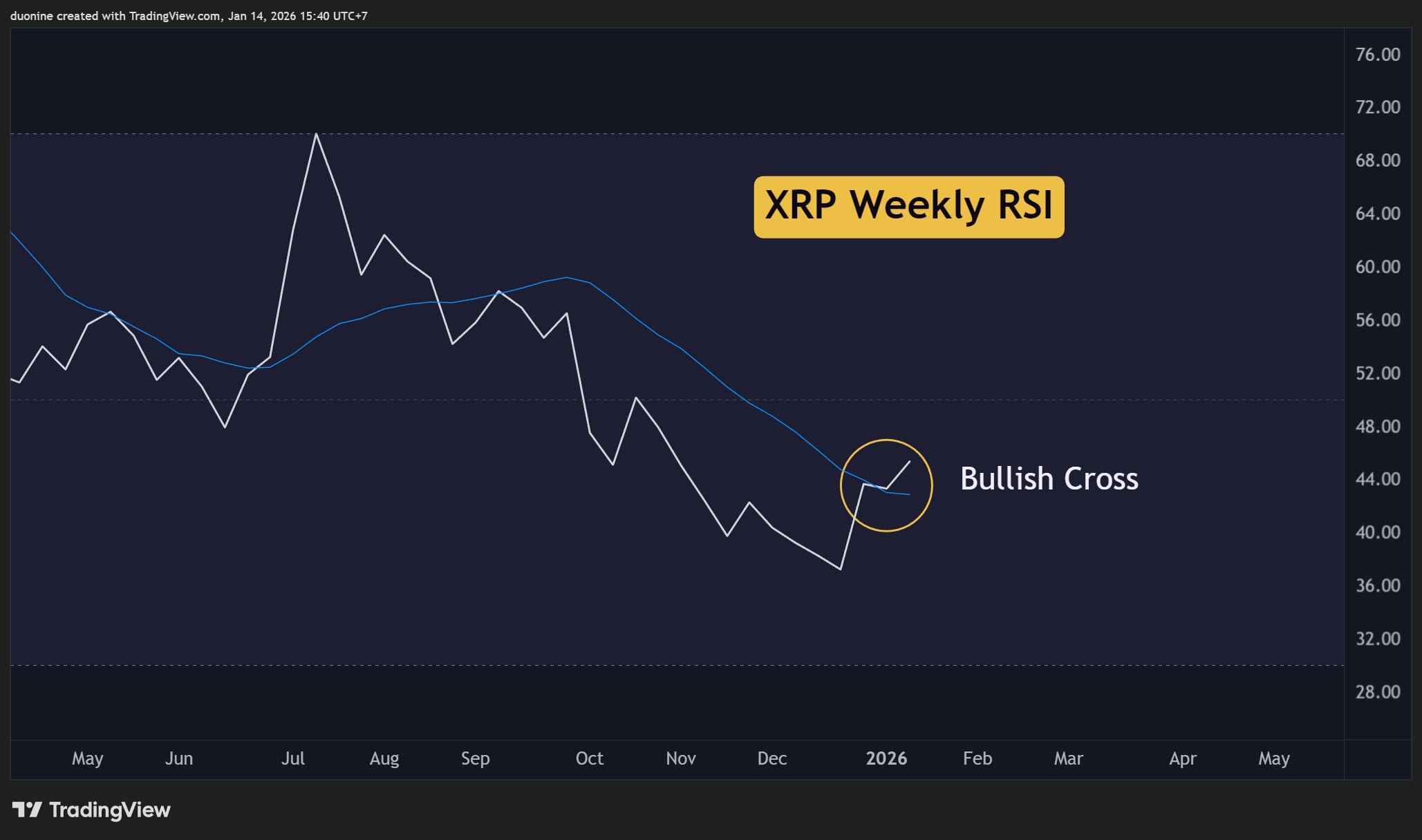

Weekly RSI Shows Bullish Signs

A potentially bullish signal has emerged on the weekly Relative Strength Index (RSI), which has crossed above its moving average. This development suggests a possible shift in momentum. However, for a more definitive confirmation, the RSI needs to climb above the 50 mark, indicating sustained buying pressure.

Broader Market Context

XRP’s performance is also influenced by broader trends in the cryptocurrency market. Positive developments in Bitcoin and Ethereum often create a favorable environment for altcoins like XRP. Additionally, regulatory clarity and institutional adoption play a crucial role in shaping long-term market sentiment.

Ripple’s Developments

Developments within Ripple, including partnerships, technological advancements, and regulatory progress, directly impact XRP’s price. Positive news tends to boost investor confidence, leading to increased buying activity and liquidity. Conversely, negative news or regulatory setbacks can trigger sell-offs and price declines.

Conclusion

XRP’s recent price action above $2 is encouraging, but it is essential to consider the context of subdued trading volume and the need for RSI confirmation. A sustained move above $2.4, accompanied by increased buying pressure, would signal a more robust bullish trend. Investors should closely monitor these technical indicators and broader market developments to make informed decisions.

Related: Crypto Market Signals Shiba Inu Breakout

Source: Original article

Quick Summary

XRP has recently reclaimed the $2 level, a key psychological threshold for traders. The broader crypto market is watching to see if XRP can sustain this level, given its history of volatility around this price point. Sustained price action above $2 could signal increased liquidity and renewed bullish momentum for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.