The total value of tokenized real-world assets (RWA) on the XRP Ledger has surpassed $1 billion. This milestone reflects a broader trend of RWA tokenization across multiple blockchains, driven by the efficiency and transparency benefits of blockchain technology.

What to Know:

- The total value of tokenized real-world assets (RWA) on the XRP Ledger has surpassed $1 billion.

- This milestone reflects a broader trend of RWA tokenization across multiple blockchains, driven by the efficiency and transparency benefits of blockchain technology.

- The growth in RWA on the XRP Ledger could attract further institutional interest and inflows into the XRP ecosystem.

The XRP Ledger has reached a significant milestone, with the total value of tokenized real-world assets (RWA) now exceeding $1 billion. This achievement underscores the growing adoption of blockchain technology in traditional finance and highlights the potential for increased institutional participation in the XRP ecosystem. The surge in RWA tokenization on the XRP Ledger is part of a broader trend as institutions seek to leverage the benefits of blockchain for asset management and trading.

Contributions from Ripple Stablecoin (RLUSD)

A significant driver of this growth has been the Ripple stablecoin, RLUSD, which accounts for a substantial portion of the increase in tokenized RWA value. Since the start of the year, RLUSD has contributed $104 million to the overall RWA value on the XRP Ledger, representing 90% of the total growth. The market capitalization of RLUSD on the XRP Ledger has now reached $338 million, making up 33.7% of the total RWA value on the network. This indicates a strong demand for stablecoin solutions within the XRP ecosystem, potentially driven by their utility in facilitating RWA transactions and providing liquidity.

Composition of Tokenized Assets

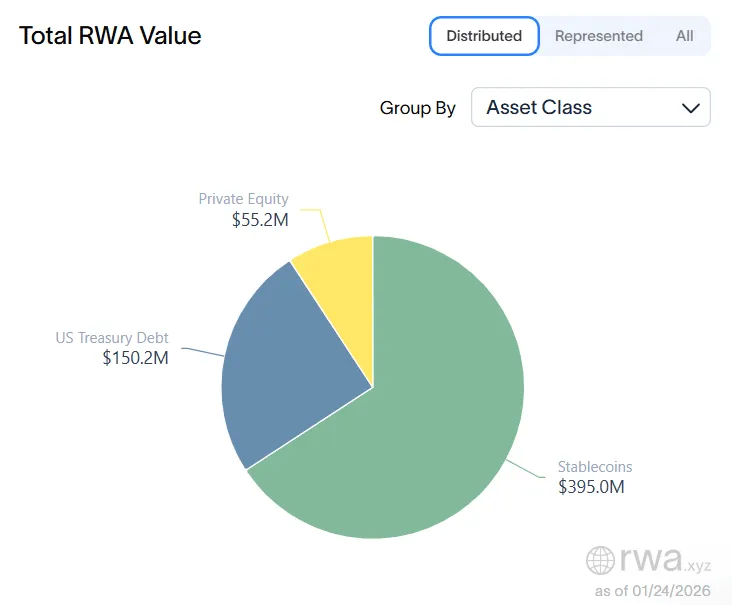

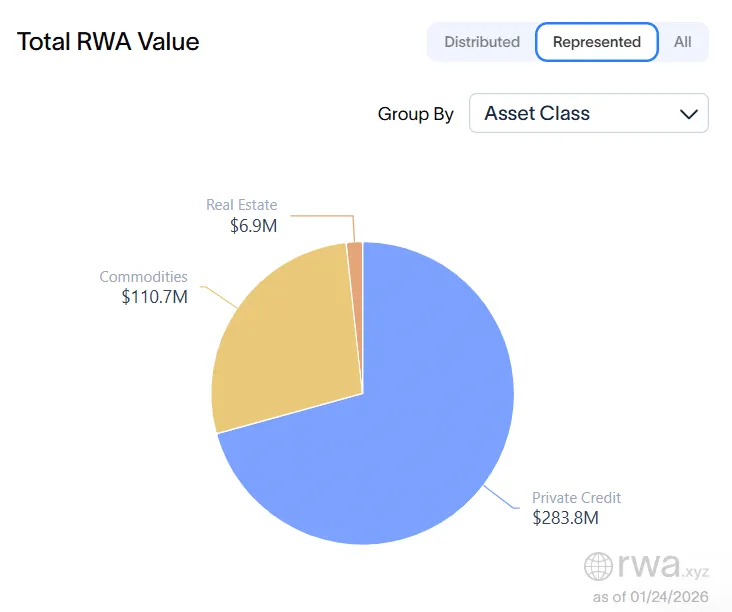

The composition of tokenized assets on the XRP Ledger includes both distributed and represented assets, each with distinct characteristics. Distributed assets, which can be held and transferred on the blockchain, account for $600.4 million (60%) of the total RWA value. These assets include private equity ($55.2 million), U.S. treasury debt ($150.2 million), and stablecoins ($395 million). Represented assets, which remain on the issuing platform and serve as internal digital records of ownership, make up the remaining $401.4 million (40%). These include commodities ($110.7 million), real estate ($6.9 million), and private credit ($283.8 million). The diversity of asset types suggests a maturing ecosystem capable of supporting a wide range of financial instruments.

XRPL’s Expansion in RWA Tokenization

The XRP Ledger has experienced rapid expansion in the tokenization of real-world assets, positioning itself as a key player in this emerging market. A year ago, the XRPL hosted only $45.179 million worth of tokenized RWA. The current figure of $1.001 billion represents a growth of $956.6 billion over the past year. This growth trajectory suggests that the XRP Ledger is well-positioned to capitalize on the increasing interest in RWA tokenization from both institutional and retail investors.

Potential Implications and Future Outlook

The $1 billion milestone for tokenized RWA on the XRP Ledger has several potential implications for the broader crypto market. First, it could attract further institutional interest and investment into the XRP ecosystem, driving increased liquidity and market activity. Second, it reinforces the narrative of RWA tokenization as a key growth area for the crypto industry, potentially leading to increased adoption and innovation across multiple blockchains. Third, the success of RLUSD as a stablecoin within the XRP ecosystem could pave the way for further stablecoin issuances and use cases. As the regulatory landscape for digital assets continues to evolve, the XRP Ledger’s focus on RWA tokenization could position it favorably for long-term growth and sustainability.

The surge in tokenized RWA on the XRP Ledger to over $1 billion marks a significant step forward for the ecosystem and the broader crypto market. With increasing institutional interest and a growing range of tokenized assets, the XRP Ledger is establishing itself as a prominent platform for RWA tokenization. This development could drive further innovation and adoption of blockchain technology in traditional finance, potentially unlocking new opportunities for investors and institutions alike.

Related: XRP Price Slumps as ETF Flows Show Weakness

Source: Original article

Quick Summary

The total value of tokenized real-world assets (RWA) on the XRP Ledger has surpassed $1 billion. This milestone reflects a broader trend of RWA tokenization across multiple blockchains, driven by the efficiency and transparency benefits of blockchain technology.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.