XRP broke a six-month downtrend, establishing a higher high and potentially reversing its bearish structure. This technical development occurs amid broader crypto market volatility and profit-taking after a strong year end.

What to Know:

- XRP broke a six-month downtrend, establishing a higher high and potentially reversing its bearish structure.

- This technical development occurs amid broader crypto market volatility and profit-taking after a strong year end.

- A sustained uptrend could attract institutional interest, contingent on maintaining key support levels and surpassing resistance.

XRP has recently signaled a potential trend reversal after a prolonged period of lower highs and lower lows. This development could mark a significant shift in market sentiment, potentially attracting renewed interest from institutional investors seeking undervalued assets. However, maintaining this momentum will be crucial for confirming a sustained recovery.

Breaking the Bearish Trend

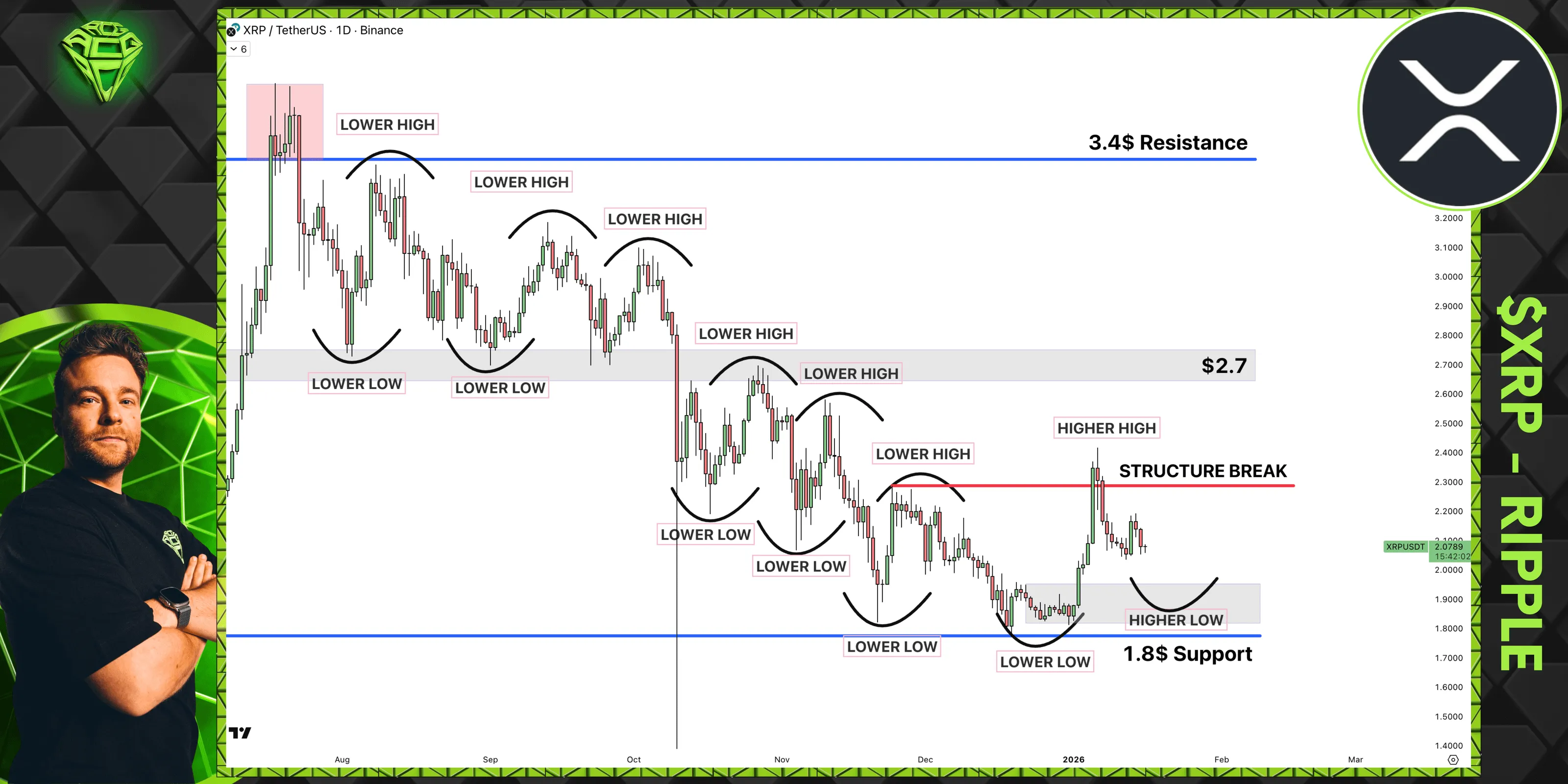

Since peaking in July 2025, XRP has experienced a consistent downtrend, marked by successive lower highs and lower lows. This pattern persisted until early January 2026, when a recovery attempt pushed XRP to $2.41. This move signified a break in the bearish structure, establishing a higher high for the first time in six months. The ability to overcome this resistance level suggests a potential shift in market dynamics.

Analyst Perspective

Sjuul Follings, founder and CEO of AltCryptoGems, highlighted this development, noting that XRP’s outlook is improving after breaking the bearish structure. However, Follings emphasizes the importance of maintaining this new trend by establishing a higher low above the December 2025 floor of $1.77. This level will be critical in validating the potential trend reversal.

Key Support and Resistance Levels

For XRP to sustain its bullish momentum, it must hold above the $1.8 support level identified by Follings. A break below this level could invalidate the recent gains and potentially lead to further downside. Conversely, a recovery above the $2.7 pivot point could accelerate the upward trajectory, with a break above the $3.4 resistance level signaling a full-fledged bullish trend.

Market Structure and Institutional Flows

The recent price action in XRP underscores the importance of market structure in attracting institutional flows. A sustained uptrend, characterized by higher highs and higher lows, typically signals a healthier market environment that is more conducive to large-scale investments. Conversely, prolonged downtrends can deter institutional investors due to increased risk and uncertainty. XRP ETFs could also play a role.

Macro Factors and Regulatory Posture

While technical analysis provides valuable insights, it’s important to consider broader macro factors and the evolving regulatory landscape. Favorable developments on these fronts could provide additional tailwinds for XRP and the broader crypto market. Conversely, adverse events could derail the recovery and lead to renewed selling pressure. The Ripple case continues to cast a shadow.

In conclusion, XRP’s recent break from its bearish structure represents a potentially significant development. However, sustaining this momentum will require maintaining key support levels and overcoming resistance. Institutional investors will likely monitor these developments closely, weighing the potential risks and rewards before committing significant capital. A bullish resolution to the Ripple case would certainly help.

Related: XRP Signals Extreme Fear: Crypto Derivatives Data

Source: Original article

Quick Summary

XRP broke a six-month downtrend, establishing a higher high and potentially reversing its bearish structure. This technical development occurs amid broader crypto market volatility and profit-taking after a strong year end. A sustained uptrend could attract institutional interest, contingent on maintaining key support levels and surpassing resistance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.