A 2013 email reveals Jeffrey Epstein was informed about Google’s plans to use Ripple’s blockchain for digital payments in Africa. This occurred amid Google’s broader strategy to link Google Wallet to email and invest in innovative technologies.

What to Know:

- A 2013 email reveals Jeffrey Epstein was informed about Google’s plans to use Ripple’s blockchain for digital payments in Africa.

- This occurred amid Google’s broader strategy to link Google Wallet to email and invest in innovative technologies.

- The early interest from a tech giant like Google underscores Ripple’s potential in reshaping global payment systems, even though Google never fully adopted the technology.

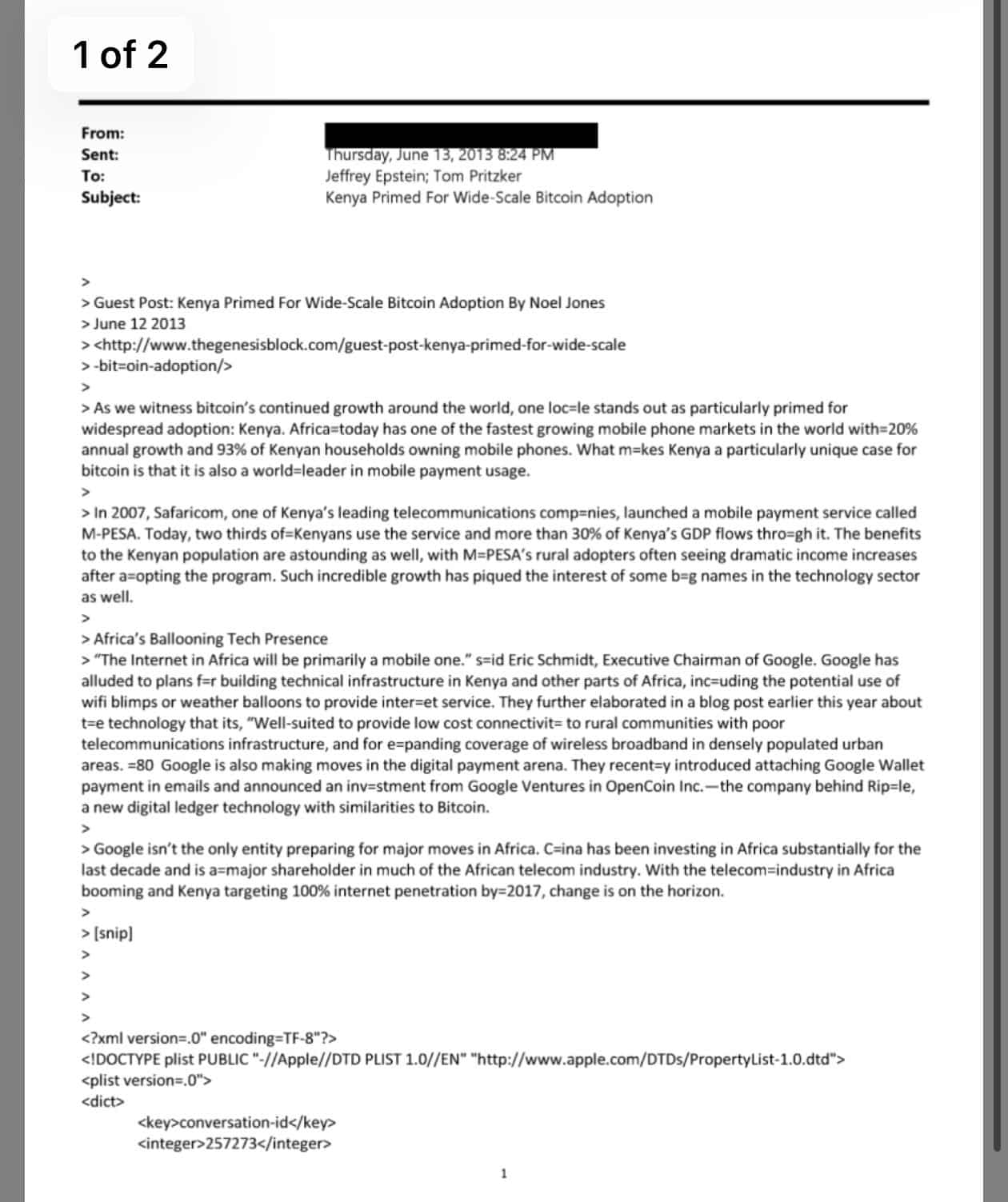

A recently resurfaced 2013 email has brought renewed attention to Google’s early interest in Ripple’s blockchain technology. The email, which includes Jeffrey Epstein, details Google’s strategy to expand digital payments in Africa through investments in Ripple, then known as OpenCoin. This revelation offers a glimpse into how major tech firms were exploring blockchain solutions long before crypto became a mainstream focus for institutional investors.

Epstein Emails Spotlight Google’s Early Investment in Ripple

The 2013 email indicates that Google invested in OpenCoin as part of a broader initiative to enhance digital payment solutions in Africa. Kenya was specifically highlighted as a key market due to its high mobile phone penetration and the established success of Safaricom’s M-PESA, a mobile payment system. The strategy involved integrating Google Wallet with email services and leveraging Google Ventures’ investment in OpenCoin to facilitate these digital transactions.

The email described OpenCoin as employing a blockchain technology similar to Bitcoin, which is interesting considering the timeline. This early exploration suggests that Google recognized the potential of blockchain to revolutionize cross-border and mobile payments, setting the stage for future developments in the digital finance landscape.

Ripple and XRP as a Google-Endorsed Alternative

According to crypto commentator Jungle Inc, the email framed Ripple and XRP as a Google-backed alternative to traditional banking systems. In 2013, Bitcoin was often perceived as a speculative asset, whereas Ripple and the XRP Ledger (XRPL) were viewed as scalable solutions for global payments by some influential entities. This perspective highlights the early recognition of XRP’s utility in facilitating international transactions, positioning it as a practical tool for financial institutions.

