ECB warns of potential market destabilization due to a possible “credibility shock” at the Federal Reserve. A Fed credibility shock could impact Bitcoin through term premiums, dollar liquidity, and broader risk appetite.

What to Know:

- ECB warns of potential market destabilization due to a possible “credibility shock” at the Federal Reserve.

- A Fed credibility shock could impact Bitcoin through term premiums, dollar liquidity, and broader risk appetite.

- Monitoring term premiums, ETF flows, and options positioning is crucial for gauging Bitcoin’s response to macro events.

European Central Bank (ECB) chief economist Philip Lane recently highlighted a potential risk that could significantly impact global markets, including Bitcoin: a Federal Reserve “credibility shock.” This concern revolves around political pressure on the Fed, potentially forcing markets to reprice U.S. assets based on governance concerns rather than economic fundamentals. The implications of such a scenario could ripple through real yields, dollar liquidity, and the overall stability of the current macro regime, all of which are critical factors for Bitcoin.

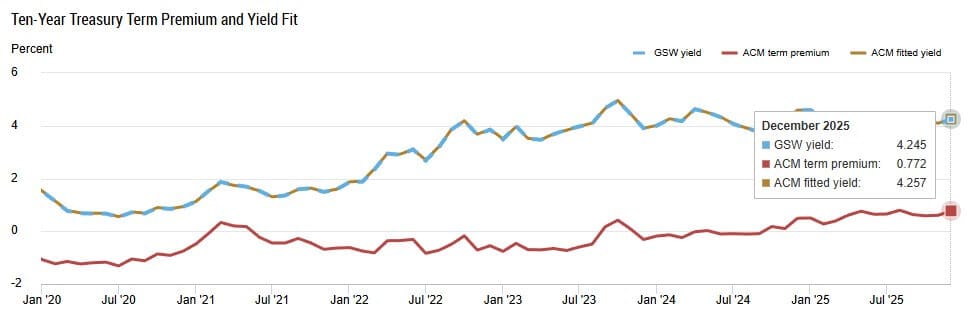

The IMF has emphasized the importance of Fed independence, warning that any erosion could be “credit negative,” which would manifest in term premiums and foreign-exchange risk premiums. A term-premium shock can occur even without a Fed rate hike, as credibility erosion can drive long-end yields higher while the policy rate remains unchanged. Bitcoin, like equities and other duration-sensitive assets, operates within this discount-rate environment.

When term premiums increase, long-end yields rise, financial conditions tighten, and liquidity premiums compress, impacting Bitcoin’s upside potential. Historically, Bitcoin’s growth has been fueled by expanding liquidity premiums, which occur when real yields are low and risk appetite is high. A term-premium shock would reverse this dynamic, affecting the crypto market even if the Fed maintains its current federal funds rate.

A “reassessment of the dollar’s role” opens two distinct possibilities: higher U.S. yields strengthening the dollar and pressuring risk assets like Bitcoin, or a credibility-risk regime where term premiums rise while the dollar weakens due to investors demanding a governance risk discount on U.S. assets. In the latter scenario, Bitcoin could function as an alternative monetary asset, especially if inflation expectations rise alongside credibility concerns. Bitcoin’s increasing correlation with equities and AI narratives further amplifies the impact of macro shocks through leverage and gamma dynamics.

Stablecoin plumbing also plays a crucial role, as a significant portion of crypto transactions are conducted using dollar-denominated stablecoins backed by safe assets like Treasuries. A term-premium shock can influence stablecoin yields, demand, and on-chain liquidity conditions. While Bitcoin isn’t a direct Treasury substitute, Treasury pricing establishes the baseline for what is considered “risk-free” within the crypto ecosystem.

