Tokenized U.S. Treasury debt on the XRP Ledger has reached $150 million, driven by platforms like Ondo and OpenEden. This growth reflects the broader trend of real-world asset (RWA) tokenization, gaining traction among institutional players.

What to Know:

- Tokenized U.S. Treasury debt on the XRP Ledger has reached $150 million, driven by platforms like Ondo and OpenEden.

- This growth reflects the broader trend of real-world asset (RWA) tokenization, gaining traction among institutional players.

- The increasing RWA activity on the XRP Ledger could attract further institutional interest and inflows to XRP-related products.

The XRP Ledger is making strides in the tokenization of real-world assets, particularly U.S. Treasury debt. With over $150 million now represented on the ledger, this marks a significant expansion in its RWA capabilities. This development aligns with the growing interest in RWA tokenization, a trend closely watched by institutional investors seeking to bridge traditional finance with blockchain technology.

XRPL’s Growing RWA Footprint

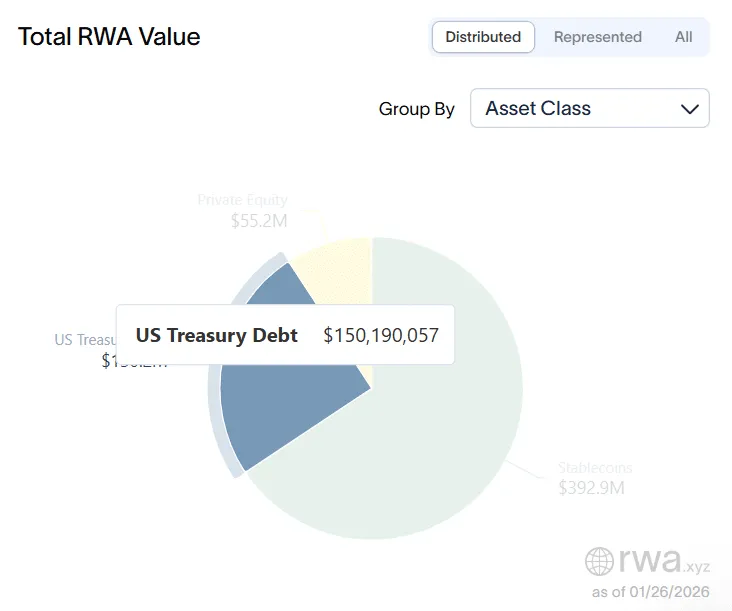

Data from RWA.xyz indicates that the XRP Ledger boasts over $1 billion in total tokenized RWAs, encompassing both distributed and represented assets. Within this figure, distributed RWAs account for $598 million, including U.S. Treasury Debt, private equity, and stablecoins. Notably, U.S. Treasury Debt comprises $150.2 million, surpassing private equity ($55.2 million) but trailing stablecoins ($392.9 million). The growth in tokenized U.S. Treasuries on the XRPL signifies increasing adoption and utility within the ecosystem.

XRPL vs. Broader Market

While the $150 million on the XRP Ledger is a notable achievement, it represents a small fraction of the total $10.13 billion in tokenized U.S. Treasuries across all blockchain networks. This indicates that the XRPL holds approximately 1.4% of the total market share. However, the significant growth from $5 million to $150 million in just one year—a 2,900% increase—demonstrates the rapid expansion and potential of the XRP Ledger in this space. This growth trajectory could attract further attention and investment as institutions explore blockchain-based solutions for traditional assets.

Key Platforms Driving Tokenization

The majority of U.S. Treasury Debt tokenization on the XRP Ledger is concentrated among a few key platforms. OpenEden Digital leads with $61.6 million through its OpenEden TBILL Vault product, accounting for 41% of the total value. Ondo follows with $40.8 million via its Ondo Short-Term U.S. Government Bond Fund (OUSG), and Zeconomy holds $40.039 million with the Guggenheim Treasury Services DCP product. Archax also contributes with $7.712 million through its abrdn Liquidity Fund (Lux) – US Dollar Fund. These platforms are instrumental in driving the adoption and accessibility of tokenized U.S. Treasuries on the XRPL.

Institutional Implications and Future Outlook

The increasing tokenization of U.S. Treasury debt on the XRP Ledger has significant implications for institutional investors. Tokenization offers benefits such as increased liquidity, fractional ownership, and enhanced transparency, making it an attractive option for managing and trading traditional assets. As the regulatory landscape evolves and institutional interest grows, the XRP Ledger’s role in RWA tokenization could expand further. This development may lead to increased inflows into XRP and related financial products as institutions seek exposure to this emerging asset class.

Conclusion

The XRP Ledger’s growth in tokenized U.S. Treasury debt to $150 million underscores its increasing relevance in the RWA space. While still a small portion of the overall market, the rapid growth and the presence of key platforms indicate strong potential. As institutional interest in RWA tokenization continues to rise, the XRP Ledger is well-positioned to capture further market share and attract significant investment.

Related: XRP Liquidation Imbalance Signals Price Target

Source: Original article

Quick Summary

Tokenized U.S. Treasury debt on the XRP Ledger has reached $150 million, driven by platforms like Ondo and OpenEden. This growth reflects the broader trend of real-world asset (RWA) tokenization, gaining traction among institutional players.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.