Messari’s “State of XRP Ledger” report for Q4 2025 indicates both institutional adoption and declines in key metrics. The launch of major US spot XRP ETFs marks a significant step towards mainstream acceptance amid broader crypto market volatility.

What to Know:

- Messari’s “State of XRP Ledger” report for Q4 2025 highlights both institutional adoption and declines in key metrics.

- The launch of major US spot XRP ETFs marks a significant step towards mainstream acceptance amid broader crypto market volatility.

- The data suggests increasing institutional interest in XRP through ETFs and RWAs, though broader on-chain activity reflects market headwinds.

The latest “State of XRP Ledger” report from Messari offers a detailed look at the XRP ecosystem’s performance in the final quarter of 2025. The report analyzes key financial metrics, revealing significant strides in institutional adoption alongside notable downturns in other crucial indicators. As XRP navigates the complex landscape of digital assets, understanding these trends is essential for investors.

XRP ETFs Attract Billion-Dollar Inflows

The fourth quarter of 2025 witnessed the launch of several major US spot XRP ETFs, led by the Canary Capital XRP ETF. This move opened the doors for traditional financial market participation, with asset managers like Franklin Templeton, Grayscale, Bitwise, and 21Shares offering pure spot XRP products in the US. These ETFs quickly amassed over $1 billion in assets under management within four weeks, demonstrating strong initial demand. The continuous inflow streak, unmatched by other crypto ETF launches since Ethereum, underscores the pent-up institutional appetite for XRP exposure.

Institutional Holdings Reflect Demand

As of late January, US spot ETFs collectively held nearly 800 million XRP, representing 1.3% of the asset’s circulating supply. Canary Capital held the largest share, with over 180 million XRP. This accumulation indicates a strategic move by Wall Street to capitalize on XRP’s potential, reflecting a broader trend of institutional investors seeking diversified crypto exposure through regulated investment vehicles.

