A purported WhatsApp conversation alleging Ripple insiders are manipulating Flare (FLR) has circulated online, drawing a sharp denial from Flare’s CEO. This event indicates the crypto market’s susceptibility to unverified claims and the importance of due diligence.

What to Know:

- A purported WhatsApp conversation alleging Ripple insiders are manipulating Flare (FLR) has circulated online, drawing a sharp denial from Flare’s CEO.

- This event highlights the crypto market’s susceptibility to unverified claims and the importance of due diligence.

- For XRP and Ripple, the incident underscores the need to manage perceptions around associated ecosystems like Flare, especially as institutional interest grows.

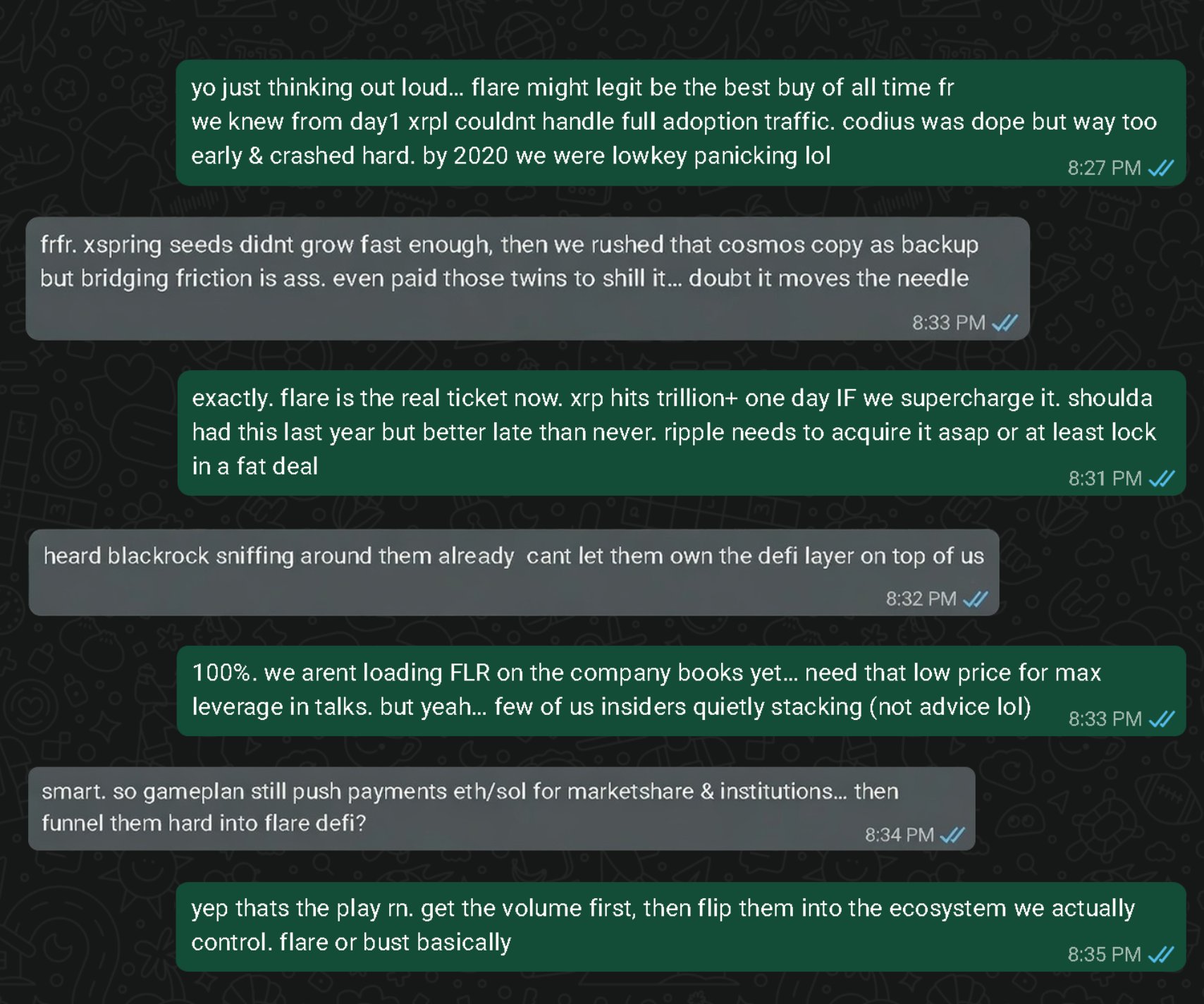

The crypto market, still navigating a period of uncertainty, was recently stirred by a viral screenshot purportedly showing a WhatsApp conversation between Ripple insiders. The alleged discussion hinted at strategic accumulation and price suppression of Flare (FLR), raising concerns about market manipulation. However, these claims were quickly refuted by Flare’s CEO, adding another layer of complexity to the situation. Understanding the context and implications of such events is crucial for institutional and high-net-worth investors navigating the digital asset space.

Debunking the Claims

Flare CEO Hugo Philion wasted no time in dismissing the WhatsApp screenshot as “clearly nonsense” and part of the “wild conspiracies” common in the crypto world. This swift response is vital, as unverified claims can rapidly impact market sentiment and asset prices. The lack of verifiable identities or supporting evidence further weakens the credibility of the alleged conversation. Seasoned investors understand the importance of relying on vetted information sources and conducting thorough due diligence before making any investment decisions.

Flare’s Role in the XRP Ecosystem

Flare was launched in 2022 to extend smart contract functionality and DeFi capabilities to networks like XRP that lack native programmability. Flare has become increasingly prominent within the XRP community, largely due to its FAsset initiative, but it’s important to note that Flare operates independently and is not controlled by Ripple. This distinction is crucial for understanding the dynamics between the two ecosystems and assessing potential risks and opportunities.

FXRP Adoption and DeFi Integration

