Bitcoin’s recent price drop erased its gains for early 2026. Market-wide sell-offs and macro headwinds contributed to the downturn. The $90,000 level is a critical support area for Bitcoin’s price.

What to Know:

- Bitcoin’s recent price drop erased its gains for early 2026.

- Market-wide sell-offs and macro headwinds contributed to the downturn.

- The $90,000 level is a critical support area for Bitcoin’s price.

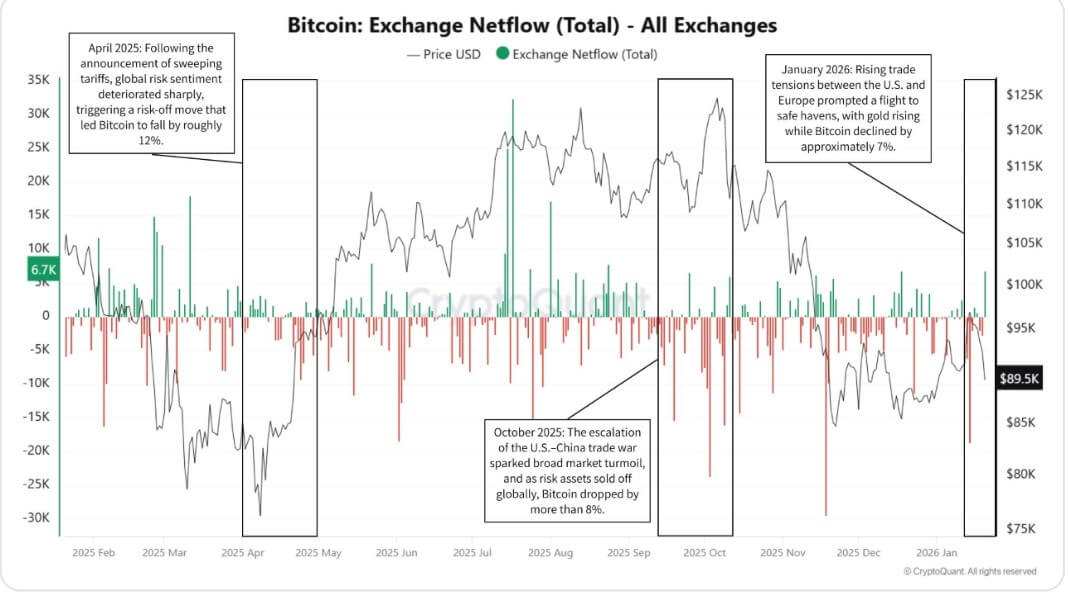

Bitcoin experienced a significant price correction, falling below the $90,000 mark and erasing its gains for the start of 2026. This downturn was part of a broader market sell-off affecting major cryptocurrencies like Ethereum, XRP, Cardano, and Solana. The combination of derivatives liquidations and genuine supply shocks accelerated the decline, highlighting the volatility inherent in the crypto market.

The speed of Bitcoin’s decline was exacerbated by liquidation cascades in the futures markets, triggering forced sell orders. Data indicates that traders holding long positions suffered substantial losses, as the market failed to sustain support near the upper $90,000s. However, the price drop was not solely due to over-leveraged speculation; aggressive selling in the spot market also played a significant role.

Large deposits into spot exchanges often precede selling pressure, creating a wall of ask liquidity that can hinder price recovery. Spot Bitcoin ETFs experienced outflows, further compounding the market’s downtrend. These movements suggest a shift in investor sentiment and a potential increase in selling pressure.

The macroeconomic backdrop, particularly the “Japanic” phenomenon originating from the Japanese bond market, added to the downward pressure. A chaotic selloff in Japanese government bonds spilled over into broader international markets, triggering a “Sell America” trade. This led to correlations converging, with equities, US Treasuries, the dollar, and Bitcoin falling in tandem due to liquidity withdrawal.

Despite the downturn, some analysts view the current setup as a temporary “momentum slip” rather than a prolonged bear market. The $89,800-$90,000 range is identified as a critical defense line for Bitcoin, representing the average purchase price for recent market entrants. Sustained support above this level is crucial for preventing further declines.

Bitcoin’s recent price correction underscores the importance of monitoring both internal market dynamics and external macroeconomic factors. While the short-term outlook remains uncertain, the long-term potential of Bitcoin as a non-sovereign asset continues to attract attention. Investors should remain vigilant and consider these factors when making investment decisions.

Related: XRP Price Prediction: 4-Month Outlook

Source: Original article

Quick Summary

Bitcoin’s recent price drop erased its gains for early 2026. Market-wide sell-offs and macro headwinds contributed to the downturn. The $90,000 level is a critical support area for Bitcoin’s price. Bitcoin experienced a significant price correction, falling below the $90,000 mark and erasing its gains for the start of 2026.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.