Eight public firms have disclosed allocations to XRP treasury strategies, committing over $2 billion combined. This trend parallels MicroStrategy’s early Bitcoin treasury strategy, indicating institutions are positioning ahead of regulatory clarity.

What to Know:

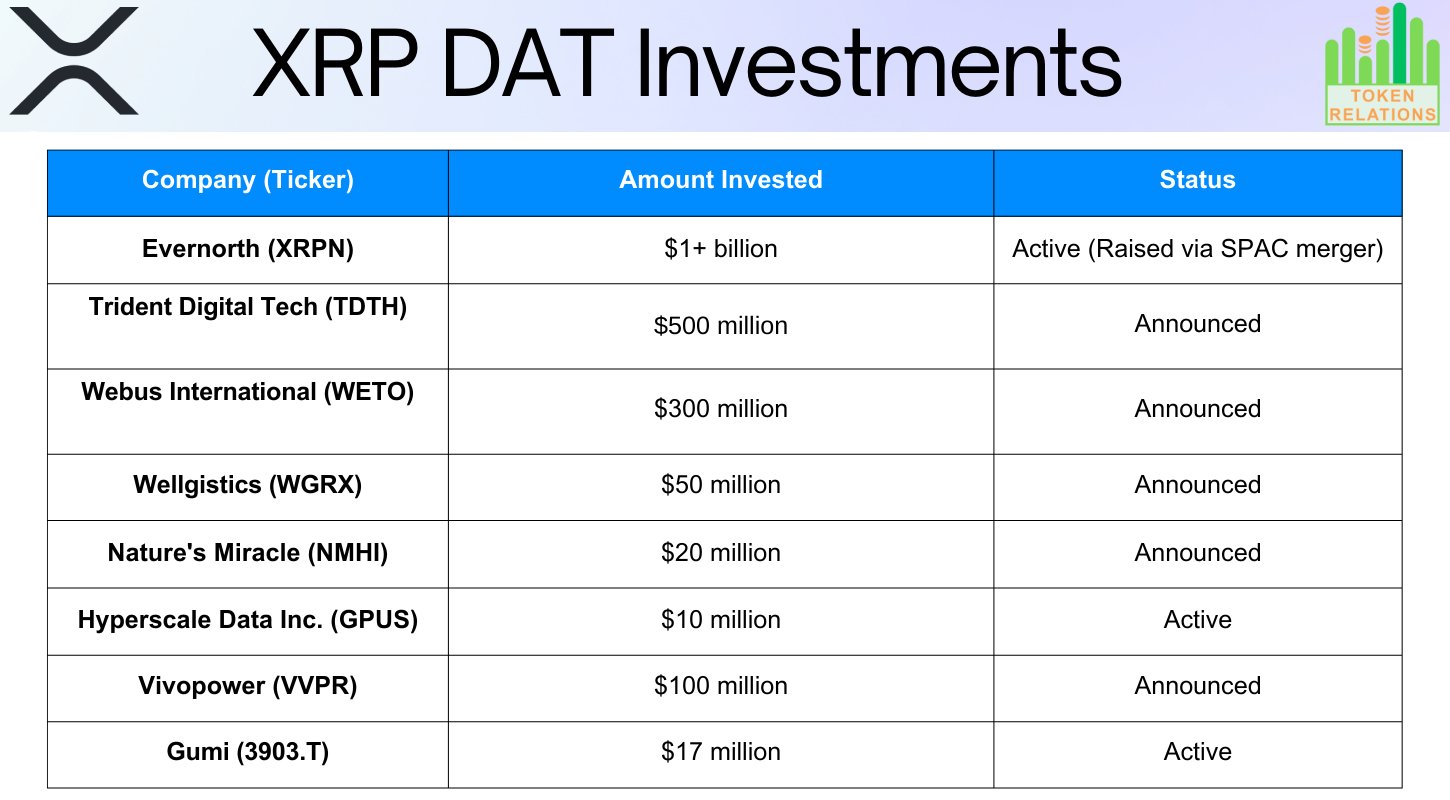

- Eight public firms have disclosed allocations to XRP treasury strategies, committing over $2 billion combined.

- This trend parallels MicroStrategy’s early Bitcoin treasury strategy, indicating institutions are positioning ahead of regulatory clarity.

- XRP’s role may be evolving from a payment tool to a treasury reserve asset, impacting institutional flows and market structure.

A growing number of publicly traded companies are adding XRP to their balance sheets, signaling a potential shift in institutional perception. Over $2 billion has been committed to XRP treasury strategies, with at least eight public firms disclosing allocations through public filings or official announcements. This activity is drawing comparisons to MicroStrategy’s early adoption of Bitcoin, suggesting a similar trajectory for XRP as a strategic treasury asset.

XRP From Speculation to Balance Sheets

The move from speculative trading to long-term treasury holdings indicates a maturing view of XRP among institutions. These firms span multiple industries, including healthcare, energy, gaming, technology, and agriculture, highlighting broad interest beyond the crypto-native space. Several firms have already begun deploying capital, while others have formally announced future allocations, signaling a sustained commitment to XRP.

Largest Allocation: Evernorth Leads With Over $1B

Evernorth (XRPN) leads with the largest reported XRP treasury commitment, exceeding $1 billion. Having already raised the necessary funds through a SPAC merger, Evernorth has begun deploying capital, marking it as the most substantial XRP treasury strategy disclosed to date. This significant investment underscores the growing confidence in XRP as a viable treasury asset.

Notable Commitments

Other firms are also making sizable balance-sheet decisions, indicating a broader trend. Trident Digital Tech (TDTH) has disclosed a $500 million investment, while Webus International (WETO) has announced a $300 million investment in XRP. These nine-figure allocations suggest XRP is being considered at scale, moving beyond experimental exposure.

Energy, Healthcare, and Logistics Join In

Traditional industries are also appearing on the list. Vivopower (VVPR), a sustainable energy firm, has committed $100 million, while Wellgistics (WGRX), a healthcare logistics company, has allocated $50 million. These decisions by conventional businesses highlight the diversification of XRP adoption beyond the tech sector, reflecting a broader acceptance of digital assets in corporate treasury strategies.

Smaller Allocations Expand Industry Diversity

Several additional companies round out the reported list. Nature’s Miracle (NMHI) has committed $20 million in the AgTech sector, Gumi (3903.T), a Japanese gaming company, has an active holding of $17 million, and Hyperscale Data Inc. (GPUS) has an active holding of $10 million in data infrastructure. While smaller in size, these allocations further broaden the range of sectors and regions adopting XRP as a reserve asset.

Implications for XRP and the Crypto Market

The accumulation of XRP by publicly traded companies could have several implications. A shift toward XRP as a treasury reserve asset may reduce its availability on exchanges, potentially impacting liquidity and price discovery. As more institutions allocate capital, the demand for XRP could increase, especially if regulatory clarity improves and institutional settlement systems evolve to accommodate digital assets. The market will be closely watching future filings, deployment timelines, and the overall impact on these companies’ balance sheets.

Related: Bitcoin Recovers: Signals $10K Daily Gain

Source: Original article

Quick Summary

Eight public firms have disclosed allocations to XRP treasury strategies, committing over $2 billion combined. This trend parallels MicroStrategy’s early Bitcoin treasury strategy, indicating institutions are positioning ahead of regulatory clarity. XRP’s role may be evolving from a payment tool to a treasury reserve asset, impacting institutional flows and market structure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.