Ripple’s licensing advancements in the UK and EU are a positive step for company-level distribution, but their conversion into tangible XRPL activity is essential for establishing XRP demand.

What to Know:

- Ripple’s licensing advancements in the UK and EU are a positive step for company-level distribution, but their conversion into tangible XRPL activity is essential for establishing XRP demand.

- While Ripple will sunset its quarterly XRP Markets Report, third-party research like Messari’s Q3 2025 snapshot provides valuable insights into XRPL’s transaction and address growth.

- Cross-border payments modernization faces challenges, with BIS and FSB reports indicating slow progress, making it crucial to monitor XRP’s sensitivity to liquidity conditions and regulatory developments.

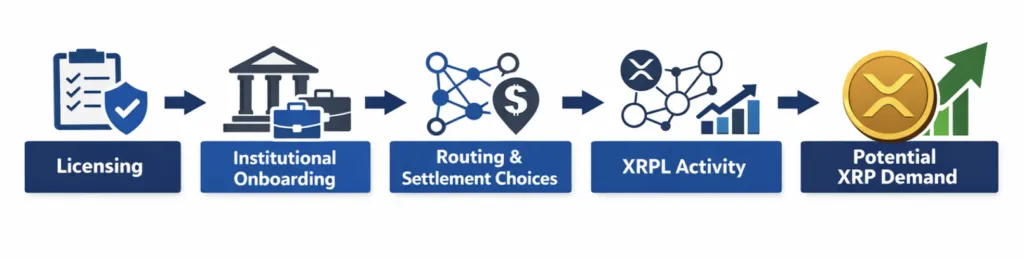

Ripple has secured significant regulatory approvals in the UK and Luxembourg, marking a pivotal moment for the company as it enters 2026. These permissions, including an Electronic Money Institution (EMI) license and cryptoasset registration in the UK, along with full EMI approval in Luxembourg, signal a strategic expansion into key European markets. The focus now shifts to translating these regulatory wins into tangible benefits for the XRP Ledger (XRPL) and its native token, XRP.

Ripple’s licensing progress represents a crucial step in enabling broader distribution of its services. However, the ultimate impact on XRP hinges on observable increases in XRPL activity.

This includes metrics like transaction volume, new wallet creation, and decentralized exchange (DEX) activity. Investors should closely monitor these on-chain indicators to gauge the real-world utility and demand for XRP.

As Ripple transitions away from its quarterly XRP Markets Report, relying on third-party research becomes increasingly important for assessing XRPL’s performance. Messari’s Q3 2025 report offers a recent snapshot, highlighting an 8.9% increase in average daily transactions and a 46.3% rise in total new addresses.

Related: XRP DeFi Upgrade Signals New Yield Opportunities

Quick Summary

Ripple’s licensing advancements in the UK and EU are a positive step for company-level distribution, but their conversion into tangible XRPL activity is essential for establishing XRP demand.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.