Vanguard’s increased position in Metaplanet doesn’t necessarily signal a bullish outlook on Bitcoin treasuries but likely reflects index mechanics. The market-to-net-asset-value (mNAV) ratio is a key indicator of the financial health of Bitcoin treasury operators.

What to Know:

- Vanguard’s increased position in Metaplanet doesn’t necessarily signal a bullish outlook on Bitcoin treasuries but likely reflects index mechanics.

- The market-to-net-asset-value (mNAV) ratio is a key indicator of the financial health of Bitcoin treasury operators.

- A genuine recovery of digital asset treasuries requires broad-based mNAV expansion, accretive Bitcoin accumulation, and positive equity market response.

Vanguard’s recent increase in its Metaplanet holdings has sparked speculation about a renewed interest in Bitcoin treasury strategies. However, this move is more likely driven by index fund mechanics rather than a direct endorsement of Bitcoin as a treasury asset. The focus should instead be on the underlying fundamentals that drive valuations of companies holding Bitcoin as a primary asset.

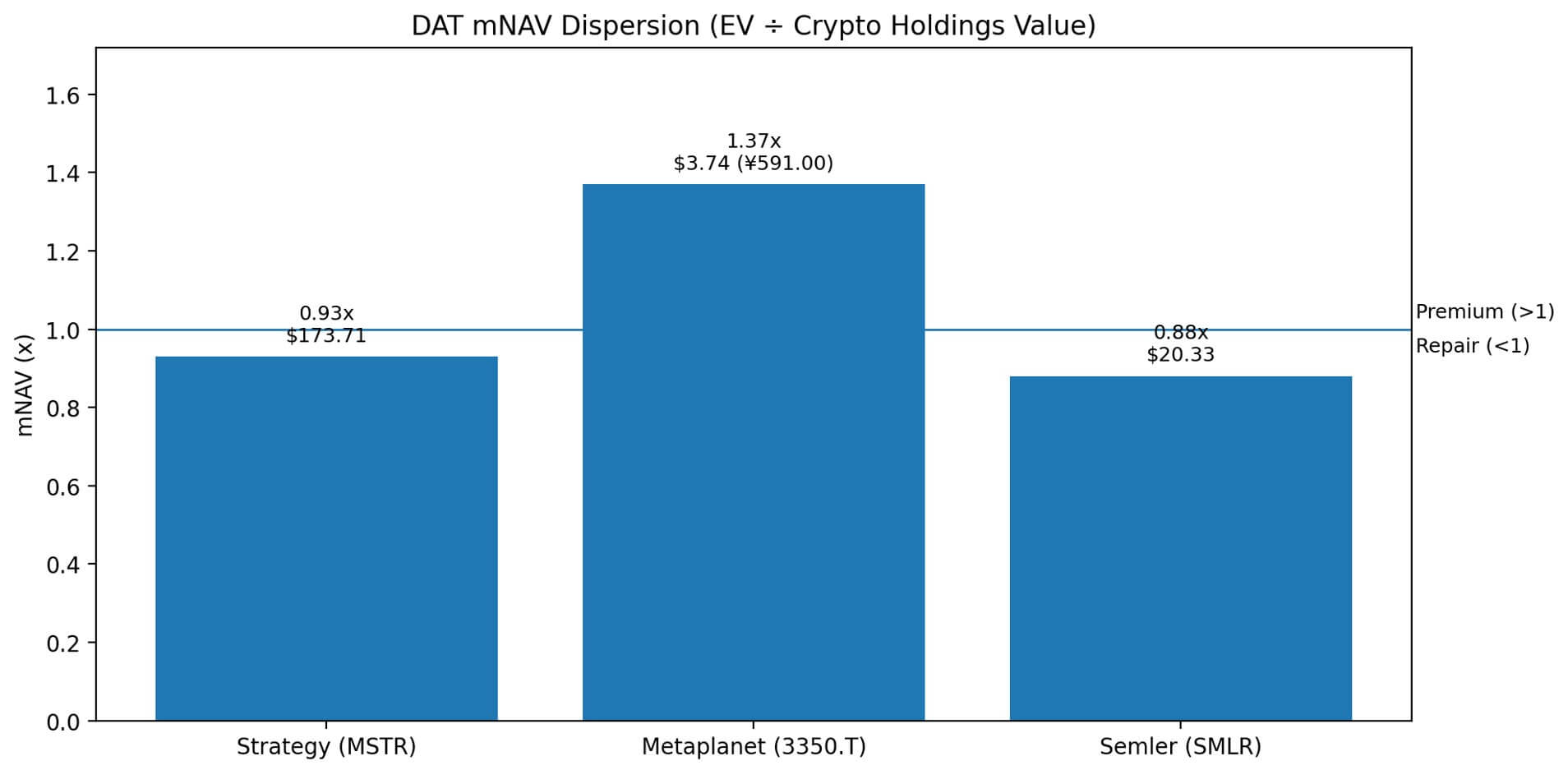

The health of Bitcoin treasury operators is primarily evaluated through their market-to-net-asset-value (mNAV) ratio. An mNAV above 1 indicates that the company’s equity is worth more than its underlying Bitcoin holdings, enabling accretive share issuance for further Bitcoin accumulation. Conversely, an mNAV below 1 signals a need for capital preservation and cautious accumulation strategies.

