XRP ETFs are accumulating supply, but price action remains muted, suggesting a potential liquidity imbalance. Shiba Inu’s burn rate has plummeted, jeopardizing its deflationary narrative and near-term price outlook.

What to Know:

- XRP ETFs are accumulating supply, but price action remains muted, suggesting a potential liquidity imbalance.

- Shiba Inu’s burn rate has plummeted, jeopardizing its deflationary narrative and near-term price outlook.

- Justin Sun’s public offer to pay Elon Musk for a conversation highlights the intersection of clout, capital, and speculation in crypto markets.

The past week in digital assets presented a mixed bag of developments, ranging from ETF accumulation of XRP to a sharp decline in Shiba Inu’s burn rate and Justin Sun’s eyebrow-raising proposition to Elon Musk. These events, while seemingly disparate, offer valuable insights into the current state of the market, institutional adoption, and the ever-present influence of social media narratives. For institutional investors, understanding these dynamics is crucial for navigating the evolving landscape and identifying potential opportunities or risks.

XRP ETF Inflows and Price Disconnect

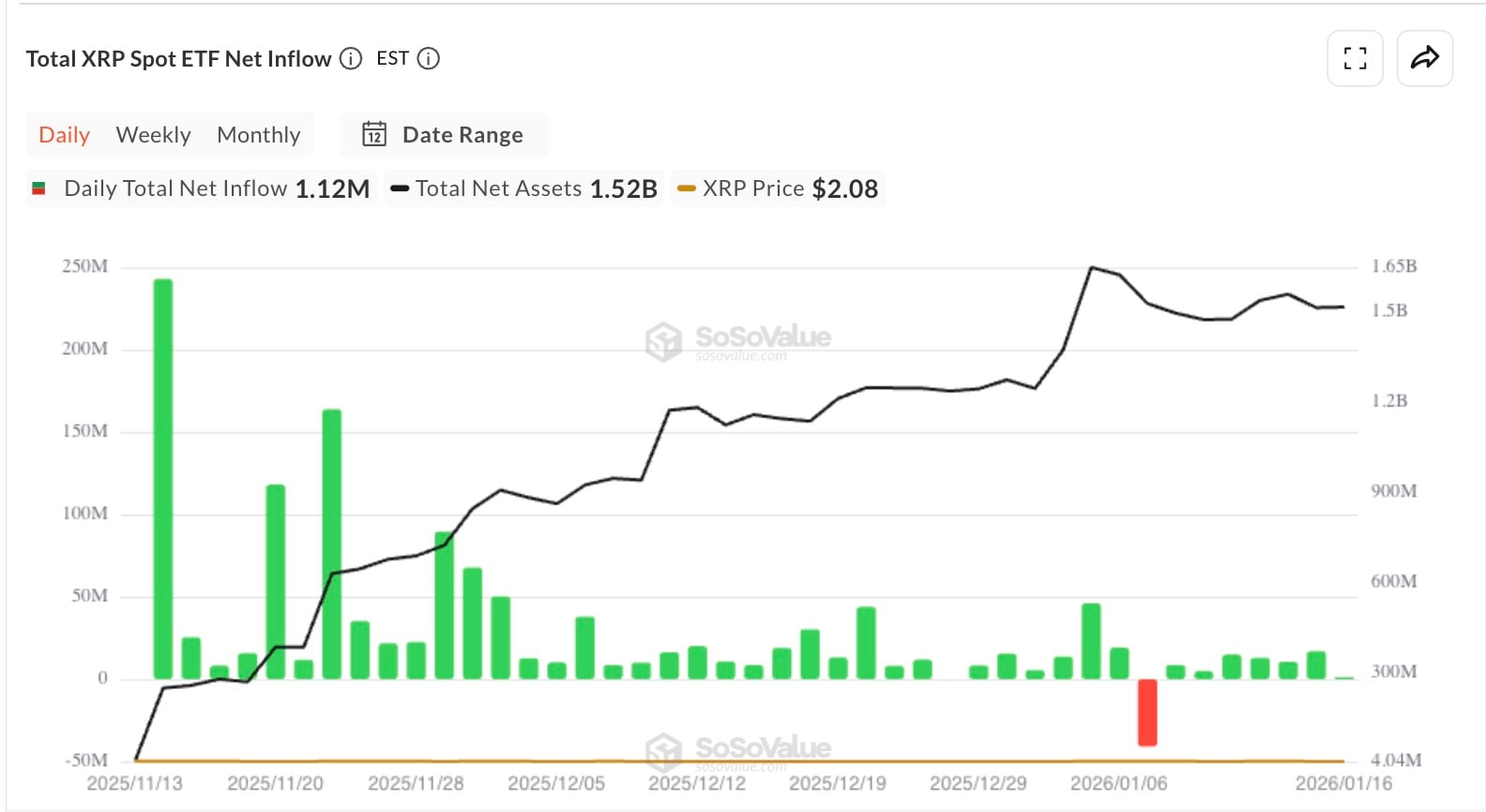

U.S. spot XRP ETFs have collectively amassed $1.52 billion worth of XRP, effectively removing 1.20% of the token’s total market capitalization from circulation. This supply absorption should theoretically exert upward pressure on the price. However, XRP has remained range-bound, trading near $2.05 and struggling to overcome resistance at $2.10 and its 200-day moving average at $2.32. This divergence between ETF inflows and price action suggests a potential imbalance between supply and demand, or that the market had already priced in the ETF catalyst.

The muted price response could indicate a lack of retail follow-through or the presence of significant overhead supply. If XRP fails to break above $2.32 in the near term, it risks falling into a “liquidity trap,” where reduced token availability is offset by insufficient buying interest. This scenario underscores the importance of monitoring both ETF flows and broader market sentiment to gauge the true impact of institutional adoption. We’ve seen similar dynamics play out in other asset classes, where ETF launches initially generate excitement but ultimately fail to deliver sustained price appreciation if underlying demand is lacking.

Shiba Inu’s Burn Rate Collapse

Shiba Inu (SHIB) recently experienced a dramatic 86.14% decline in its burn rate, with only 749,126 tokens burned in a 24-hour period. This sharp drop undermines the deflationary narrative that has been a key driver of SHIB’s appeal. While the token had recently formed a golden cross between its 23-day and 50-day moving averages, fueling speculation of a potential rally towards the 200-day average at $0.0000096, the dwindling burn rate casts doubt on this bullish outlook.

The price of SHIB is currently hovering around $0.00000841, clinging to a trendline established post-Christmas. A break below $0.000008 would likely invalidate the golden cross and trigger further downside. For meme coins like SHIB, deflationary mechanisms are crucial for maintaining investor interest and supporting price appreciation. The sudden collapse in the burn rate raises concerns about the project’s long-term viability and its ability to sustain its community-driven momentum. This serves as a reminder of the inherent risks associated with investing in assets heavily reliant on hype and sentiment.

