Ethereum’s staking milestone reflects increasing adoption, with over 36 million ETH staked, representing nearly 30% of the circulating supply. The composition of stakers is evolving, with a growing concentration among corporate entities, influencing network dynamics.

What to Know:

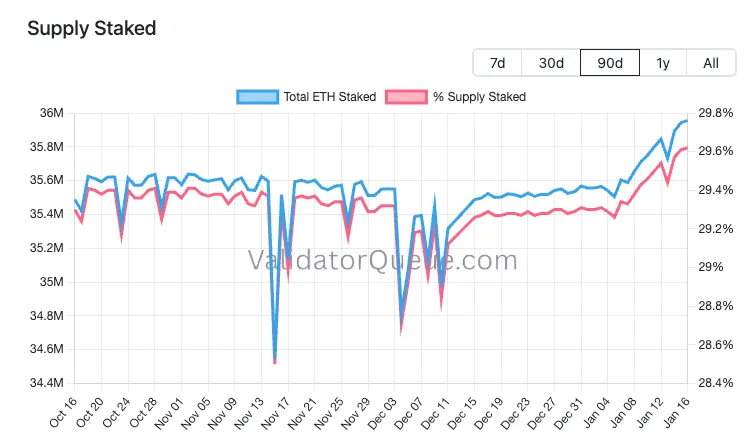

- Ethereum’s staking milestone reflects increasing adoption, with over 36 million ETH staked, representing nearly 30% of the circulating supply.

- The composition of stakers is evolving, with a growing concentration among corporate entities, influencing network dynamics.

- Liquid staking introduces a liquidity mirage, creating both opportunities and potential fragilities in the Ethereum ecosystem.

Ethereum’s proof-of-stake system has reached a new milestone, with over 36 million ETH now staked, representing close to 30% of the circulating supply. This significant amount, worth over $118 billion, highlights the growing confidence in Ethereum’s long-term prospects. However, a deeper look reveals a complex landscape where motivations and participants are becoming increasingly concentrated.

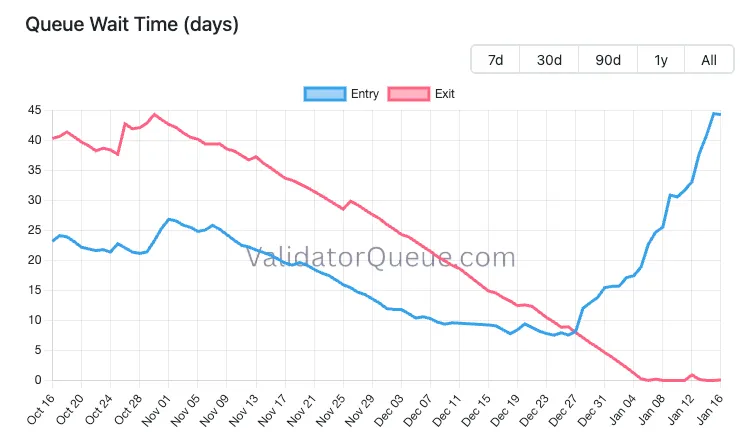

The increasing amount of staked ETH indicates a strong belief in the network’s security and the potential for earning rewards through validation. However, the mechanics of staking, including entry and exit queues, play a crucial role in understanding the true picture. The current state shows a significant delay in validator activation, suggesting sustained demand for staking.

Liquid staking protocols are reshaping the staking landscape by allowing users to trade tokens representing their staked ETH. This convenience, however, concentrates influence through a few major channels, creating potential chokepoints. As staking participation rises, so does the share of staking running through these centralized channels.

The liquidity provided by liquid staking can create a mirage for both bulls and bears. While bulls see scarcity due to less liquid ETH, bears see potential leverage as claims on staked ETH are used as collateral. Understanding these dynamics is crucial for assessing the true state of Ethereum’s market.

BitMine’s aggressive staking strategy, with over 1.25 million ETH staked, demonstrates the rise of corporate validators. This significant participation raises questions about how much of the overall network confidence is driven by a single entity’s strategy. The company’s plan to launch a commercial staking solution further emphasizes the increasing institutionalization of Ethereum staking.

Ultimately, the rise of institutional staking introduces trade-offs, including the concentration of influence and correlated behavior. While large operators can improve uptime and make staking accessible, a network secured by fewer entities is vulnerable to shared failure modes. The market signal of increased staking becomes noisier as corporate treasury choices blend with retail conviction and liquid staking designs.

In conclusion, Ethereum’s staking milestone signifies a shift towards ETH as productive collateral, with liquidity migrating into different venues. The evolving composition of stakers, including the rise of corporate validators, introduces new dynamics that investors and traders should consider. Understanding these underlying factors is crucial for navigating the evolving Ethereum landscape.

Related: XRP Liquidation Imbalance Signals Bear Target

Source: Original article

Quick Summary

Ethereum’s staking milestone reflects increasing adoption, with over 36 million ETH staked, representing nearly 30% of the circulating supply. The composition of stakers is evolving, with a growing concentration among corporate entities, influencing network dynamics. Liquid staking introduces a liquidity mirage, creating both opportunities and potential fragilities in the Ethereum ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.