This narrative aligns with the broader crypto community’s view of XRP as a key player in global payments. Ripple’s strategic partnerships with major institutions, such as Japan’s SBI Group, have further solidified the token’s credibility in the financial sector. While the early endorsement by Google did not lead to direct integration, it underscores the potential that established tech companies saw in Ripple’s technology.

No Evidence of Google’s Adoption of Ripple Tech

Despite Google’s initial investment and interest, there is no concrete evidence that the tech giant ever implemented Ripple’s payment technology or utilized the XRP Ledger for its global payment solutions. Instead, Google has since developed its own blockchain technology, known as Google Cloud Universal Ledger (GCUL), for financial services. Some industry observers have even labeled GCUL as an “XRP killer,” though the two systems differ significantly in design and purpose.

GCUL is structured as a private, permissioned blockchain, contrasting with the public and decentralized nature of the XRP Ledger. Additionally, Google’s blockchain does not incorporate a native token, further distinguishing it from XRP. While Google’s early interest in Ripple highlights the potential of blockchain in finance, the company’s strategic direction has since diverged, focusing on proprietary solutions tailored to its specific needs.

Implications for XRP and Institutional Flows

The resurfaced email serves as a historical reminder of the early interest in Ripple’s technology from major tech players. While Google’s investment did not translate into a full-scale adoption, it highlights the potential for XRP and the XRP Ledger to address inefficiencies in global payment systems. For institutional investors, this historical context may reinforce the idea that XRP has long been considered a viable solution for cross-border transactions, predating much of the current crypto market hype.

Ultimately, the implications of Google’s early interest in Ripple are nuanced. While it didn’t lead to immediate adoption, it did signal a forward-thinking approach to integrating blockchain into mainstream financial systems. As the digital asset landscape continues to evolve, such historical insights can provide valuable context for assessing the long-term potential of various blockchain technologies and their impact on institutional finance.

Related: XRP Liquidation Imbalance Signals Caution

Source: Original article

Quick Summary

A 2013 email reveals Jeffrey Epstein was informed about Google’s plans to use Ripple’s blockchain for digital payments in Africa. This occurred amid Google’s broader strategy to link Google Wallet to email and invest in innovative technologies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.