Gold recently hit an all-time high, briefly exceeding Bitcoin’s market cap in a single day, sparking comparisons to XRP. Analysts attribute gold’s gains to its market depth and maturity, contrasting it with the relatively thinner crypto markets.

What to Know:

- Gold recently hit an all-time high, briefly exceeding Bitcoin’s market cap in a single day, sparking comparisons to XRP.

- Analysts attribute gold’s gains to its market depth and maturity, contrasting it with the relatively thinner crypto markets.

- Despite a recent downturn in both precious metals and crypto, some analysts believe Bitcoin and XRP may experience a similar breakout after gold’s peak.

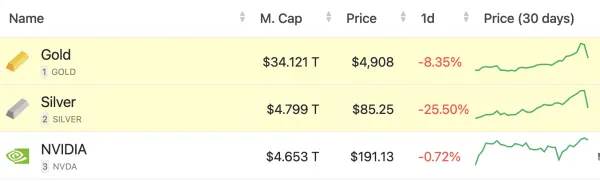

This week’s surge in precious metals, particularly gold reaching unprecedented highs, has prompted interesting discussions about market capitalization and potential future performance across asset classes. While gold’s rapid gains dwarfed the entire market cap of Bitcoin at one point, the conversation has extended to XRP, inviting speculation about its potential trajectory. Understanding the nuances of market depth and maturity is crucial for assessing the prospects of both traditional and digital assets.

Gold’s Market Cap Surge Explained

The sheer scale of gold’s market cap expansion, adding $2.2 trillion in a single day, caught the attention of market observers. This increase surpassed Bitcoin’s total valuation at the time, and dwarfed XRP’s market cap by a factor of twenty. However, analysts point out that gold’s established market and high liquidity mean even small percentage moves can translate into massive nominal gains.

Relative Market Maturity

The comparison between gold and crypto assets like Bitcoin and XRP highlights the difference in market maturity. Gold’s deep and liquid market can absorb significant inflows without causing dramatic price swings, while the relatively thinner crypto markets are more susceptible to volatility. This also implies that crypto assets can react far more quickly to changes in sentiment or market conditions.

Anticipating a Crypto Breakout

Despite the recent downturn in both precious metals and crypto, some analysts believe that Bitcoin and XRP could experience a similar breakout in the future. The idea is that crypto’s major rally may unfold after gold and silver reach their respective peaks. This perspective suggests a potential rotation of capital from traditional safe-haven assets into riskier, higher-growth digital assets.

XRP’s Potential “Silver Moment”

The analogy to silver’s surge, which outpaced gold’s gains, has fueled speculation about XRP’s potential for significant price appreciation. Some commentators argue that XRP, like precious metals, has experienced price suppression and is poised for a sudden repricing event. If XRP were to mirror silver’s gains, its price could see a substantial increase, although such projections are purely speculative.

Future Outlook and Considerations

While mathematical estimates provide a framework for potential gains, the future performance of crypto assets remains uncertain. The potential breakout for Bitcoin and XRP could be much higher than anticipated, or they could face a deeper bear phase before any major rally occurs. Investors should carefully consider market conditions, regulatory developments, and macroeconomic factors when assessing the risks and opportunities in the crypto market. Diversification and risk management remain crucial in this evolving landscape.

Related: Crypto Liquidation Signals $850M Bullish Bets

Source: Original article

Quick Summary

Gold recently hit an all-time high, briefly exceeding Bitcoin’s market cap in a single day, sparking comparisons to XRP. Analysts attribute gold’s gains to its market depth and maturity, contrasting it with the relatively thinner crypto markets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.