XRP displays signs of short-term bullish momentum following a false breakdown, but overall market indecision persists. Trading volumes remain subdued, suggesting a lack of strong conviction from either buyers or sellers.

What to Know:

- XRP displays signs of short-term bullish momentum following a false breakdown, but overall market indecision persists.

- Trading volumes remain subdued, suggesting a lack of strong conviction from either buyers or sellers.

- A potential breakdown of the $1.82 support level on the weekly chart could trigger a more significant price correction toward $1.60.

XRP, the digital asset closely associated with Ripple Labs, continues to navigate a complex market environment. While recent price action suggests a possible short-term bounce, broader market uncertainty and low trading volumes raise questions about the sustainability of any upward momentum. Institutional investors are closely monitoring XRP’s price movements amid ongoing regulatory developments and its potential role in cross-border payments.

Technical Rebound or False Dawn?

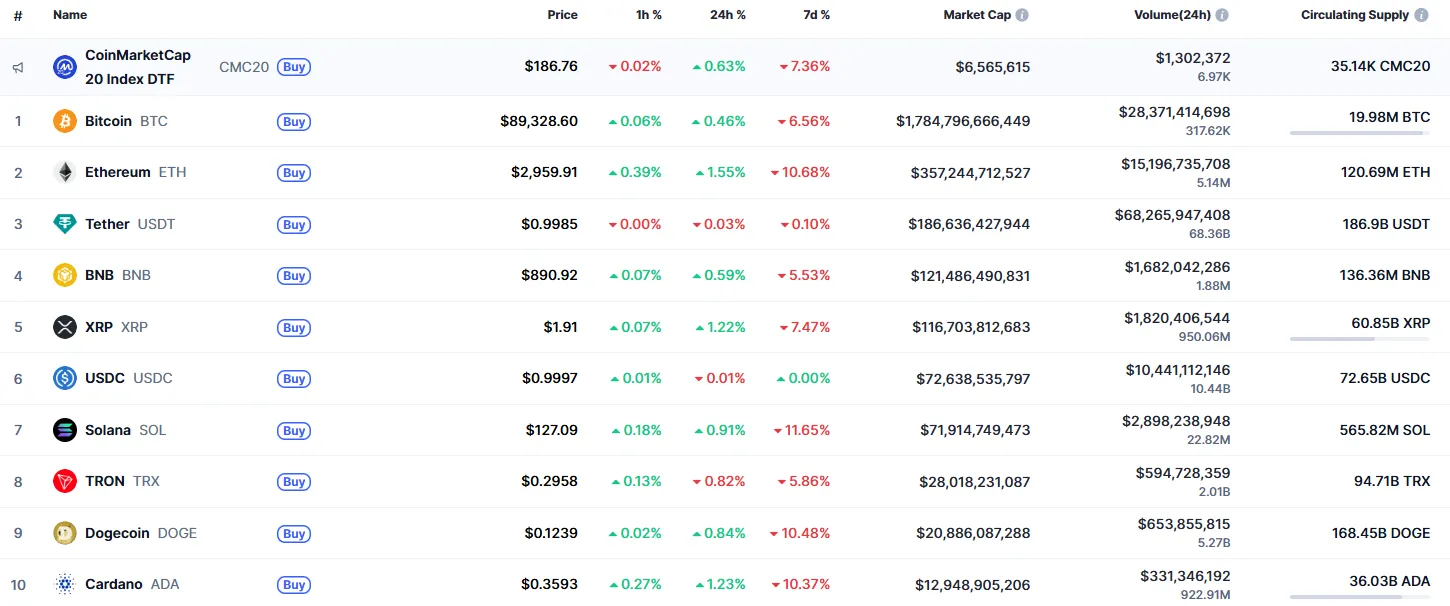

XRP’s price experienced a 1.22% increase over the past 24 hours, reflecting a minor recovery across the cryptocurrency market. On the hourly chart, a false breakout below the $1.9161 support level hints at potential short-term bullishness. However, traders should exercise caution, as a failure to sustain upward momentum could lead to further consolidation or a renewed test of lower support levels. Such “fakeouts” are common in sideways markets, often trapping over-leveraged retail traders.

Sideways Trading Persists

Despite the recent uptick, XRP’s price action remains largely confined within a narrow range. Low trading volumes indicate a lack of decisive market participation, suggesting that neither buyers nor sellers have enough conviction to drive a significant price move. This period of consolidation could persist in the short term, with the price fluctuating between $1.90 and $1.95. Seasoned traders often avoid range-bound markets, preferring to allocate capital to assets exhibiting clearer directional trends and stronger liquidity.

Weekly Chart Signals Caution

Looking at the weekly chart, the $1.8209 support level emerges as a crucial area to watch. A decisive break below this level could trigger a more substantial price decline, potentially sending XRP toward the $1.60 area. This scenario highlights the importance of risk management and the need for traders to set appropriate stop-loss orders to protect their positions. The weekly chart provides a broader perspective on market trends, filtering out short-term noise and offering insights into potential long-term trajectories.

Ripple’s Regulatory Landscape

XRP’s price performance continues to be influenced by the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). Any significant developments in the case, whether positive or negative, could trigger substantial price swings. Institutional investors are closely monitoring the regulatory landscape, as clarity on XRP’s legal status could pave the way for increased adoption and integration into traditional financial systems. The regulatory overhang remains a primary factor weighing on XRP’s long-term outlook.

Broader Market Sentiment

XRP’s price action is also influenced by broader market sentiment and macroeconomic factors. Positive developments in the cryptocurrency market as a whole, such as increased institutional adoption of Bitcoin ETFs or a more favorable regulatory environment, could provide a tailwind for XRP. Conversely, negative news or a risk-off sentiment in global financial markets could weigh on XRP’s price. It is important to consider the interconnectedness of the cryptocurrency market and the broader economic landscape when evaluating XRP’s potential.

In summary, XRP’s short-term outlook appears cautiously optimistic, but significant challenges remain. Low trading volumes, regulatory uncertainty, and broader market volatility all contribute to a complex environment. Investors should exercise caution and conduct thorough due diligence before making any investment decisions regarding XRP.

XRP is trading at $1.9201 at press time.

Related: XRP Upgrade Signals Key Deadline

Source: Original article

Quick Summary

XRP displays signs of short-term bullish momentum following a false breakdown, but overall market indecision persists. Trading volumes remain subdued, suggesting a lack of strong conviction from either buyers or sellers.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.