The Senate Agriculture Committee has advanced the CLARITY Act, making it a step forward in establishing regulatory clarity for crypto markets. A key point of contention remains over stablecoin rewards, causing gridlock in the Banking Committee and prompting White House intervention.

What to Know:

- The Senate Agriculture Committee has advanced the CLARITY Act, marking a step forward in establishing regulatory clarity for crypto markets.

- A key point of contention remains over stablecoin rewards, causing gridlock in the Banking Committee and prompting White House intervention.

- The future of the CLARITY Act hinges on resolving bipartisan disagreements and reconciling Senate and House versions of the bill.

The CLARITY Act, a crypto market-structure bill, has achieved a significant milestone with its advancement by the Senate Agriculture Committee, signaling potential progress in defining the regulatory landscape for digital assets. This move brings the legislation closer to addressing which regulator will oversee spot crypto markets, a long-standing question for the industry. However, challenges persist, particularly concerning the treatment of stablecoin “interest” and rewards.

The Agriculture Committee’s approval occurred along party lines, highlighting the ongoing need for bipartisan consensus on key provisions within the CLARITY Act. Democratic lawmakers have voiced concerns about the bill’s lack of clarity regarding decentralized finance and measures to prevent political officials from leveraging crypto ventures for personal gain.

Despite these concerns, industry leaders such as Ripple CEO Brad Garlinghouse and Coinbase CEO Brian Armstrong have expressed cautious optimism, emphasizing the importance of regulatory clarity for fostering innovation and growth in the crypto space. The White House, through its AI and Crypto Czar David Sacks, has also affirmed its commitment to working across the aisle to secure broader support for the legislation.

The Senate Banking Committee remains stalled due to disagreements over whether crypto firms should be allowed to offer interest or rewards on stablecoins. Banks argue that such incentives could drain deposits from insured institutions, while crypto firms contend that restrictions would stifle competition with traditional financial products.

This impasse has prompted the White House to convene a summit, bringing together representatives from the banking and crypto sectors to seek a resolution. Patrick Witt, Executive Director of the President’s Council of Advisors for Digital Assets, underscored the geopolitical importance of establishing a clear regulatory framework for digital assets, emphasizing the need for the United States to maintain its leadership in the evolving global financial landscape.

Looking ahead, the CLARITY Act faces several procedural hurdles, including potential debates, cloture motions, and reconciliation with the House version of the bill. Achieving passage will require significant bipartisan support in the Senate, as well as cooperation between the House and Senate to address remaining differences.

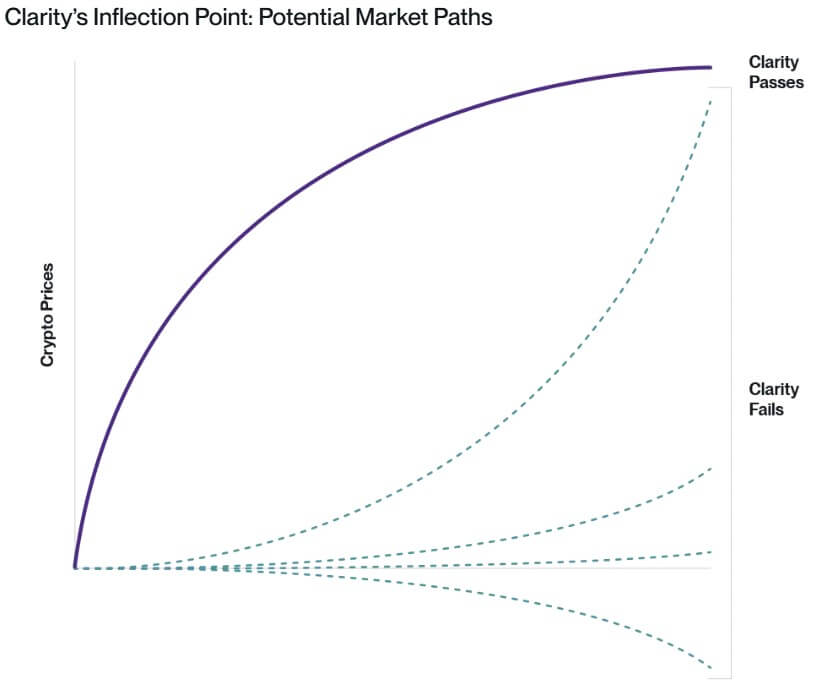

Despite these challenges, market sentiment remains cautiously optimistic, with some analysts predicting a positive market reaction if the CLARITY Act is enacted in a form acceptable to the industry. Conversely, failure to pass the legislation could lead to a “wait and see” period, where price appreciation depends on demonstrable real-world adoption rather than regulatory tailwinds.

The CLARITY Act represents a critical step toward establishing a comprehensive regulatory framework for the crypto industry in the United States. While challenges remain, the ongoing efforts to address bipartisan concerns and reconcile differing perspectives offer hope for a future where digital assets can thrive within a well-defined and transparent regulatory environment.

Related: XRP ETF Sees Largest Outflow, $92M Exit

Source: Original article

Quick Summary

The Senate Agriculture Committee has advanced the CLARITY Act, marking a step forward in establishing regulatory clarity for crypto markets. A key point of contention remains over stablecoin rewards, causing gridlock in the Banking Committee and prompting White House intervention.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.