Despite a significant downturn in XRP’s price since July 2025, short-term holders have recently accumulated approximately 1.8 billion tokens. This accumulation occurs amidst a broader bearish trend affecting XRP, highlighting a potential divergence in sentiment among different investor classes.

What to Know:

- Despite a significant downturn in XRP’s price since July 2025, short-term holders have recently accumulated approximately 1.8 billion tokens.

- This accumulation occurs amidst a broader bearish trend affecting XRP, highlighting a potential divergence in sentiment among different investor classes.

- The activity of these short-term holders could signal a speculative interest in a potential price rebound, but their historical behavior suggests caution for long-term trend predictions.

XRP has experienced a notable price decline since peaking in July 2025, with ongoing selling pressure pushing the asset down by 55%. Despite this bearish trend, recent on-chain data reveals a substantial accumulation of XRP by short-term holders, suggesting a potential shift in market sentiment. This activity raises questions about the motivations behind these investments and their possible impact on XRP’s price trajectory.

XRP’s Struggle Amidst Market Downturn

XRP has faced headwinds since its peak in July 2025, with the price retreating from $3.6. The fourth quarter of 2025 saw a particularly sharp decline, contributing to an overall 55% drop from its high. Despite attempts at recovery earlier this year, XRP has continued to struggle, down 13% year-to-date, reflecting ongoing challenges in the market.

Short-Term Holders Show Renewed Interest

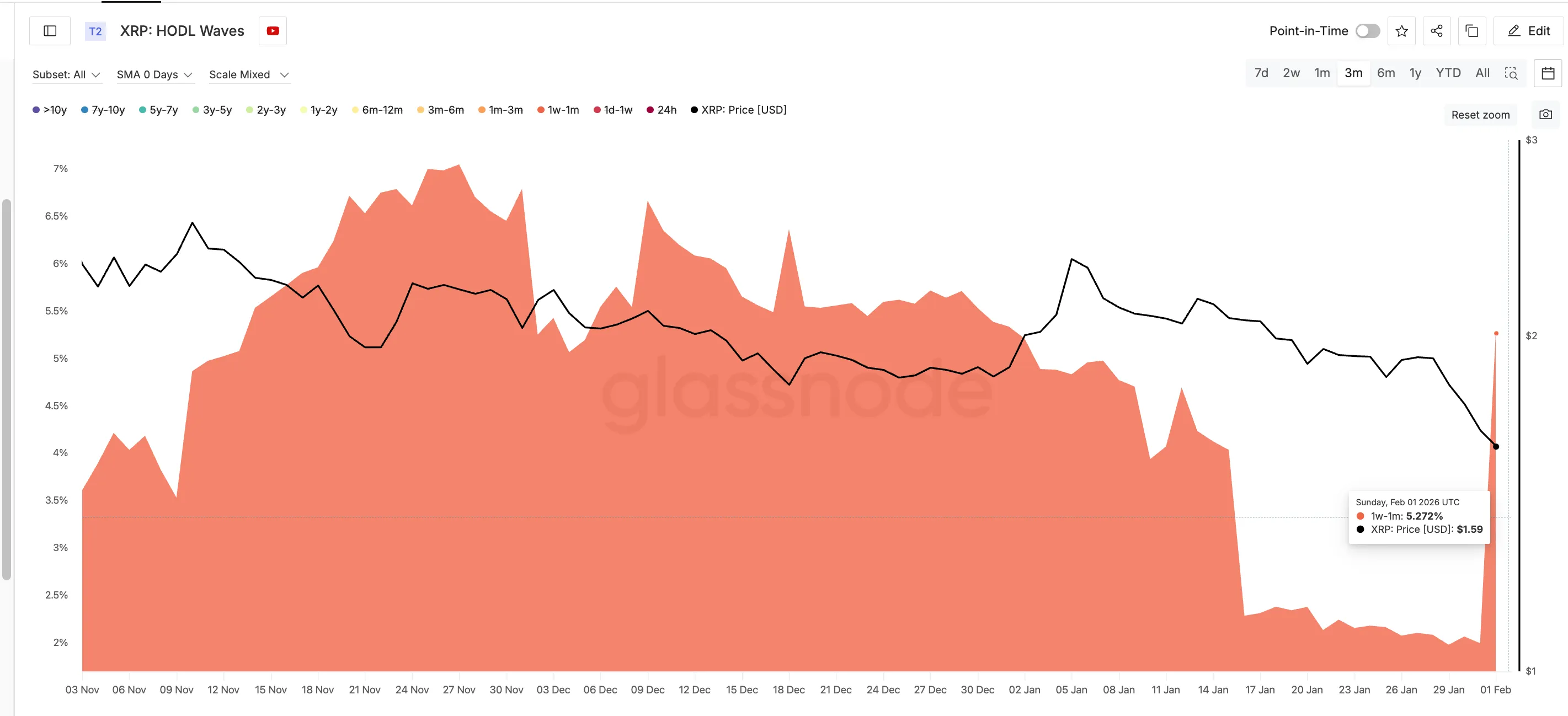

While XRP’s price has been under pressure, short-term holders, defined as those holding XRP for one week to one month, have exhibited renewed interest. In late January and early February, these holders accumulated 1.8 billion XRP, valued at $2.88 billion, even as the price declined by over 8%. This accumulation suggests a contrarian view among these investors, potentially anticipating a price reversal.

Analyzing the Accumulation Trend

The recent accumulation has increased the holdings of these short-term addresses to 5.272% of XRP’s total supply, approximately 5.266 billion tokens worth $8.4 billion. This marks a significant increase from their previous holdings, which were below 2.52% of the total supply. Historical data indicates that these holders have been reactive to market movements, increasing their holdings after declines, only to later reduce them.

Potential Implications and Cautionary Notes

The accumulation by short-term holders raises the question of whether these investors foresee opportunities that are not yet apparent to the broader market. Such buying activity can indicate perceived value at lower price levels and expectations of a rebound. However, it’s important to note that this group tends to be nimble, moving in and out of positions quickly, making their actions less reliable as indicators of XRP’s long-term direction.

Concluding Thoughts on XRP’s Trajectory

While the recent surge in accumulation by short-term XRP holders may signal short-term confidence and a potential price bounce, it does not guarantee a sustained recovery. Institutional investors should view this activity as a data point within a broader analysis of XRP’s market dynamics, considering the historical behavior of these holders and the overall market conditions. Prudence and comprehensive research remain essential when navigating the digital asset landscape.

Related: XRP Stablecoin Soars; Signals $35M Liquidity

Source: Original article

Quick Summary

Despite a significant downturn in XRP’s price since July 2025, short-term holders have recently accumulated approximately 1.8 billion tokens. This accumulation occurs amidst a broader bearish trend affecting XRP, highlighting a potential divergence in sentiment among different investor classes.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.