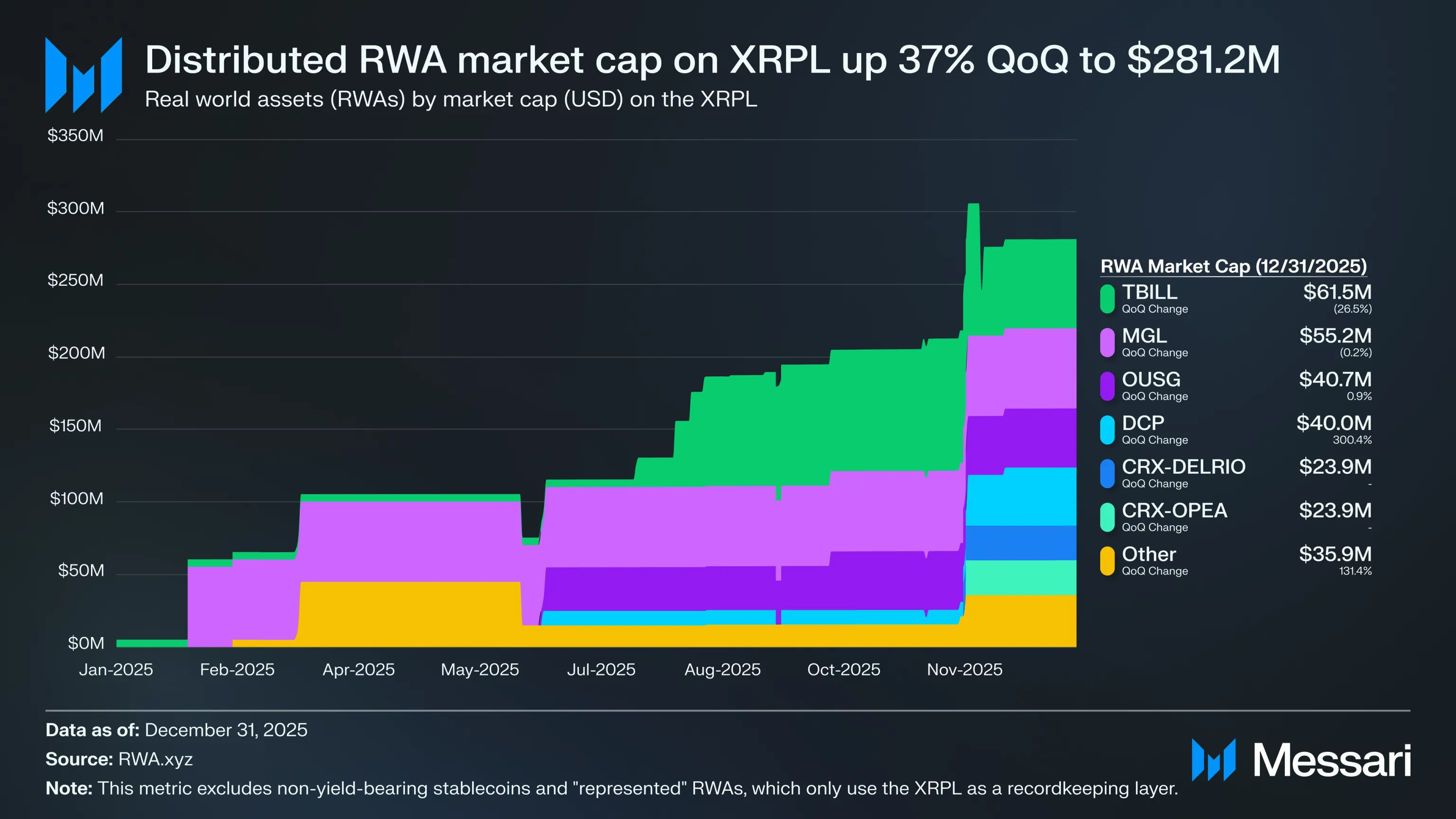

RWA Market Cap Reaches All-Time High

The XRP Ledger’s real-world asset (RWA) market is experiencing substantial growth, signaling increasing institutional traction. Distributed RWAs issued on the XRP Ledger saw a 37% quarter-over-quarter increase, closing Q4 with a record-high market cap of $2.28 billion. This growth reflects the issuance of several RWAs launched earlier in the year, excluding non-yield-bearing stablecoins.

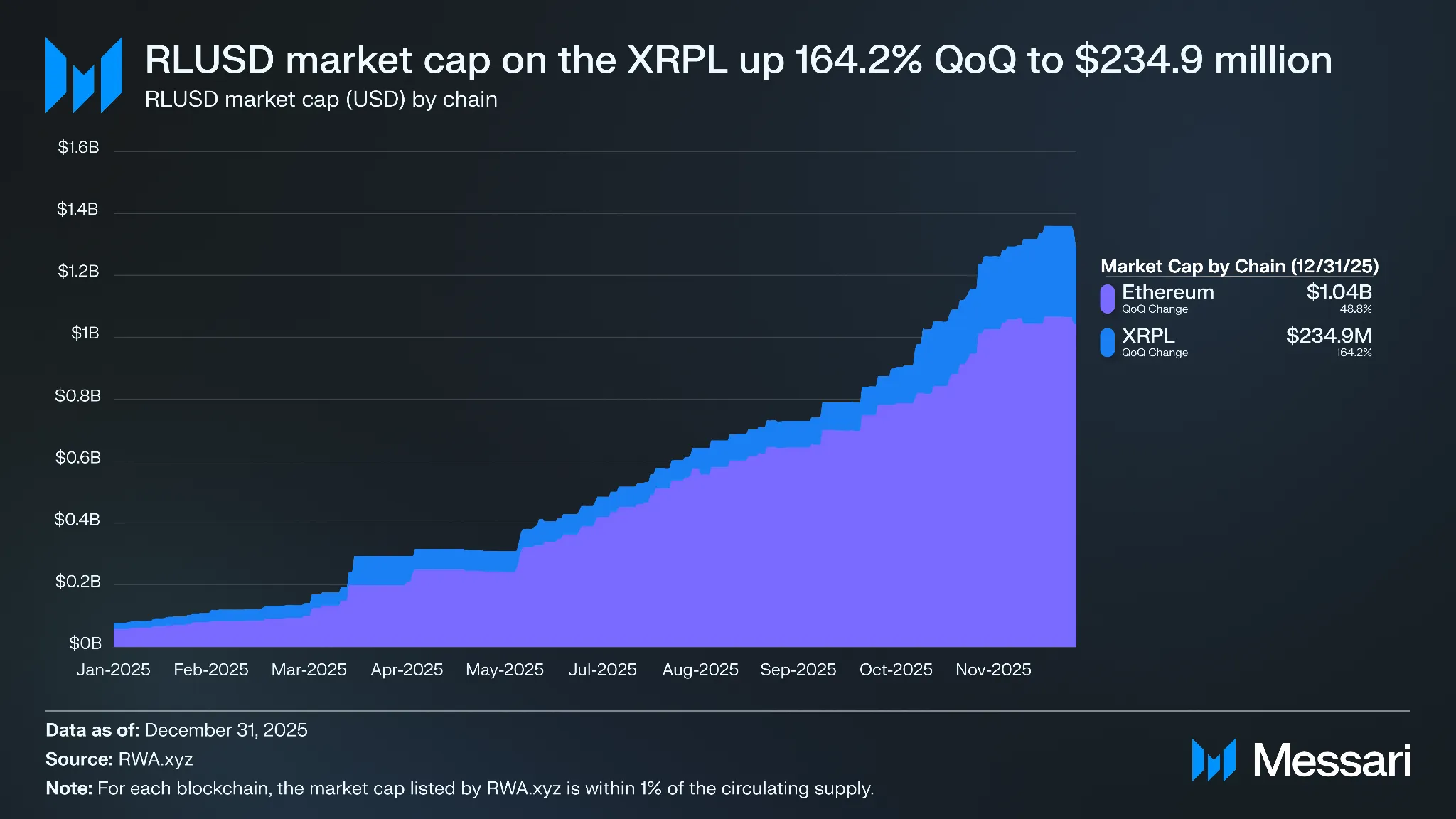

RLUSD Stablecoin Shows Impressive Growth

The RLUSD stablecoin supply on the XRP Ledger experienced significant expansion, with its market cap rising 164.2% QoQ to $234.9 million. While RLUSD on Ethereum saw milder growth at 48.8%, reaching $1.04 billion, the combined market cap closed at $1.28 billion. Current data indicates continued growth, with RLUSD’s total market cap now at $1.49 billion, split between Ethereum and the XRP Ledger. This growth highlights the increasing utility and adoption of stablecoins within the XRP ecosystem.

