XRP experienced a massive long liquidation event, highlighting the dangers of excessive leverage in the crypto market. The liquidation imbalance suggests a need for funding rates and open interest to normalize before price stabilization can occur.

What to Know:

- XRP experienced a massive long liquidation event, highlighting the dangers of excessive leverage in the crypto market.

- The liquidation imbalance suggests a need for funding rates and open interest to normalize before price stabilization can occur.

- The $1.81 level now acts as significant resistance, hindering potential recovery attempts.

XRP recently underwent a severe liquidation event, underscoring the risks associated with high leverage in the digital asset space. This episode serves as a stark reminder of the volatility inherent in crypto markets, particularly when derivatives positioning becomes skewed. For institutional investors, understanding these dynamics is crucial for risk management and informed decision-making.

Liquidation Cascade

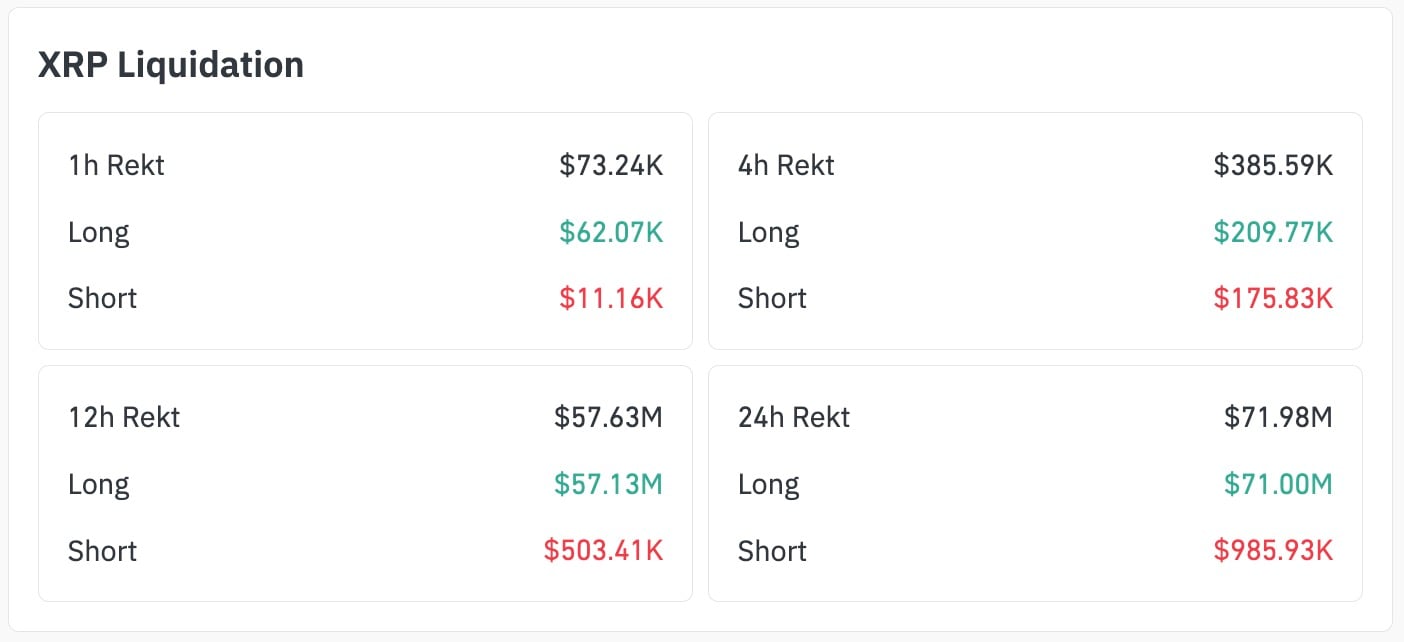

The data reveals a staggering imbalance in liquidations, with over $57 million in long positions wiped out compared to a mere $503,000 in shorts. This 11,348% disparity signals an overcrowded long side, ripe for a correction. Such imbalances often precede sharp price declines as over-leveraged positions are forcibly closed, exacerbating downward pressure. This type of event is not uncommon across asset classes, but the speed and magnitude can be amplified in the crypto market due to its 24/7 nature and often thinner liquidity.

Price Action and Technical Levels

The sell-off saw XRP’s price plummet from $1.81 to $1.71, a significant move that reflects the force of the liquidation cascade. The lack of a defensive wick on the chart indicates intense selling pressure and a scarcity of buyers willing to step in. The $1.81 level, previously a potential launchpad, now acts as a resistance barrier, making recovery more challenging. This type of technical breakdown can deter institutional investors, who often rely on established support and resistance levels for entry and exit points.

Derivatives Market Distortion

The 24-hour liquidation data further confirms the severity of the event, with $71 million in long liquidations dwarfing the $985,930 in short liquidations. This imbalance highlights the distorted positioning in the derivatives market, where excessive speculation can lead to abrupt and painful corrections. Until the derivatives market finds a new equilibrium, with more balanced positioning, XRP’s price is likely to remain vulnerable to further downside. Prudent institutional investors will be monitoring open interest and funding rates for signs of stabilization.

Historical Parallels

This liquidation event echoes similar episodes in other crypto assets and even traditional markets. Periods of rapid price appreciation, fueled by leverage, often end in sharp corrections as overextended positions are unwound. The dot-com bubble and the 2008 financial crisis offer broader examples of how excessive risk-taking and leverage can lead to market instability. Learning from these historical precedents is essential for navigating the crypto market’s inherent volatility.

Risk Management and Future Outlook

The key takeaway is the importance of risk management, particularly when dealing with leveraged instruments. Investors should avoid chasing upside without proper risk controls and be wary of crowded trades. For XRP, monitoring funding rates and open interest will be crucial for identifying potential stabilization points. Until these metrics normalize, the risk of further downside towards $1.68 remains a distinct possibility. Institutional investors should also assess XRP’s regulatory landscape and adoption prospects, which could influence its long-term trajectory.

In conclusion, the recent XRP liquidation event serves as a cautionary tale about the dangers of excessive leverage and the importance of risk management in the crypto market. While the short-term outlook remains uncertain, monitoring key metrics and maintaining a disciplined approach will be essential for navigating future volatility. The event also highlights the need for a more balanced derivatives market to promote price stability and sustainable growth.

Related: XRP Buy Signals? Million-Dollar Bet Revealed

Source: Original article

Quick Summary

XRP experienced a massive long liquidation event, highlighting the dangers of excessive leverage in the crypto market. The liquidation imbalance suggests a need for funding rates and open interest to normalize before price stabilization can occur. The $1.81 level now acts as significant resistance, hindering potential recovery attempts.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.