XRP experienced a slight price decrease, reflecting broader market volatility. Short-term technical analysis suggests potential for further correction if key support levels are breached. Mid-term outlook remains uncertain, with focus on maintaining critical price zones to prevent deeper declines.

What to Know:

- XRP experienced a slight price decrease, reflecting broader market volatility.

- Short-term technical analysis suggests potential for further correction if key support levels are breached.

- Mid-term outlook remains uncertain, with focus on maintaining critical price zones to prevent deeper declines.

XRP, the digital asset closely associated with Ripple Labs, has seen its price fluctuate amid ongoing market uncertainty. As regulatory scrutiny and macroeconomic factors continue to influence the crypto space, institutional investors are closely monitoring XRP’s price action and its ability to maintain key support levels. Understanding these dynamics is crucial for informed decision-making in the current environment.

Current Price Action

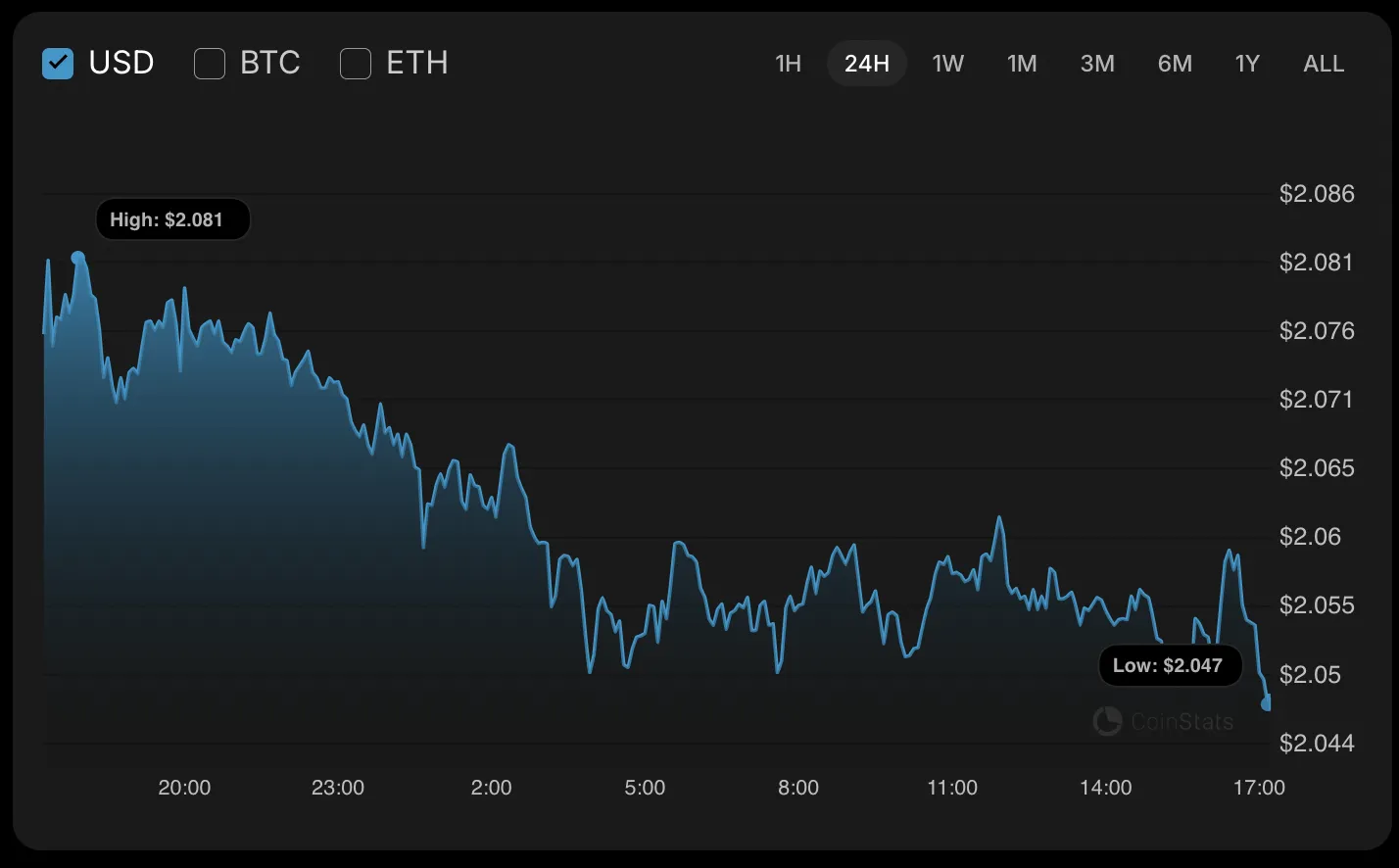

XRP’s price has seen a modest decline of 1.18% recently, reflecting the broader market’s wavering momentum. Technical analysis indicates that XRP has tested its immediate support level, with a potential for further downside if this level fails to hold. This price behavior highlights the asset’s sensitivity to short-term market fluctuations and the importance of monitoring these levels for potential trading opportunities.

Hourly Chart Analysis

An hourly chart analysis reveals that XRP attempted to break above its local support at $2.0470 but failed, resulting in a false breakout. Should the daily candle close near or below this level, it suggests a higher likelihood of continued correction toward the $2.04 area. This pattern is a key indicator for traders, as it suggests a possible short-term bearish trend that could influence immediate trading strategies.

Broader Time Frame Perspective

Examining a larger time frame, there are currently no definitive reversal signals for XRP. A breakout below the $2.0350 level could trigger a more significant downward move toward the $2.00 zone. This broader perspective is vital for investors looking beyond intraday fluctuations and considering the overall trend and potential downside risks.

Mid-Term Outlook

From a mid-term perspective, the situation remains uncertain. With XRP’s price far from critical levels, the focus is on the immediate support zone of $2.00. A failure to maintain this level could lead to a more substantial drop toward the $1.8209 support, underscoring the need for vigilance among investors with a longer-term horizon.

Market Sentiment and Key Levels

The market’s sentiment toward XRP appears cautious, with traders closely watching key support levels. The ability of XRP to hold these levels will likely dictate its price trajectory in the coming weeks. Institutional investors are keenly aware of these technical thresholds, as they often serve as triggers for algorithmic trading and large-scale position adjustments.

In summary, XRP’s recent price action indicates a period of uncertainty, with key support levels playing a crucial role in determining its short to mid-term trajectory. Investors should closely monitor these levels and remain aware of broader market dynamics that could influence XRP’s price. As with any digital asset, informed decision-making is paramount in navigating the inherent volatility of the cryptocurrency market.

Related: XRP Liquidation Imbalance Signals Bear Target

Source: Original article

Quick Summary

XRP experienced a slight price decrease, reflecting broader market volatility. Short-term technical analysis suggests potential for further correction if key support levels are breached. Mid-term outlook remains uncertain, with focus on maintaining critical price zones to prevent deeper declines.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.