XRP ETFs have recovered from a $40 million outflow earlier this year, fueled by recent inflows. This rebound reflects broader market dynamics and investor sentiment toward digital asset ETFs. The recovery is significant for gauging institutional interest in XRP and Ripple’s market position.

What to Know:

- XRP ETFs have recovered from a $40 million outflow earlier this year, fueled by recent inflows.

- This rebound reflects broader market dynamics and investor sentiment toward digital asset ETFs.

- The recovery is significant for gauging institutional interest in XRP and Ripple’s market position.

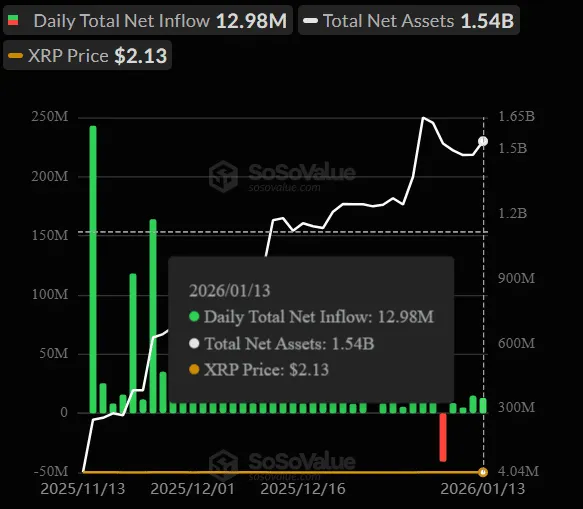

XRP ETFs have demonstrated resilience by recouping earlier losses, signaling continued institutional appetite for exposure to the token. Recent data highlights a recovery from a $40 million outflow, driven by renewed inflows into these investment vehicles. This reversal underscores the dynamic nature of the digital asset market and the evolving perceptions of XRP’s investment potential. As the market matures, understanding these flow dynamics becomes crucial for assessing the long-term viability of XRP and similar crypto assets.

Inflow Dynamics and Market Sentiment

The initial outflow of $40 million on January 7 raised concerns about potential waning interest in XRP ETFs. However, the subsequent recovery, marked by consistent inflows over the following four trading days, suggests a temporary shift in sentiment rather than a fundamental loss of confidence. This rapid turnaround highlights the importance of analyzing short-term market fluctuations within the context of broader trends. Institutional investors often rebalance portfolios based on various factors, including macroeconomic conditions, regulatory developments, and alternative investment opportunities.

XRP ETF Performance Metrics

Since the launch of the first XRP ETF by Canary Capital in November 2025, these products have collectively amassed significant inflows. Crossing the $1 billion mark in cumulative inflows within 21 days of consistent positive flows is a testament to the initial enthusiasm surrounding XRP ETFs. While Bitcoin and Ethereum ETFs still lead in total inflows, XRP ETFs have carved out a notable position, surpassing Solana ETFs in attracting capital. This performance underscores the appeal of XRP as an alternative digital asset within the ETF landscape.

Comparative Analysis with Other Crypto ETFs

When compared to other crypto ETFs, XRP’s performance is particularly noteworthy. While Bitcoin ETFs, launched in January 2024, boast $57.27 billion in cumulative inflows and Ethereum ETFs, launched in July 2024, have recorded $12.57 billion, XRP ETFs have outperformed many of their peers. Solana ETFs, despite launching earlier, have yet to reach the $1 billion milestone, highlighting XRP’s relative strength in attracting investment. The performance of smaller crypto ETFs, such as those linked to Dogecoin, Chainlink, and Litecoin, further emphasizes the concentration of institutional interest in a select few digital assets.

Implications for Institutional Investors

The ability of XRP ETFs to recover from significant outflows and maintain positive momentum is a positive sign for institutional investors. It suggests that despite short-term volatility, there is underlying confidence in XRP’s long-term prospects. This resilience may encourage further institutional participation, driving additional inflows and increasing liquidity in the XRP market. However, regulatory developments and Ripple’s ongoing legal battles remain key factors that could influence investor sentiment.

Future Outlook and Market Considerations

Looking ahead, the performance of XRP ETFs will likely depend on several factors, including regulatory clarity, market adoption, and technological advancements within the Ripple ecosystem. Continued positive inflows could lead to increased market capitalization and greater price stability for XRP. However, investors should remain vigilant and monitor market conditions closely, as unforeseen events can significantly impact the value of digital assets. The recovery of XRP ETFs serves as a reminder of the potential for both risks and rewards in the evolving crypto market.

Related: Crypto Liquidity Signals; Bitcoin Breakout Targets

Source: Original article

Quick Summary

XRP ETFs have recovered from a $40 million outflow earlier this year, fueled by recent inflows. This rebound reflects broader market dynamics and investor sentiment toward digital asset ETFs. The recovery is significant for gauging institutional interest in XRP and Ripple’s market position.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.