XRP is trading below its 9-period Simple Moving Average, signaling bearish momentum. Broader market sentiment remains mixed, with long/short ratios indicating bullish bias despite price struggles.

What to Know:

- XRP is trading below its 9-period Simple Moving Average, signaling bearish momentum.

- Broader market sentiment remains mixed, with long/short ratios indicating bullish bias despite price struggles.

- Analyst suggests a potential bullish move if XRP breaks out of its current consolidation pattern, which could impact institutional positioning.

XRP has experienced downward pressure, trading below key moving averages amid mixed market sentiment. Despite recent declines, long/short ratios on major exchanges reflect a persistent bullish bias among traders. An analyst on X anticipates a potential upward move if XRP can break out of its current consolidation phase, presenting a possible opportunity for institutional investors.

XRP Price Analysis

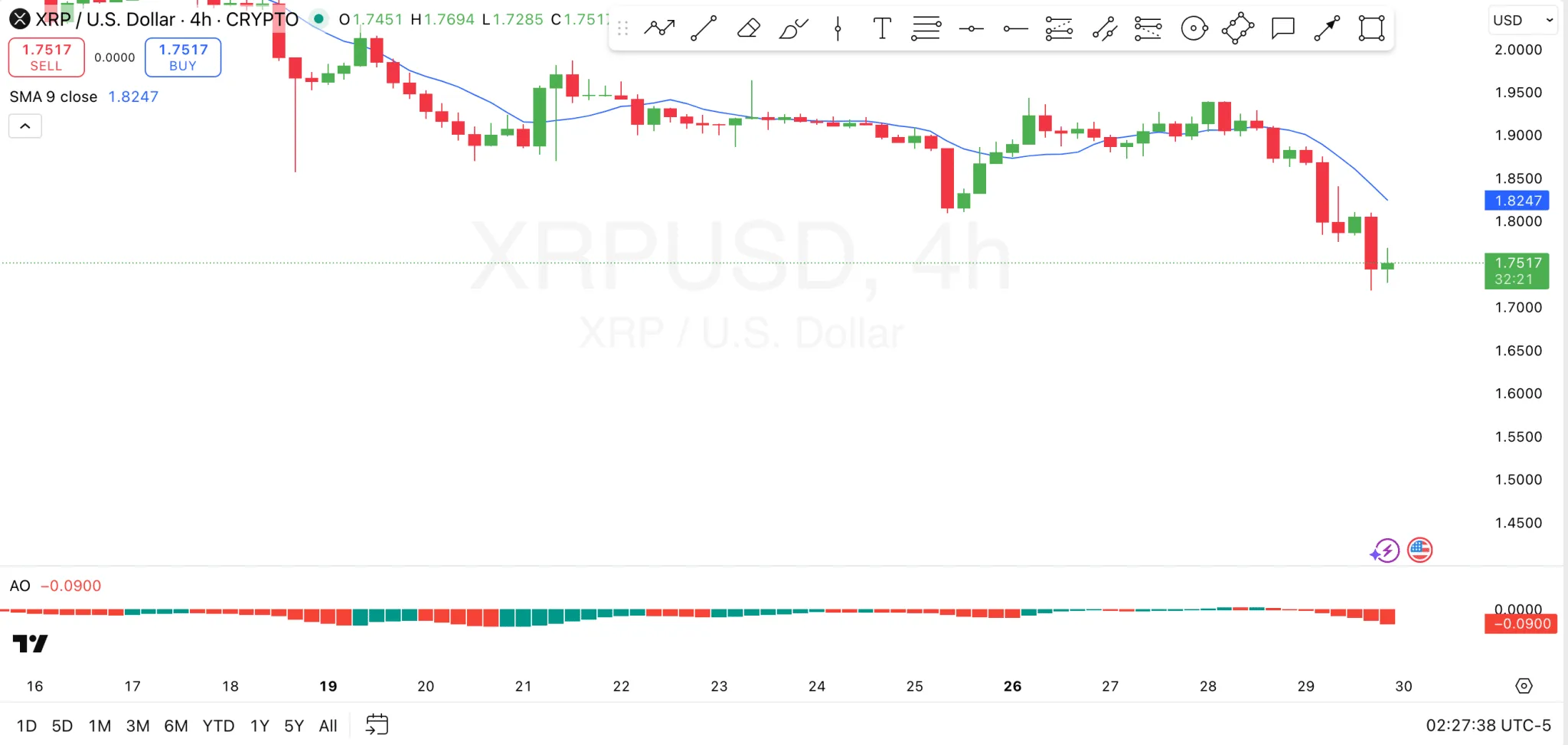

On the 4-hour chart, XRP is trading below its 9-period Simple Moving Average, which now acts as a critical resistance level at $1.8247. Overcoming this resistance is essential for initiating an upward movement. The inability to surpass the SMA suggests that sellers currently dominate market action, potentially leading to further declines if the resistance holds.

Immediate support lies at the $1.72 mark. A failure to maintain this level could trigger further drops toward the $1.70 support zone. The Awesome Oscillator, with a negative reading of -0.0900, reinforces the bearish momentum, as red histogram bars indicate prevailing selling pressure. A sustained crossover above the SMA, coupled with a shift in the AO toward positive territory, would signal a potential bullish reversal.

Analyst’s Bullish Outlook

An analyst known as Amonyx recently shared an XRP chart highlighting a potential bullish move. The chart shows XRP consolidating within a descending triangle, characterized by a declining trendline and support at the lower range. These levels have prevented significant breakouts in either direction, creating a defined consolidation zone.

According to the analyst, a defense of the support line could precede an upward move, contingent on breaching the descending trendline. The analyst’s chart suggests a target above $4.6 if the pattern materializes. This scenario depends on XRP overcoming immediate resistance and maintaining positive momentum.

Long/Short Ratios and Market Sentiment

Despite the recent price struggles, long/short ratios on platforms like Binance and OKX remain elevated, with ratios exceeding 2.5. This indicates that a significant portion of traders are positioned for upward movement. However, the disconnect between bullish positioning and actual price action suggests a cautious approach is warranted. Institutional investors often monitor these ratios to gauge overall market sentiment and potential for short squeezes or sustained rallies.

Broader Market Context

XRP’s performance is influenced by broader cryptocurrency market trends, regulatory developments, and macroeconomic factors. The ongoing legal battle between Ripple and the SEC continues to cast a shadow over XRP, impacting investor confidence and market liquidity. Any positive resolution in this case could act as a significant catalyst for XRP, potentially unlocking pent-up demand and attracting institutional inflows.

Derivatives Positioning and Potential Catalysts

Derivatives positioning in XRP, including perpetual swaps and futures contracts, can amplify price movements. High leverage ratios and concentrated positions can lead to increased volatility, particularly around key technical levels. Potential catalysts for XRP include advancements in Ripple’s cross-border payment solutions, partnerships with financial institutions, and regulatory clarity in key jurisdictions. These factors could drive renewed interest and investment in XRP from both retail and institutional investors.

In summary, XRP faces immediate resistance while showing potential for an upward move if key levels are breached. Market sentiment, as reflected in long/short ratios, remains cautiously optimistic, but actual price action requires confirmation. Investors should monitor technical indicators, regulatory developments, and broader market trends to assess the risk-reward profile of XRP accurately.

Related: XRP Signals Key Support Level

Source: Original article

Quick Summary

XRP is trading below its 9-period Simple Moving Average, signaling bearish momentum. Broader market sentiment remains mixed, with long/short ratios indicating bullish bias despite price struggles. Analyst suggests a potential bullish move if XRP breaks out of its current consolidation pattern, which could impact institutional positioning.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.