Key takeaway #1 — XRP is holding above $2, showing early signs of a trend reversal after reclaiming its 50-day moving average. Key takeaway #2 summarizing major data — Institutional flows into XRP investment products were significantly positive last week, contrasting with broader market outflows.

What to Know:

- Key takeaway #1 — XRP is holding above $2, showing early signs of a trend reversal after reclaiming its 50-day moving average.

- Key takeaway #2 summarizing major data — Institutional flows into XRP investment products were significantly positive last week, contrasting with broader market outflows.

- Key takeaway #3 explaining trader or institutional implications — The balanced onchain volume and positive institutional sentiment suggest a potential accumulation phase for XRP rather than speculative excess, which could lead to further price appreciation if the $2.40 resistance is broken.

XRP has shown resilience by maintaining its position above $2, a level that coincides with increasing institutional investment. This price stability, coupled with positive inflows into XRP investment products, hints at a potential shift in market dynamics for the altcoin. The combination of technical indicators and institutional sentiment suggests that XRP’s rally may have further to run if certain resistance levels are breached.

XRP investment product inflows support price stability

XRP began 2026 by reclaiming a bullish position above its 50-day simple moving average (SMA) during the first weekend of January. The move aligns with a classic downtrend retest, a structure that leads to higher prices if buyers maintain control. However, the price action so far suggests stabilization rather than acceleration.

This stability appears reinforced by institutional investors’ participation. While the digital asset market experienced one of its worst weekly performances since mid-2023, with roughly $454 million in outflows, XRP price moved in the opposite direction.

CoinShares data showed $45 million in weekly inflows into XRP, a more than 400% increase week over week, that stood in contrast to broader market outflows.

This contrast has helped XRP hold above $2 even as liquidity conditions tightened elsewhere, highlighting that its recent strength is not purely sentiment-driven.

What does derivatives data suggest about XRP’s next move?

Derivatives data provides insights into the potential future price movements of XRP. Analysis of funding rates, open interest, and trading volumes in XRP futures can reveal whether the market is leaning bullish or bearish. High positive funding rates often indicate excessive speculation and potential for a correction, while negative rates suggest that traders are positioned for a decline.

Additionally, monitoring the options market for XRP can provide clues about potential volatility and price targets. A concentration of call options at a certain strike price may suggest that traders anticipate a move towards that level. By examining these derivatives metrics, investors can gain a better understanding of the market’s expectations for XRP and adjust their strategies accordingly.

Currently, derivatives data indicates a cautious optimism surrounding XRP, with balanced positions and moderate volatility expectations.

