Analysts are weighing whether XRP can stage a meaningful recovery over the next four months. Forecasts suggest modest gains, contingent on Bitcoin’s performance and overall market sentiment. Institutional flows and regulatory clarity remain critical for XRP to break higher.

What to Know:

- Analysts are weighing whether XRP can stage a meaningful recovery over the next four months.

- Forecasts suggest modest gains, contingent on Bitcoin’s performance and overall market sentiment.

- Institutional flows and regulatory clarity remain critical for XRP to break higher.

XRP is again capturing the attention of market participants as they assess its potential performance in the coming months. Despite recent struggles, several analysts suggest the next four months could offer notable upside for the digital asset. As XRP navigates a consolidation phase, the question remains: how high can it realistically climb?

CORE Satoshi Sets XRP Target at $2–$4

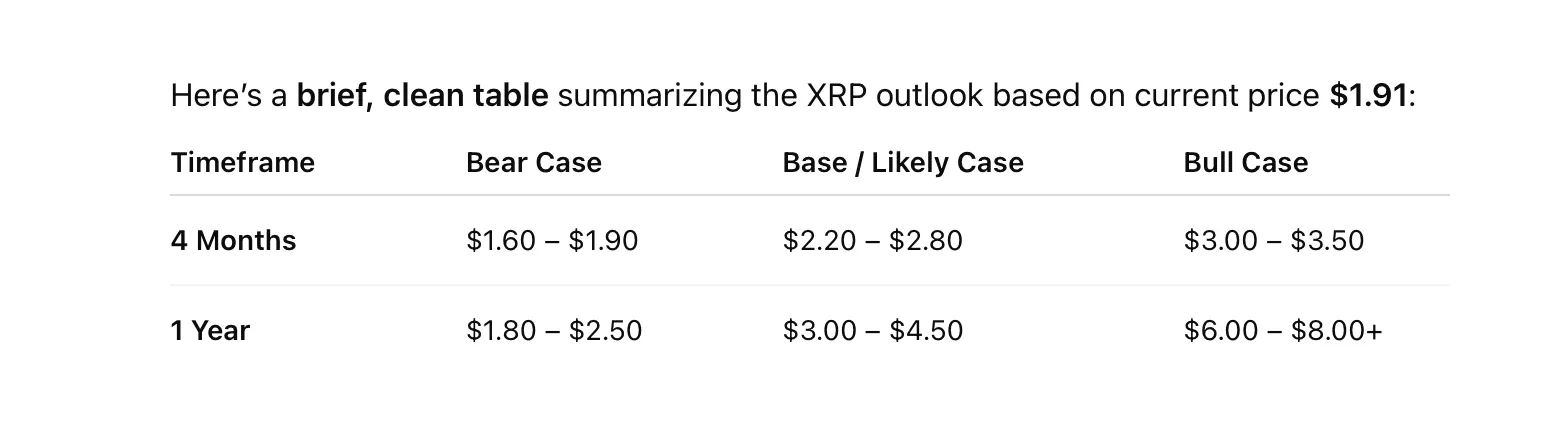

CORE Satoshi, a widely followed crypto markets account, recently shared its price expectations for major crypto assets. The projection places XRP in a $2 to $4 range over the next four months. This outlook suggests XRP could reclaim the $2 level and potentially retest the $3 psychological zone if market conditions improve.

A move toward $4 would represent a substantial gain from current levels but would still fall within a measured bullish scenario rather than an explosive breakout. Moreover, a $4 price would mark an all-time high for XRP, a level that has eluded the asset for years.

How This Compares With Other XRP Forecasts

CORE Satoshi’s XRP target aligns with other short-term projections shared in recent weeks. Analyst Dr. Whale, for example, also forecasted a $2 to $4 range for XRP back in November over a similar timeframe. Meanwhile, longer-term forecasts remain more aggressive, with some analysts projecting XRP could reach between $5.20 and $6.50 later in the cycle.

Compared to those more ambitious projections, the $2–$4 range reflects a cautious stance, assuming XRP tracks broader market strength without immediately entering price discovery. This suggests a focus on sustainable growth rather than speculative pumps.

AI Forecasts for XRP

AI models also offer insights into XRP’s potential trajectory. Grok, the AI platform on X, noted that most estimates point to modest upside, with a realistic range of $1.80–$3.00. According to Grok, a move above $3 would likely require strong catalysts, such as regulatory clarity or significant adoption milestones.

OpenAI’s ChatGPT suggests XRP’s short-term outlook depends heavily on Bitcoin momentum, regulatory clarity, and adoption trends. It noted that forecast models suggest a $2.20–$3.40 range in a bullish-to-moderate scenario, while neutral views expect sideways movement or limited gains. Ultimately, ChatGPT concluded that a realistic range for XRP may top out around $3.50, assuming broader crypto market conditions remain supportive.

Bitcoin’s Role in XRP’s Next Move

A recurring theme across recent forecasts is Bitcoin’s influence. CORE Satoshi expects Bitcoin to trade between $130,000 and $150,000 within the same four-month window. If Bitcoin pushes toward new highs, capital rotation into large-cap altcoins like XRP could follow. Historically, XRP tends to lag during Bitcoin’s initial rallies before reacting once overall market confidence strengthens.

In that scenario, XRP moving back above $2 and gradually pressing toward $3 would align with past market cycles. This highlights the interconnectedness of the crypto market, where Bitcoin’s performance often sets the tone for altcoin movements.

Factors That Could Push XRP Higher

While current projections focus on conservative ranges, several developments could shift expectations higher. These include ongoing inflows from spot XRP ETFs, expanding institutional use cases, and Ripple’s continued push into cross-border payments. The regulatory posture surrounding XRP also remains a key factor, as clarity could unlock further institutional interest.

Should any of these catalysts accelerate alongside a broader altcoin rally, XRP breaking above $4 would become more plausible. Until then, analysts are comfortable viewing the next four months as a recovery and positioning phase rather than the peak of the cycle.

The near-term outlook for XRP appears cautiously optimistic, with analysts and AI models suggesting potential gains contingent on broader market conditions and specific catalysts. Bitcoin’s performance, regulatory developments, and institutional adoption will likely play critical roles in determining whether XRP can achieve and sustain higher price levels. For now, a measured approach seems prudent, with a focus on long-term fundamentals rather than speculative hype.

Related: XRP Binance Listing Signals Bullish Turn

Source: Original article

Quick Summary

Analysts are weighing whether XRP can stage a meaningful recovery over the next four months. Forecasts suggest modest gains, contingent on Bitcoin’s performance and overall market sentiment. Institutional flows and regulatory clarity remain critical for XRP to break higher.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.