Flare is positioning itself as a core DeFi layer for XRP. Its wrapped asset, FXRP, is minted by locking XRP in Flare’s vaults. It has reached a circulating supply of 89.03 million tokens, valued at approximately $170.98 million. This growing adoption signals increasing integration of XRP into the DeFi space, offering potential yield-generating opportunities for investors. The growth of FXRP is primarily driven by retail participants, with institutional players yet to fully enter the space, suggesting significant potential for future expansion.

Market Sentiment and Regulatory Posture

Events like these underscore the importance of maintaining a balanced perspective and avoiding knee-jerk reactions based on unverified information. The regulatory posture surrounding digital assets remains a key consideration for institutional investors. Increased regulatory scrutiny often leads to greater market stability and maturity, but it can also introduce uncertainty and compliance challenges. Investors should closely monitor regulatory developments and adapt their strategies accordingly.

Historical Context and Future Outlook

The crypto market has a history of being influenced by rumors and speculation, often leading to volatility. While past performance is not indicative of future results, understanding historical market behavior can provide valuable context for navigating the current landscape. As the digital asset space matures, the importance of institutional-grade research, risk management, and compliance will only increase. The long-term success of XRP, Flare, and other digital assets will depend on their ability to demonstrate real-world utility, attract institutional adoption, and navigate the evolving regulatory environment.

In conclusion, while the viral screenshot and its subsequent debunking may cause short-term ripples, the underlying fundamentals of XRP and Flare remain the key drivers for long-term value. Institutional investors should focus on verifiable information, conduct thorough due diligence, and maintain a strategic perspective to capitalize on the opportunities presented by the evolving digital asset landscape.

Related: Bitcoin Treasury Survives, Exposes Strategy

Source: Original article

Quick Summary

A purported WhatsApp conversation alleging Ripple insiders are manipulating Flare (FLR) has circulated online, drawing a sharp denial from Flare’s CEO. This event highlights the crypto market’s susceptibility to unverified claims and the importance of due diligence.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.