Ripple expands its European presence and partners with LMAX Group to enhance institutional stablecoin adoption. The broader crypto market sees continued growth in spot Bitcoin ETF inflows, signaling strong institutional interest.

What to Know:

- Ripple expands its European presence and partners with LMAX Group to enhance institutional stablecoin adoption.

- The broader crypto market sees continued growth in spot Bitcoin ETF inflows, signaling strong institutional interest.

- These developments could positively impact XRP liquidity and market sentiment, though price predictions remain divided.

Ripple continues to make strategic moves in the cryptocurrency space, focusing on European expansion and institutional partnerships. While XRP has yet to mirror the gains of other altcoins, recent developments suggest a potential shift in momentum. This market update examines Ripple’s evolving regulatory landscape, key collaborations, and the overall sentiment surrounding XRP’s price trajectory.

European Expansion and Regulatory Clarity

Ripple has strategically prioritized Europe amid regulatory challenges in the United States. The company recently received preliminary approval for an Electronic Money Institution license in Luxembourg, which would enable Ripple to issue digital cash and provide various financial services across CSSF-regulated jurisdictions. Additionally, Ripple Markets UK Ltd. secured registration with the Financial Conduct Authority (FCA), confirming its compliance with anti-money laundering and counter-terrorist financing regulations. These regulatory advancements in Europe underscore Ripple’s commitment to establishing a compliant and robust operational framework.

Partnership with LMAX Group

LMAX Group, a global fintech firm, has partnered with Ripple to accelerate institutional stablecoin adoption and cross-asset mobility. The integration of Ripple’s stablecoin, RLUSD, into LMAX’s institutional trading infrastructure will provide clients with enhanced trading options. RLUSD, pegged 1:1 with the U.S. dollar, has gained traction among exchanges and banking institutions, including BNY Mellon, which serves as a custodian. With a market capitalization of nearly $1.4 billion, RLUSD is steadily climbing the ranks in the digital asset space.

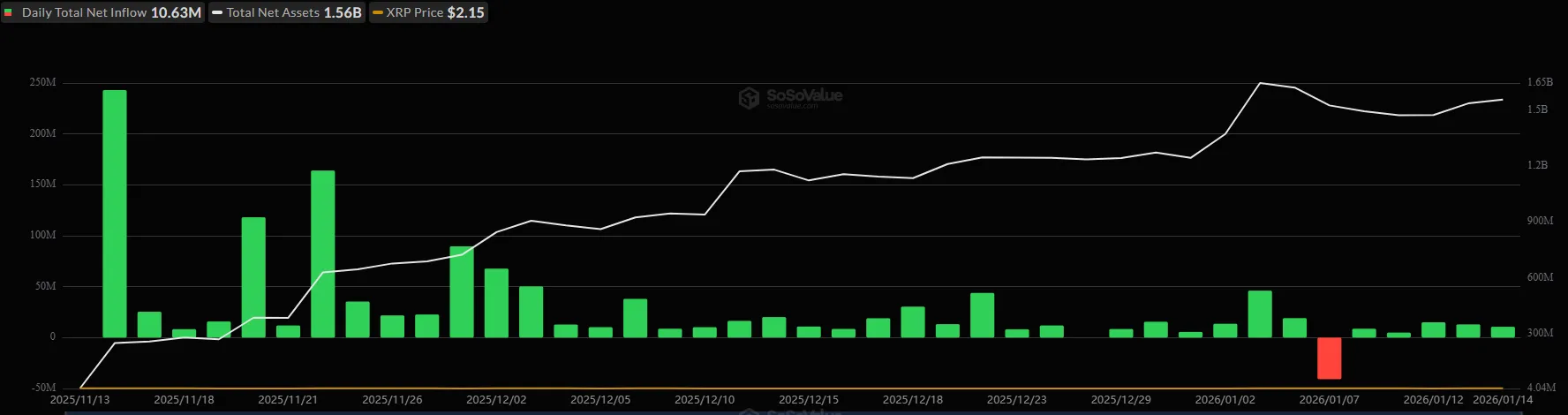

Bitcoin ETF Inflows Continue

The launch of spot Bitcoin ETFs in the U.S. has generated significant interest from institutional investors. These ETFs have experienced substantial net inflows since their inception, with a cumulative total of $1.26 billion to date, according to data from SoSoValue. This demonstrates strong institutional appetite for Bitcoin exposure through regulated investment vehicles. The consistent inflows into these ETFs reflect a positive sentiment towards the overall crypto market and could indirectly benefit other digital assets like XRP.

XRP Price Analysis and Market Sentiment

As of this writing, XRP is trading around $2.12, showing a modest 0.6% increase on a weekly scale. While XRP’s price performance has lagged behind some other altcoins, numerous analysts suggest a potential bull run on the horizon. However, opinions on XRP’s future price vary, with some predicting substantial gains while others caution against potential pullbacks. This mixed sentiment underscores the importance of conducting thorough research and exercising caution when investing in XRP.

Conclusion

Ripple’s strategic focus on European expansion, coupled with its partnership with LMAX Group, highlights the company’s commitment to growth and innovation. The continued inflows into spot Bitcoin ETFs signal strong institutional interest in the crypto market, which could positively impact XRP and related liquidity. While XRP’s price outlook remains subject to varying predictions, these recent developments warrant attention from institutional investors seeking opportunities in the evolving cryptocurrency landscape.

Related: XRP: CEO Silence Signals Coinbase Drama

Source: Original article

Quick Summary

Ripple expands its European presence and partners with LMAX Group to enhance institutional stablecoin adoption. The broader crypto market sees continued growth in spot Bitcoin ETF inflows, signaling strong institutional interest. These developments could positively impact XRP liquidity and market sentiment, though price predictions remain divided.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.