Volume data and trader outlook define the range

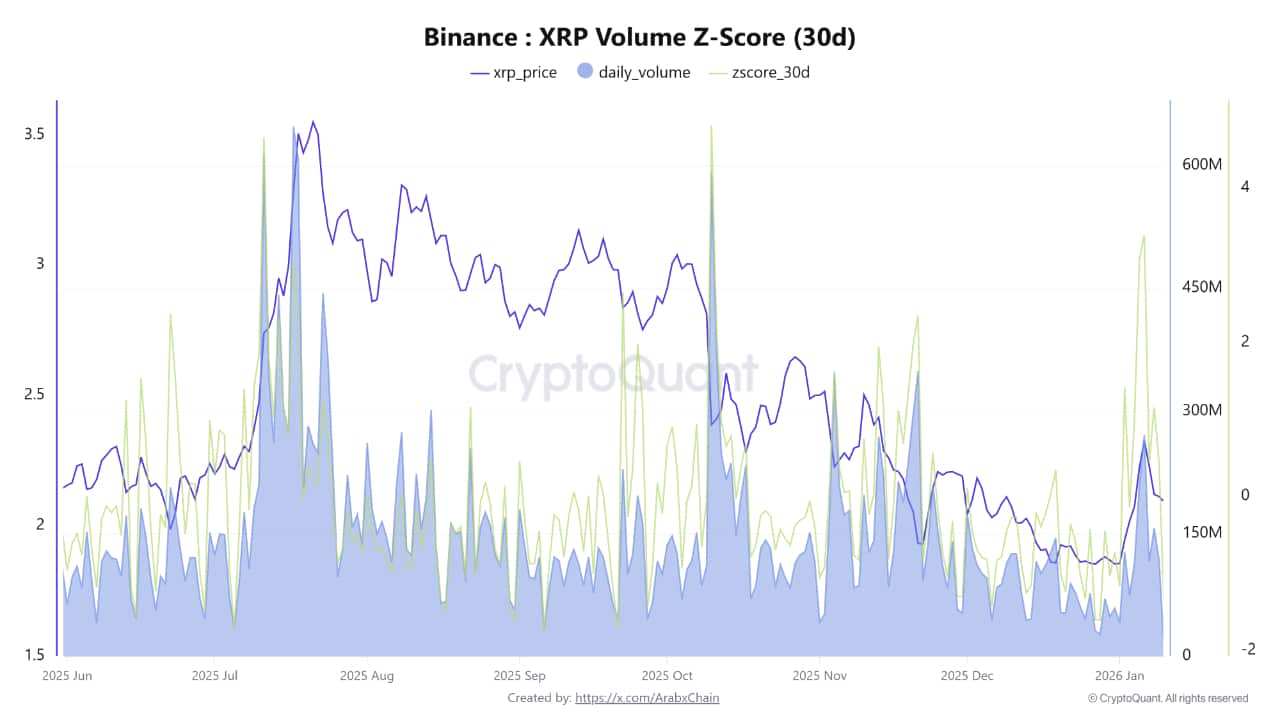

CryptoQuant data adds further nuance. Trading volume Z-Scores on Binance hover around 0.44, placing activity slightly above the 30-day average but firmly within a neutral range.

This suggests XRP’s price is not being pushed by speculation, but by balanced activity between buyers and sellers, a condition seen during accumulation phases.

Meanwhile, market analyst CrediBULL said that a completed “triple tap” at range highs leaves two paths: either a pullback toward $1.77 within a larger uptrend, or a defended base around $2 where dips continue to be bought. Given the current market, the analyst favors an uptrend, targeting higher, untapped levels at around $3.

However, futures trader Dom emphasized that while $2.10 has held for months, moves toward the mid-$2.40 range could only deliver a meaningful market shift on the daily chart. The analyst believed that strong price action likely begins once the altcoin establishes acceptance well above the $2.40 level.

How are ETF flows influencing XRP’s price action?

Exchange-Traded Funds (ETFs) that include XRP, or are focused on the broader crypto market, can significantly impact XRP’s price. Inflows into these ETFs suggest increasing investor interest and can drive up demand for XRP. Conversely, outflows can indicate waning confidence and lead to price declines. Monitoring ETF flows provides insights into institutional sentiment and broader market trends affecting XRP.

The recent inflows into XRP-related investment products, as highlighted by CoinShares data, support the notion that institutional investors are becoming more bullish on XRP. This increased demand from ETFs and institutional investors can provide a solid foundation for XRP’s price, helping it withstand broader market downturns and potentially fueling further rallies. Tracking these flows is crucial for understanding the underlying dynamics driving XRP’s price movements.

The divergence between XRP investment product inflows and overall market outflows underscores the unique position XRP currently holds in the crypto market.

Analyzing XRP Ledger activity and on-chain metrics

Analyzing activity on the XRP Ledger can provide valuable insights into the health and potential future performance of XRP. Metrics such as transaction volume, active addresses, and the number of new accounts can indicate the level of adoption and usage of the XRP Ledger. An increase in these metrics suggests growing interest and utility, which can positively influence XRP’s price.

Additionally, monitoring the concentration of XRP holdings among the top addresses can reveal potential risks associated with whale activity. Large holders making significant moves can create volatility in the market. By examining these on-chain metrics, investors can gain a deeper understanding of the underlying fundamentals driving XRP’s value and make more informed decisions.

Currently, on-chain data suggests a healthy level of activity on the XRP Ledger, with balanced participation indicating sustainable growth rather than speculative bubbles.

XRP’s ability to hold above $2, supported by strong institutional inflows and balanced on-chain activity, paints a cautiously optimistic picture for the altcoin. While technical resistance remains, the underlying dynamics suggest potential for further gains if key levels are breached, solidifying XRP’s position in the market.

Related: XRP Signals Bullish Move After Ratio Reset

Source: Original article

Quick Summary

Key takeaway #1 — XRP is holding above $2, showing early signs of a trend reversal after reclaiming its 50-day moving average. Key takeaway #2 summarizing major data — Institutional flows into XRP investment products were significantly positive last week, contrasting with broader market outflows.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.