Bitcoin rebounded from a nine-month low, facing resistance at $79,000. Broader markets saw a downturn influenced by macroeconomic factors and geopolitical tensions. HYPE and CC showed notable gains, diverging from the sluggish performance of major altcoins, potentially impacting liquidity flows.

What to Know:

- Bitcoin rebounded from a nine-month low, facing resistance at $79,000.

- Broader markets saw a downturn influenced by macroeconomic factors and geopolitical tensions.

- HYPE and CC showed notable gains, diverging from the sluggish performance of major altcoins, potentially impacting liquidity flows.

Bitcoin experienced a volatile week, hitting a nine-month low before recovering slightly. The initial downturn was attributed to a combination of factors, including the US Federal Reserve’s decision to hold off on interest rate cuts and escalating geopolitical tensions in the Middle East. While Bitcoin has since rebounded, it faces resistance at the $79,000 level, highlighting the ongoing uncertainty in the market.

BTC Struggles Below $79,000

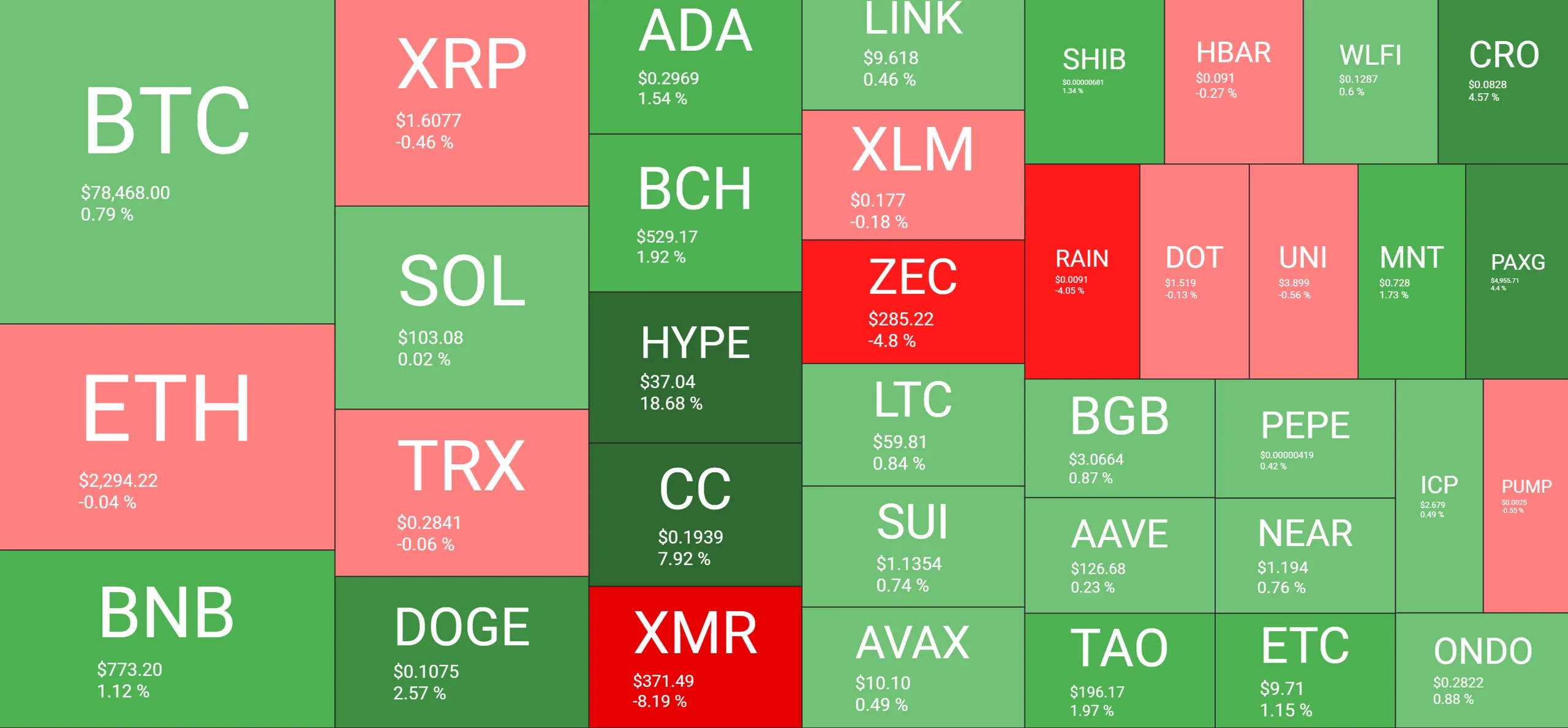

Bitcoin’s struggle to break above $79,000 underscores the current market sentiment. After briefly touching $90,000, the price began a steady decline, exacerbated by macroeconomic announcements and global events. The cryptocurrency dipped to a low of $75,000, a level not seen since April of the previous year, before staging a modest recovery. Currently, Bitcoin’s market capitalization stands at $1.560 trillion, with a dominance of 57.7% over the altcoin market, according to CG data.

Altcoin Market Dynamics

The altcoin market largely mirrored Bitcoin’s trajectory, with Ethereum experiencing a significant drop from over $3,000 to around $2,100. While Ethereum has since recovered somewhat, it continues to face resistance below $2,300. Other major altcoins like XRP, TRX, and XLM have seen slight losses, while SOL, BNB, ADA, and BCH have recorded minimal gains. The divergence in performance highlights the nuanced dynamics within the altcoin market, where specific project developments and community sentiment can play a significant role.

HYPE and CC Outperform

bucking the trend, HYPE has emerged as a notable outperformer, surging by 19% to reach $37. CC also posted substantial gains, rising by 8% to over $0.19. This performance may be attributed to project-specific news, technological advancements, or increased adoption within their respective ecosystems. The strong performance of these altcoins amid broader market stagnation suggests a potential shift in investor focus towards projects with unique value propositions.

Total Market Capitalization Recovers

The total cryptocurrency market capitalization has rebounded by $70 billion from its recent low, currently exceeding $2.7 trillion. This recovery indicates renewed investor confidence and a potential shift in market sentiment. However, the market remains sensitive to macroeconomic factors and geopolitical developments, which could trigger further volatility.

Implications for XRP and Market Liquidity

The current market environment has implications for XRP and overall market liquidity. XRP’s performance, along with other major altcoins, is closely tied to Bitcoin’s price movements and broader market sentiment. Increased volatility and uncertainty can lead to decreased liquidity, making it more challenging for institutional investors to execute large trades efficiently. The performance of HYPE and CC also highlights the potential for liquidity to flow towards specific altcoins that demonstrate strong growth potential, driven by unique value propositions or technological advancements.

In conclusion, the cryptocurrency market is currently navigating a period of uncertainty, with Bitcoin facing resistance and altcoins exhibiting mixed performance. While the total market capitalization has recovered somewhat, investors should remain cautious and closely monitor macroeconomic factors and geopolitical developments. The performance of individual altcoins like HYPE and CC suggests opportunities for growth within specific niches, but overall market liquidity remains a key consideration for institutional investors.

Related: Bitcoin Holds Support: Crypto Fear Signals

Source: Original article

Quick Summary

Bitcoin rebounded from a nine-month low, facing resistance at $79,000. Broader markets saw a downturn influenced by macroeconomic factors and geopolitical tensions. HYPE and CC showed notable gains, diverging from the sluggish performance of major altcoins, potentially impacting liquidity flows.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.