Bitcoin reached a new two-month high, driven by positive economic data. Altcoins followed Bitcoin’s lead, with Ethereum and XRP showing notable gains. Increased market activity suggests renewed interest in crypto assets, potentially benefiting XRP liquidity.

What to Know:

- Bitcoin reached a new two-month high, driven by positive economic data.

- Altcoins followed Bitcoin’s lead, with Ethereum and XRP showing notable gains.

- Increased market activity suggests renewed interest in crypto assets, potentially benefiting XRP liquidity.

Bitcoin experienced a significant surge, reaching a two-month peak and pulling the broader crypto market upward. The rally was fueled by lower-than-expected CPI data and subsequent market reactions. Altcoins, including Ethereum and XRP, followed suit, posting substantial gains.

Bitcoin’s Bullish Momentum

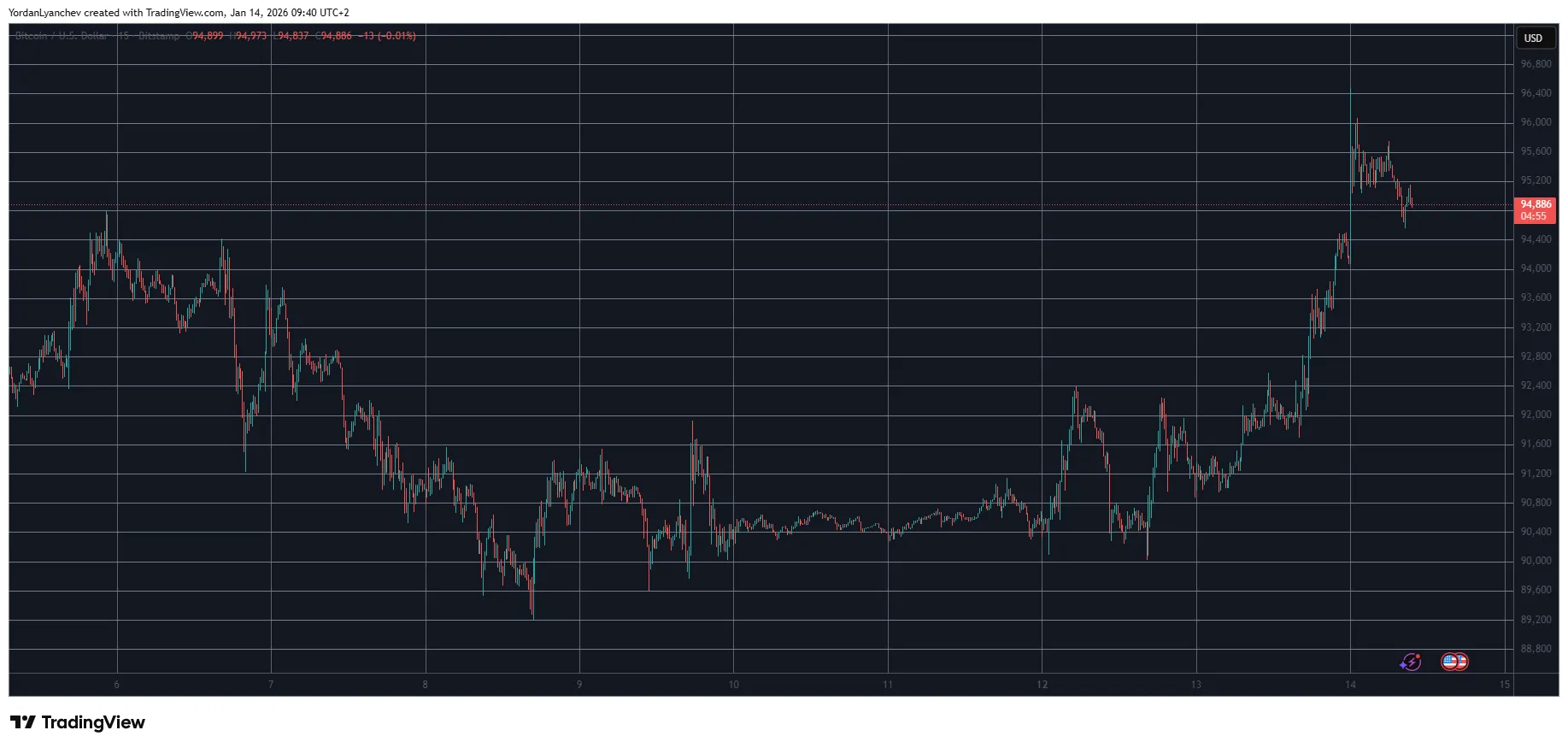

After a period of sideways trading, Bitcoin broke through resistance levels to reach $96,500, a high not seen in two months. Although it has since retraced slightly, Bitcoin remains above $95,000, with its market capitalization approaching $1.9 trillion. This surge indicates renewed bullish sentiment and strong buying pressure.

Altcoins Experience Gains

Ethereum has been a standout performer among large-cap altcoins, rising above $3,300 after briefly dipping below $3,100. XRP also saw positive movement, approaching $2.15. Other altcoins like Cardano (ADA) and Stellar (XLM) recorded even more impressive gains, demonstrating broad-based market strength.

Broader Market Uptick

The overall cryptocurrency market capitalization has increased by over $110 billion in the last 24 hours, reaching $3.330 trillion. This influx of capital suggests growing investor confidence and renewed interest in digital assets. The positive price action across various cryptocurrencies indicates a potential shift in market dynamics.

Implications for XRP and Liquidity

XRP’s recent price increase reflects the broader positive sentiment in the crypto market. Increased trading volumes and market participation can lead to enhanced liquidity for XRP, potentially benefiting institutional investors. As market conditions improve, XRP may attract further attention and investment, especially if Ripple continues to make progress in its legal proceedings and expand its use cases.

Conclusion

The cryptocurrency market is showing signs of renewed strength, with Bitcoin leading the charge and altcoins following suit. Positive economic data and increased investor confidence have contributed to the recent surge. These developments could have significant implications for XRP and overall market liquidity, potentially creating new opportunities for institutional engagement.

Related: Chainlink ETF Launches: Bitwise Details

Source: Original article

Quick Summary

Bitcoin reached a new two-month high, driven by positive economic data. Altcoins followed Bitcoin’s lead, with Ethereum and XRP showing notable gains. Increased market activity suggests renewed interest in crypto assets, potentially benefiting XRP liquidity. Bitcoin experienced a significant surge, reaching a two-month peak and pulling the broader crypto market upward.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.