Bitcoin’s recent dip below $70,000 triggered a widespread selloff in the crypto market. Over $1 billion in trading positions were liquidated as a result of the price drop. The market’s weakness reflects a shift in sentiment and capital rotation towards other asset classes.

What to Know:

- Bitcoin’s recent dip below $70,000 triggered a widespread selloff in the crypto market.

- Over $1 billion in trading positions were liquidated as a result of the price drop.

- The market’s weakness reflects a shift in sentiment and capital rotation towards other asset classes.

Bitcoin’s recent dip below the $70,000 mark has sent ripples through the crypto market, triggering a broad selloff. The correction erased over $1 billion in trading positions, impacting major cryptocurrencies. This downturn highlights the inherent volatility and interconnectedness within the digital asset space.

The market experienced a significant downturn, with Ethereum dropping 7% to around $2065 and XRP falling more than 14% to $1.35. Other major tokens like Cardano, BNB, Solana, and Dogecoin also experienced similar losses, reflecting widespread selling pressure. This synchronized decline indicates a broader market correction rather than isolated incidents.

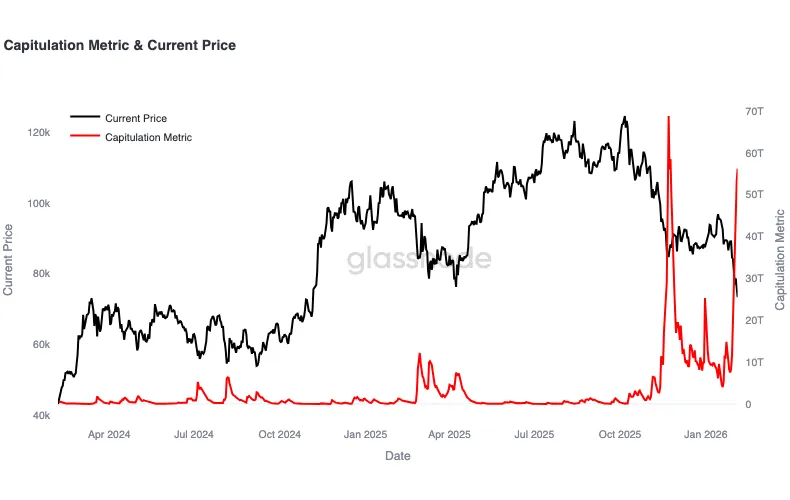

On-chain data reveals a sharp increase in forced selling during the downturn. Glassnode reported that Bitcoin’s capitulation metric recorded its second-largest spike in two years, signaling rapid liquidations. These stress events typically lead to heightened volatility as traders adjust their exposure to the market.

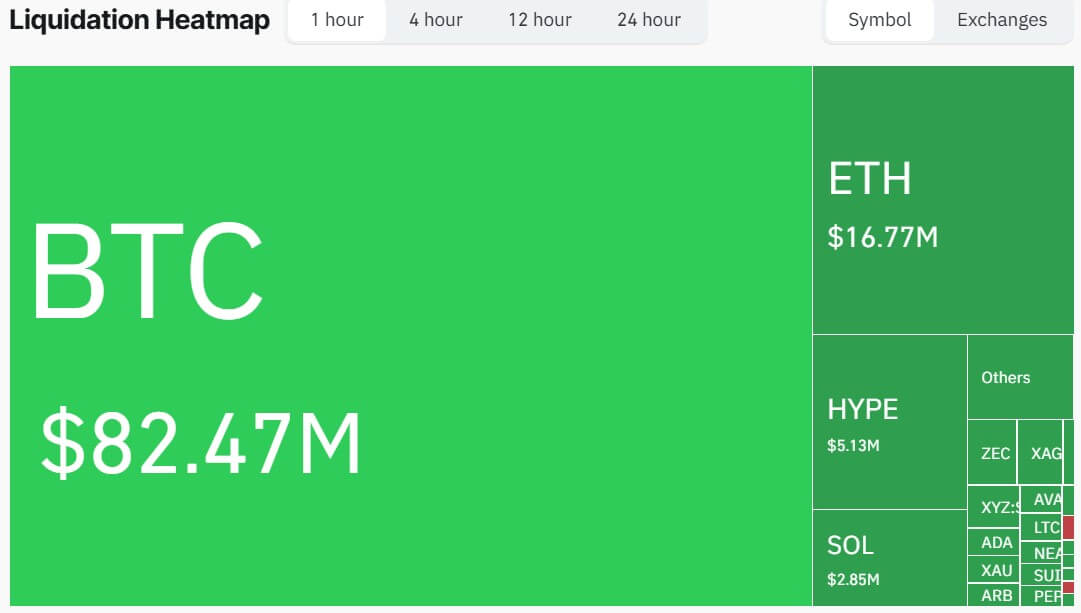

The price drop triggered substantial liquidations in the derivatives market. Coinglass data indicated that over $120 million in positions were liquidated within an hour as prices fell below key technical levels. Bitcoin-linked contracts were hit the hardest, with liquidations totaling over $86 million, emphasizing the impact of Bitcoin’s price movements on the broader market.

In conclusion, the recent market correction serves as a reminder of the crypto market’s sensitivity to broader economic factors and investor sentiment. While volatility remains a key characteristic, the long-term outlook for digital assets remains positive as the market continues to mature and attract institutional interest.

Related: Crypto HYPE Soars: Can It Pump More?

Source: Original article

Quick Summary

Bitcoin’s recent dip below $70,000 triggered a widespread selloff in the crypto market. Over $1 billion in trading positions were liquidated as a result of the price drop. The market’s weakness reflects a shift in sentiment and capital rotation towards other asset classes.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.