Justin Sun’s Offer to Elon Musk

TRON founder Justin Sun publicly stated his willingness to pay Elon Musk $30 million for a one-hour conversation. While the intent behind this offer remains unclear—whether it was a genuine attempt to collaborate, a publicity stunt, or a combination of both—it highlights the unique dynamics of the crypto space, where social media influence and attention can translate into tangible value. Sun has a history of high-profile PR moves, suggesting a strategic approach to leveraging attention for marketing purposes.

In a world where clout markets increasingly intersect with token charts, even a seemingly offhand comment can spark speculation and drive market movements. The potential implications of a collaboration between Sun and Musk, such as a TRON-Tesla stablecoin or TRX integration on X, remain purely speculative. However, the fact that such possibilities are even being discussed underscores the power of social media narratives to shape perceptions and influence capital flows in the crypto market.

Broader Market Outlook

Analyzing price decomposition data from CryptoQuant reveals that Tuesdays and Thursdays tend to be the most volatile days of the week in the crypto market, while weekends typically exhibit lower activity. This pattern suggests that institutional trading activity, which tends to be concentrated during weekdays, plays a significant role in driving price fluctuations. As such, monitoring ETF flows and other institutional indicators on these key days can provide valuable insights into potential market movements.

Looking ahead, Bitcoin faces a confluence of technical, structural, and psychological resistance near the $100,000 level. A failure to meet expectations for ETF inflows on Tuesdays could trigger a rejection and set the tone for the remainder of Q1. For XRP, a sustained break above $2.32 could open up a repricing window towards $2.5-$2.7. Shiba Inu, on the other hand, needs to see a rebound in its burn rate to avoid revisiting the $0.00000800 coil zone.

In conclusion, the recent developments in XRP, SHIB, and the broader market underscore the importance of a nuanced understanding of market dynamics, institutional flows, and social media narratives. While ETF adoption can provide a boost to certain assets, it is not a guaranteed path to price appreciation. Similarly, deflationary mechanisms can be effective in driving demand, but only if they are sustained over time. And finally, social media hype can create opportunities, but also carries significant risks.

Related: Crypto Derivatives Data Shows Negative Funding

Source: Original article

Quick Summary

XRP ETFs are accumulating supply, but price action remains muted, suggesting a potential liquidity imbalance. Shiba Inu’s burn rate has plummeted, jeopardizing its deflationary narrative and near-term price outlook. Justin Sun’s public offer to pay Elon Musk for a conversation highlights the intersection of clout, capital, and speculation in crypto markets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.