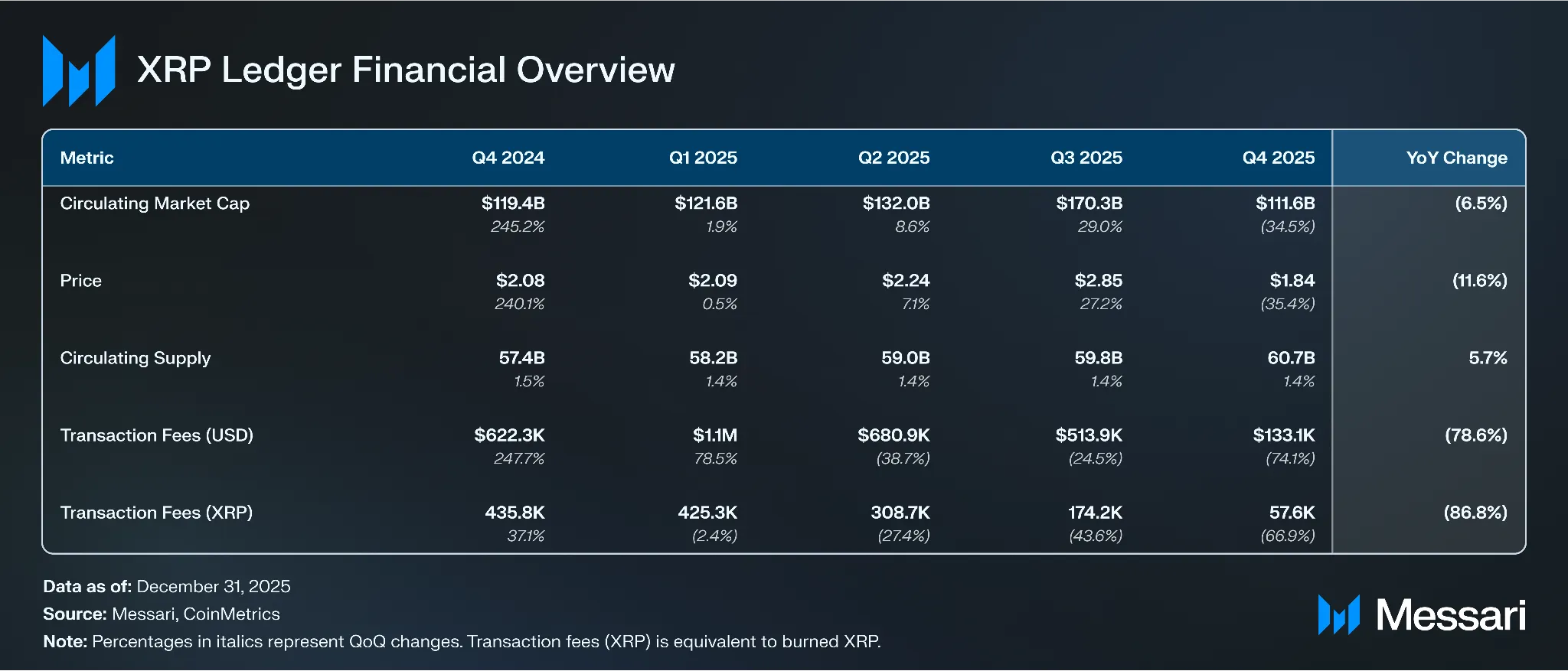

Mixed Signals in Key Financial Metrics

Despite positive developments in ETFs and RWAs, the XRP Ledger experienced downturns in other key metrics. XRP’s circulating supply dropped 34.5% QoQ, from $170.3 billion to $111.6 billion, and its price declined 35.4%, from $2.85 to $1.84. Transaction fees generated on the XRPL also plummeted by 74.1%, reflecting decreased user activity and price volatility. These declines highlight the challenges faced by the XRP ecosystem amid broader crypto market headwinds.

While the Messari report paints a mixed picture of the XRP Ledger’s performance in Q4 2025, the launch and success of spot XRP ETFs, coupled with the growth in RWAs and stablecoins, point to increasing institutional interest. However, declines in circulating supply, price, and transaction fees indicate broader market challenges. Investors should carefully weigh these factors when assessing XRP’s potential in the evolving digital asset landscape.

Related: XRP DeFi Opens to Institutions

Source: Original article

Quick Summary

Messari’s “State of XRP Ledger” report for Q4 2025 highlights both institutional adoption and declines in key metrics. The launch of major US spot XRP ETFs marks a significant step towards mainstream acceptance amid broader crypto market volatility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.