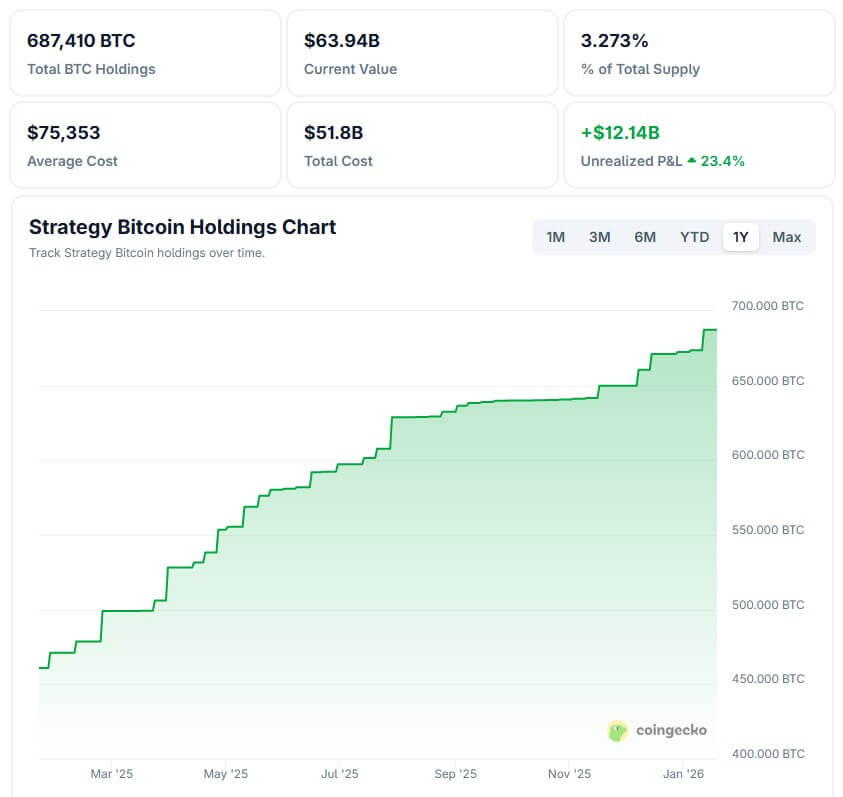

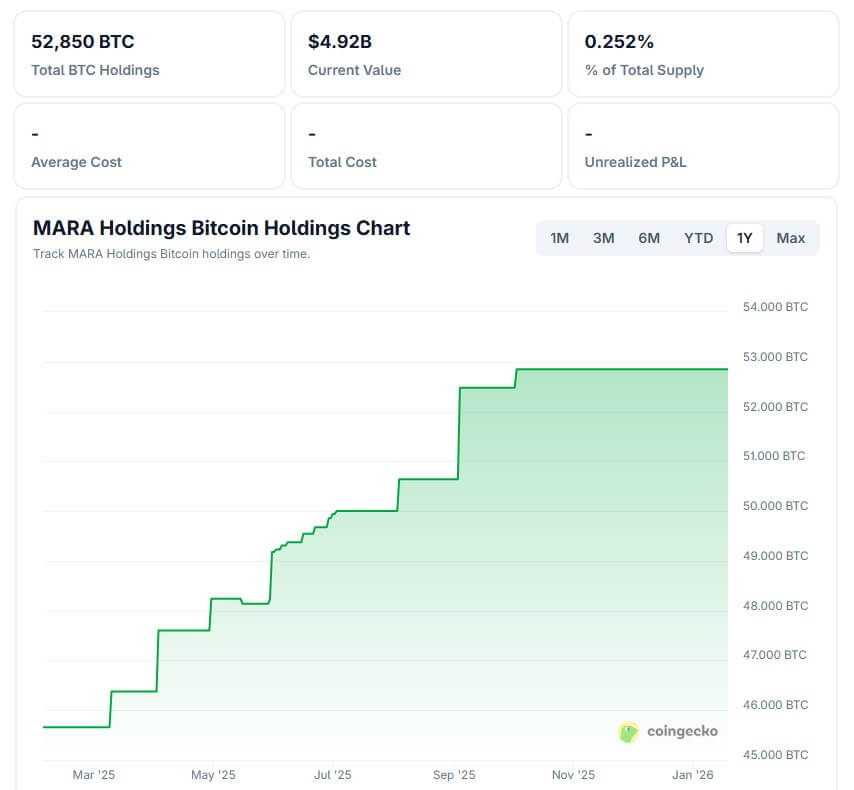

As of mid-January 2026, leading Bitcoin treasury operators display significant dispersion in their mNAV ratios. Strategy trades at an mNAV of 0.93x despite continuing to accumulate Bitcoin, while Metaplanet boasts a premium mNAV of 1.37x, allowing for accretive equity issuance. Semler Scientific, on the other hand, trades at a discount and has paused its Bitcoin accumulation.

The divergence in mNAV ratios reflects varying market perceptions of execution risk, regulatory exposure, and accumulation strategies. Metaplanet benefits from operating outside US regulatory jurisdiction and maintaining a clean Bitcoin treasury narrative. Strategy’s discount suggests market skepticism despite its aggressive accumulation strategy.

For a true resurgence of digital asset treasuries, the sector needs broad-based mNAV expansion, sustained accretive Bitcoin accumulation, and positive equity market responses. Currently, only a subset of companies, like Metaplanet, meet these criteria. This highlights that company-specific execution is becoming more critical than sector-wide trends.

In conclusion, while Vanguard’s increased position in Metaplanet has drawn attention to Bitcoin treasuries, a deeper analysis reveals a more nuanced picture. The sector’s recovery is bifurcated, with individual company performance and strategic execution playing a more significant role than overall market trends. Investors should focus on mNAV ratios and accumulation strategies to gauge the true health of these digital asset treasuries.

Related: XRP Forecast: AI Signals Valentine’s Day Rally

Source: Original article

Quick Summary

Vanguard’s increased position in Metaplanet doesn’t necessarily signal a bullish outlook on Bitcoin treasuries but likely reflects index mechanics. The market-to-net-asset-value (mNAV) ratio is a key indicator of the financial health of Bitcoin treasury operators.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.