XRP is exhibiting significant weakness, trapped in a downtrend with exhausted buyers and sellers firmly in control. Ethereum experienced a sharp market shock due to a sudden surge in trading volume, leading to the liquidation of large positions and a breach of key support levels.

What to Know:

- XRP is exhibiting significant weakness, trapped in a downtrend with exhausted buyers and sellers firmly in control.

- Ethereum experienced a sharp market shock due to a sudden surge in trading volume, leading to the liquidation of large positions and a breach of key support levels.

- Shiba Inu is facing its worst decline of 2026, with the RSI indicating oversold conditions that might set the stage for a potential relief bounce.

XRP, Ethereum, and Shiba Inu are each facing unique challenges as they navigate the current market environment. For institutional investors, understanding the nuances of these assets’ price action, liquidity, and underlying market structure is crucial for informed decision-making. Macro factors and regulatory developments continue to exert pressure, making diligent analysis all the more important.

XRP’s Persistent Downtrend

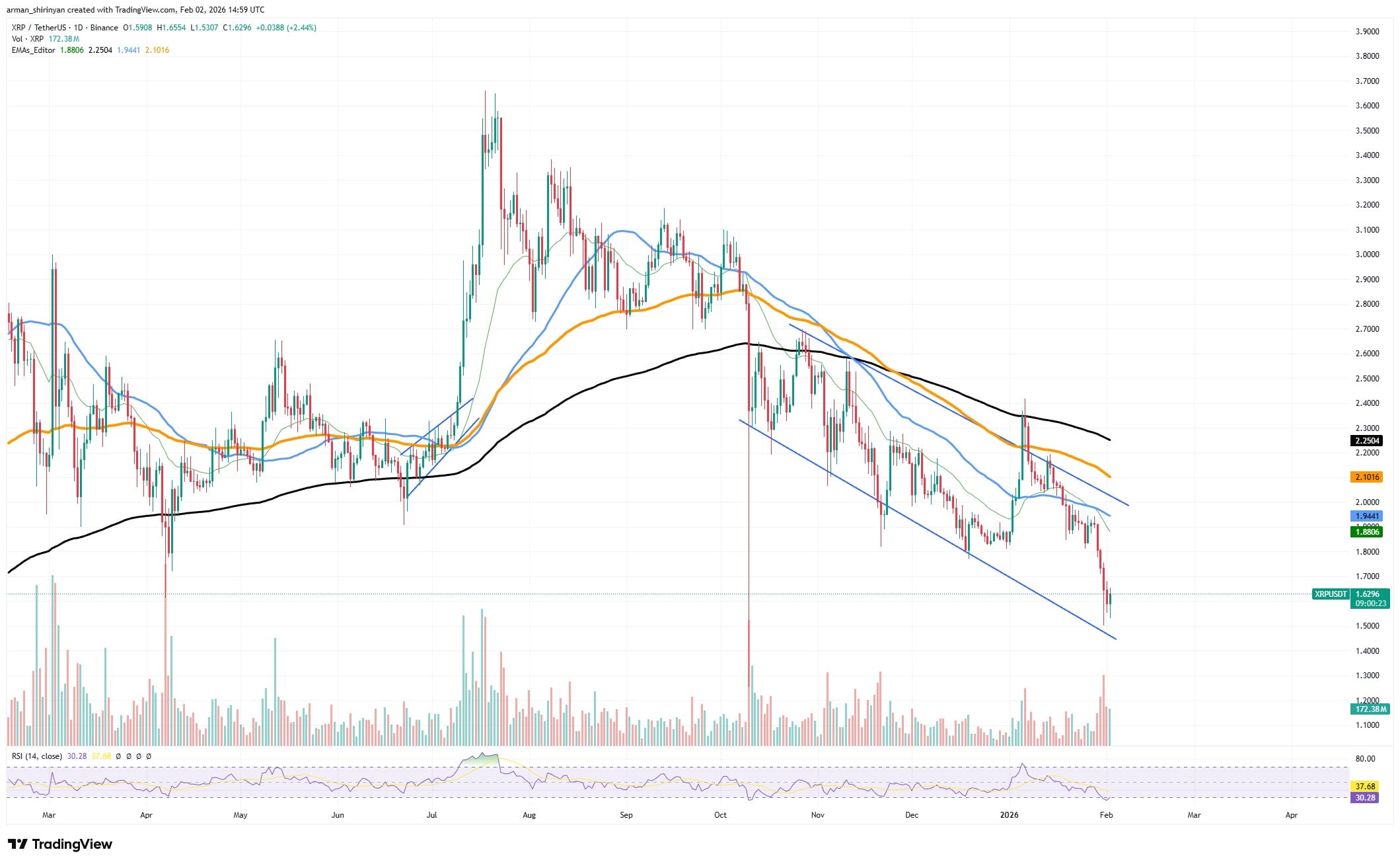

XRP’s recent price action reveals a market firmly controlled by sellers, with buyers showing little strength to defend key price levels. The asset is currently trading at levels not seen in months, trapped in a persistent downtrend characterized by lower highs and lower lows. Failed recovery attempts and a break from a descending structure signal a lack of confidence among investors.

The inability of XRP to sustain any upward momentum is concerning. Volume spikes coinciding with declining trends further confirm that market participants are primarily selling. For institutional portfolios, such persistent weakness raises questions about the asset’s near-term viability. A potential stabilization would require a significant influx of buying interest to reclaim key resistance levels, a scenario that currently seems unlikely.

Ethereum’s Market Correction

Ethereum recently experienced a sharp market shock, triggered by a sudden surge in trading volume that led to a significant price decline. This move wiped out key support levels, sending ETH tumbling within hours. The event appears to be driven by the forced liquidation of large whale positions, amplifying selling pressure across the market.

The rapid decline highlights the vulnerabilities within Ethereum’s market structure. The break below the $2,800 support level, after weeks of struggling to maintain stability, indicates a fragile market sentiment. Large leveraged positions likely triggered automated liquidations, pushing ETH towards the $2,300-$2,400 range. This type of event is reminiscent of past market corrections, where cascading liquidations exacerbate downward pressure.

Shiba Inu’s Oversold Conditions

Shiba Inu has experienced its worst decline in 2026, shattering investor hopes for a substantial market recovery. The token recently broke down from a consolidation structure, triggering another wave of selling that pushed it to fresh local lows. Trading volume spiked during the decline, suggesting forced selling and panic exits.

Despite the bearish trend, the Relative Strength Index (RSI) indicates that SHIB is now in extremely oversold territory. Historically, when SHIB’s RSI has reached these levels, the market has often seen at least a brief relief bounce. While oversold conditions do not guarantee an immediate reversal, they do suggest that downside momentum may be waning, potentially opening the door for a rebound or consolidation phase.

Broader Market Implications

The recent price action in XRP, Ethereum, and Shiba Inu reflects broader market dynamics and investor sentiment. The weakness in XRP underscores the challenges faced by assets struggling to maintain bullish momentum in a risk-off environment. Ethereum’s sharp correction highlights the potential for cascading liquidations to destabilize even the most established cryptocurrencies. Shiba Inu’s oversold conditions offer a glimmer of hope for a potential rebound, but caution remains warranted given the overall negative trend.

Related: XRP Liquidity Signals Potential Buy

Source: Original article

Quick Summary

XRP is exhibiting significant weakness, trapped in a downtrend with exhausted buyers and sellers firmly in control. Ethereum experienced a sharp market shock due to a sudden surge in trading volume, leading to the liquidation of large positions and a breach of key support levels.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.