XRP has broken below a key support level of $1.6, signaling further potential downside. The broader crypto market is experiencing a period of correction, influenced by macroeconomic factors and persistent selling pressure.

What to Know:

- XRP has broken below a key support level of $1.6, signaling further potential downside.

- The broader crypto market is experiencing a period of correction, influenced by macroeconomic factors and persistent selling pressure.

- The next support levels at $1.4 and $1 are critical areas to watch for potential buying interest and possible relief rallies in XRP.

XRP is currently navigating a challenging period, mirroring the broader downturn observed across the cryptocurrency market. After failing to maintain support at $1.6, the digital asset is now eyeing lower levels. Investors and traders are closely monitoring upcoming support zones for signs of stabilization amidst the ongoing volatility.

XRP Loses Key Support

XRP has succumbed to sustained selling pressure, breaching the critical $1.6 support level. This breakdown suggests a potential continuation of the downtrend, with the next targets situated at $1.4 and $1. These levels are crucial as they may attract buyers looking for an entry point, potentially triggering a relief rally.

Dominance of Sell Volume

The monthly chart reveals a consistent pattern of red candles since October 2025, underscoring the intensity of the current selloff. Despite a brief recovery attempt around $2, the level ultimately failed to hold, reinforcing bearish sentiment. Market participants should closely observe the $1.4 level, as it could present an opportunity for a bounce.

Bearish Macro Outlook

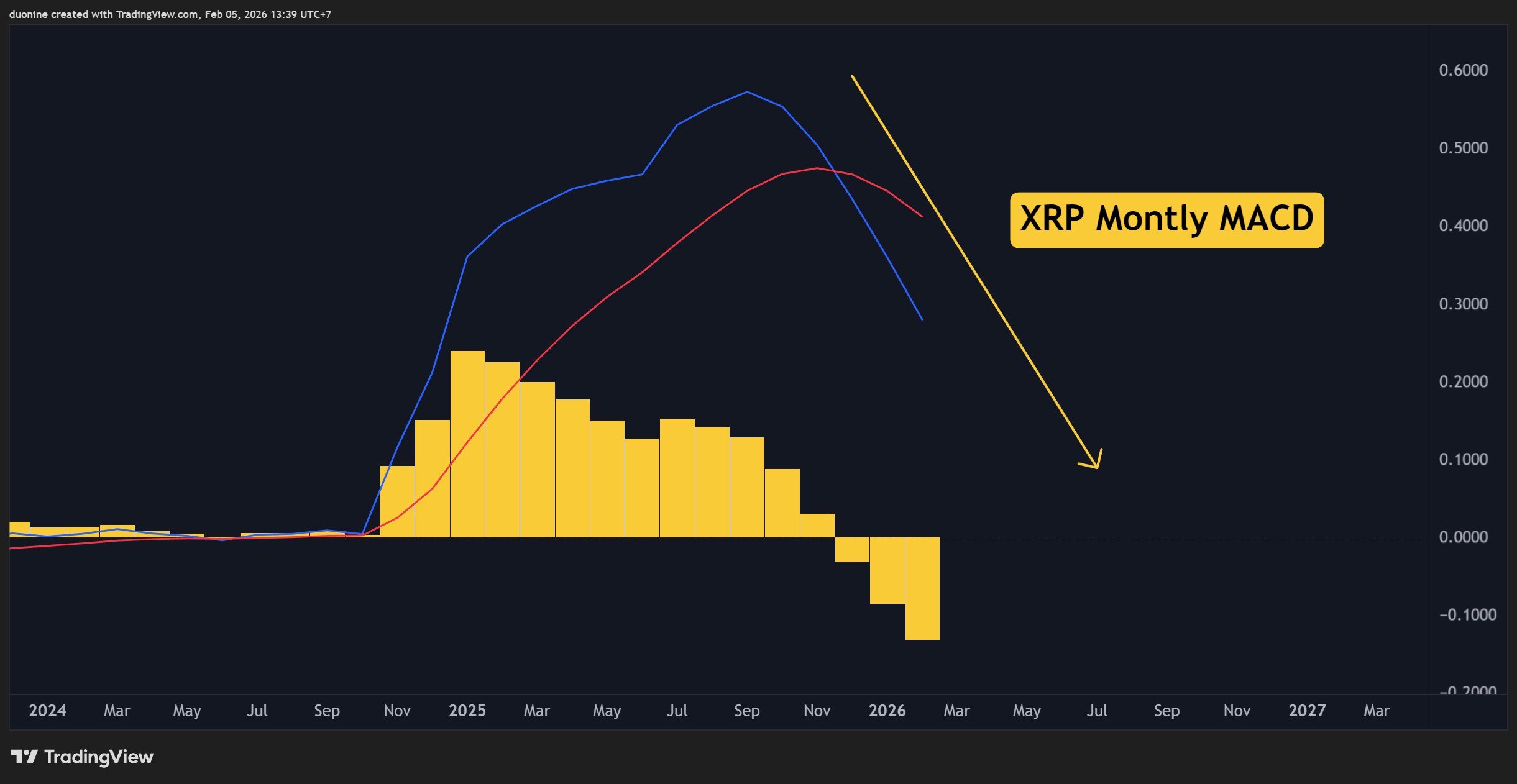

The monthly MACD indicator paints a bearish picture for XRP’s macroeconomic outlook. Even if buyers emerge in the short term, the overall trend suggests further downside potential. This prolonged downtrend may persist for several months before a definitive bottom is established.

Broader Market Context

XRP’s price action is occurring against a backdrop of general weakness in the cryptocurrency market. Bitcoin and Ethereum have also experienced pullbacks, influenced by macroeconomic uncertainty and profit-taking activities. The performance of these leading cryptocurrencies often sets the tone for altcoins like XRP, highlighting the interconnectedness of the market.

Implications for Liquidity

The current market conditions may impact liquidity across various XRP trading pairs. Increased volatility and uncertainty can lead to wider bid-ask spreads and reduced market depth. Market makers and liquidity providers may adjust their strategies in response to these dynamics, potentially affecting trading conditions for institutional investors.

Looking Ahead

While the short-term outlook for XRP appears bearish, potential developments, such as progress in Ripple’s legal proceedings or positive regulatory updates, could alter the trajectory. Investors should closely monitor these factors, as well as overall market sentiment, to gauge future price movements.

In summary, XRP is currently facing significant headwinds after losing a key support level. The next few weeks will be crucial in determining whether the asset can find stability at lower levels or if further declines are in store. Monitoring both technical indicators and fundamental developments will be essential for making informed decisions in this environment.

Related: Bitcoin Signals Brain-Driven Rally

Source: Original article

Quick Summary

XRP has broken below a key support level of $1.6, signaling further potential downside. The broader crypto market is experiencing a period of correction, influenced by macroeconomic factors and persistent selling pressure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.