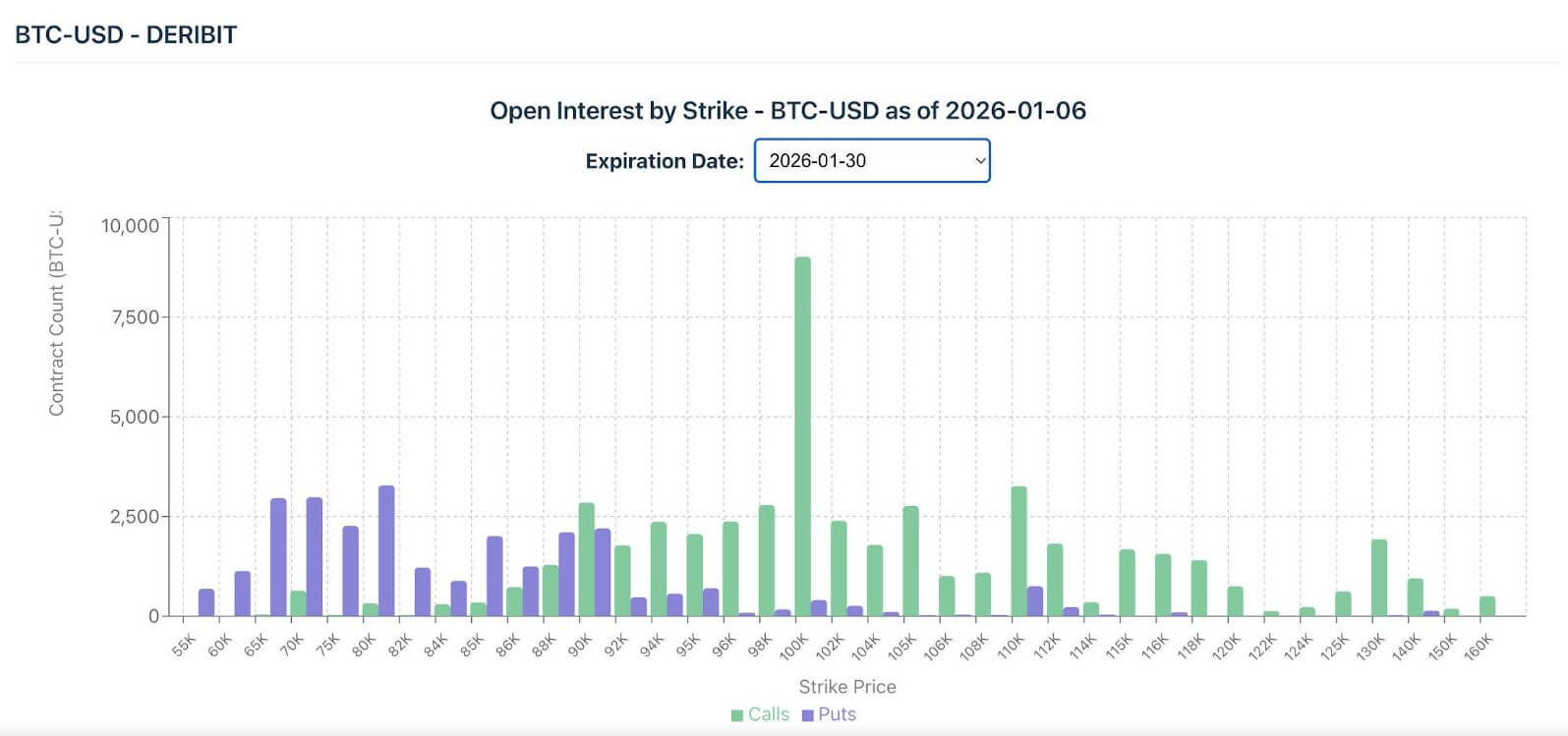

In conclusion, monitoring macro indicators like term premiums, real yields, inflation expectations, and the dollar index is essential for understanding Bitcoin’s price action. Additionally, tracking spot Bitcoin ETF flows and options positioning around key strikes can provide valuable insights into market sentiment and potential volatility. While the oil premium has subsided, the governance risk flagged by the ECB remains a critical factor to watch for those investing in Bitcoin and other digital assets.

Related: XRP Liquidity Signals Negative Funding

Source: Original article

Quick Summary

ECB warns of potential market destabilization due to a possible “credibility shock” at the Federal Reserve. A Fed credibility shock could impact Bitcoin through term premiums, dollar liquidity, and broader risk appetite. Monitoring term premiums, ETF flows, and options positioning is crucial for gauging Bitcoin’s response to macro events.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.