XRP recently closed below its 100-week exponential moving average (EMA), a technical level that, when breached in the past, has preceded significant price declines. This development occurs amid broader crypto market headwinds, increasing the potential for further downside.

What to Know:

- XRP recently closed below its 100-week exponential moving average (EMA), a technical level that, when breached in the past, has preceded significant price declines.

- This development occurs amid broader crypto market headwinds, increasing the potential for further downside.

- Institutional investors should monitor whether XRP can reclaim this key level to avoid potentially substantial losses, while Ripple’s overall market position could face added pressure.

XRP has been under pressure, mirroring the broader crypto market’s recent struggles. A concerning technical development has emerged as XRP closed below its 100-week exponential moving average (EMA). This level has historically acted as a critical support, and a sustained break below it could signal further price weakness. Investors are now closely watching to see if XRP can reclaim this pivotal level.

XRP’s Dance Around the 100W EMA

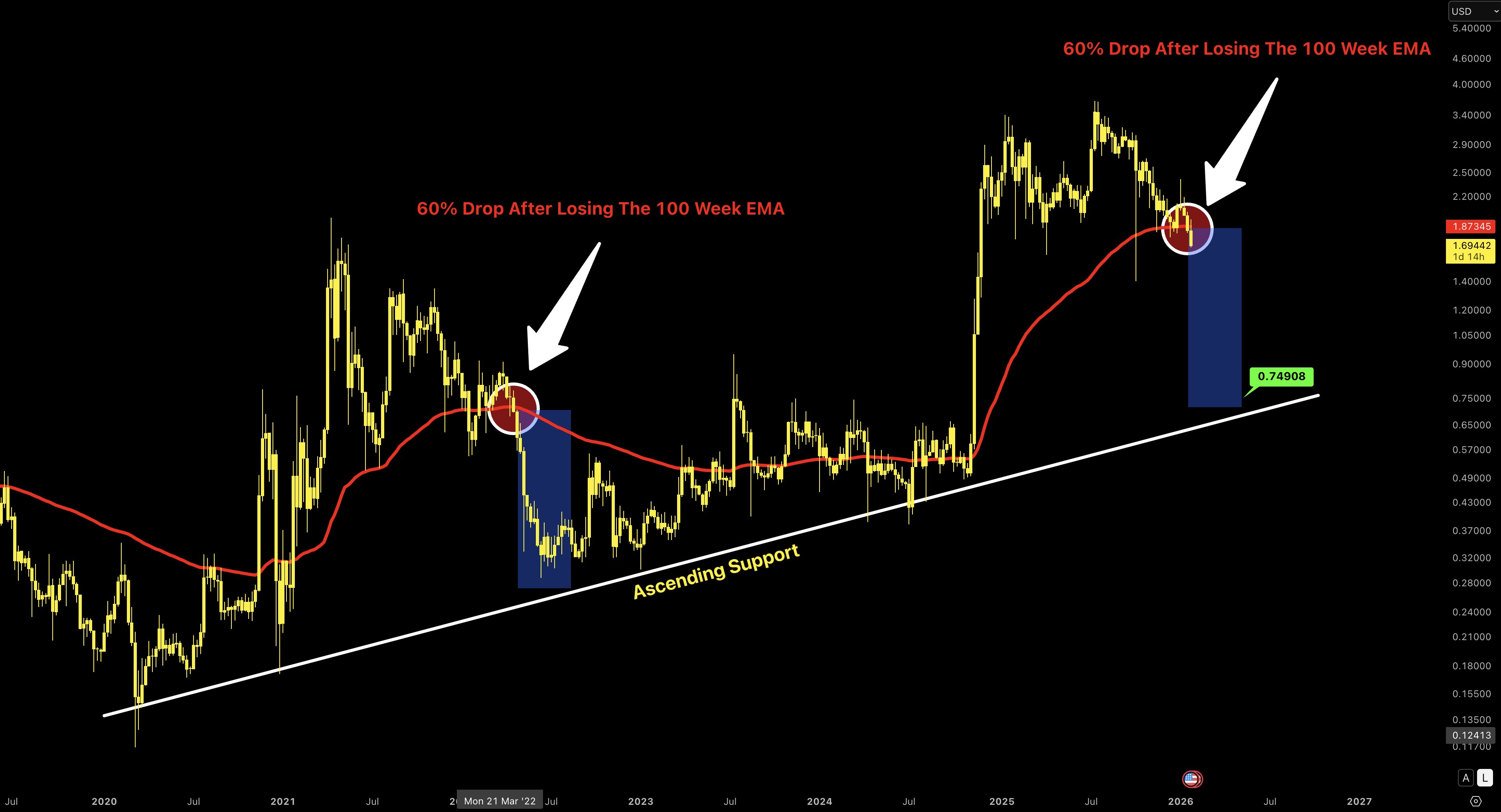

Throughout 2023 and 2024, XRP repeatedly tested the 100-week EMA, oscillating above and below it within a relatively tight range. This EMA level acted as a magnet, with XRP’s price gravitating towards it during periods of consolidation. However, the landscape shifted following a notable upswing, pushing XRP significantly above this long-term moving average. After peaking in early December 2024, XRP began retracing, eventually retesting the 100-week EMA from October 2025 onward as prices saw rapid declines.

Breaching a Critical Threshold

While previous retests of the 100-week EMA resulted in bounces, the recent price action is different. XRP decisively closed below the 100-week EMA, a bearish signal that has traders on high alert. The last time such a breakdown occurred, XRP experienced a substantial correction, leading some analysts to suggest that a similar move could be in store. A decisive break below this long-term moving average could trigger further selling pressure as technical traders adjust their positions.

Downside Targets and Support Levels

Market analysts are now eyeing potential downside targets for XRP, with some suggesting a move toward levels not seen in recent times. These projections are based on historical price action following similar breakdowns below the 100-week EMA. While these targets are speculative, they highlight the potential for significant volatility should the bearish trend persist. Traders are also closely monitoring key support levels that could provide a floor for XRP’s price.

A Word of Caution

It’s crucial to acknowledge that technical analysis is not a crystal ball. Market conditions can change rapidly, and unforeseen events can invalidate even the most well-reasoned predictions. While the breakdown below the 100-week EMA is a cause for concern, it’s not a guarantee of further downside. Investors should exercise caution, manage their risk appropriately, and avoid making impulsive decisions based solely on technical indicators.

The Road Ahead

The near-term outlook for XRP hinges on its ability to reclaim the 100-week EMA. A successful move back above this level would negate the recent bearish signal and potentially pave the way for a recovery. However, failure to do so could lead to further declines. Investors should closely monitor price action and be prepared to adjust their strategies accordingly. The coming weeks will be crucial in determining XRP’s trajectory.

XRP’s recent break below the 100-week EMA is a significant technical development that warrants close attention. While the potential for further downside exists, it’s essential to remember that markets are dynamic and unpredictable. Prudent risk management and a balanced perspective are crucial for navigating these uncertain times.

Related: Bitcoin Liquidity Signals Traders on Edge

Source: Original article

Quick Summary

XRP recently closed below its 100-week exponential moving average (EMA), a technical level that, when breached in the past, has preceded significant price declines. This development occurs amid broader crypto market headwinds, increasing the potential for further downside.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.