XRP faces near-term sideways trading but longer-term bearish pressure. A weekly close near $1.2543 support could signal further correction to $1.20. Monitor buyer pressure at $1.4547 for a potential test of the $1.47 resistance zone.

What to Know:

- XRP faces near-term sideways trading but longer-term bearish pressure.

- A weekly close near $1.2543 support could signal further correction to $1.20.

- Monitor buyer pressure at $1.4547 for a potential test of the $1.47 resistance zone.

XRP’s recent price action reflects the broader choppy conditions in the digital asset market. As institutional interest grows, understanding these short-term fluctuations and potential long-term corrections becomes crucial for portfolio management. Investors must weigh technical indicators against the backdrop of regulatory developments and overall market sentiment.

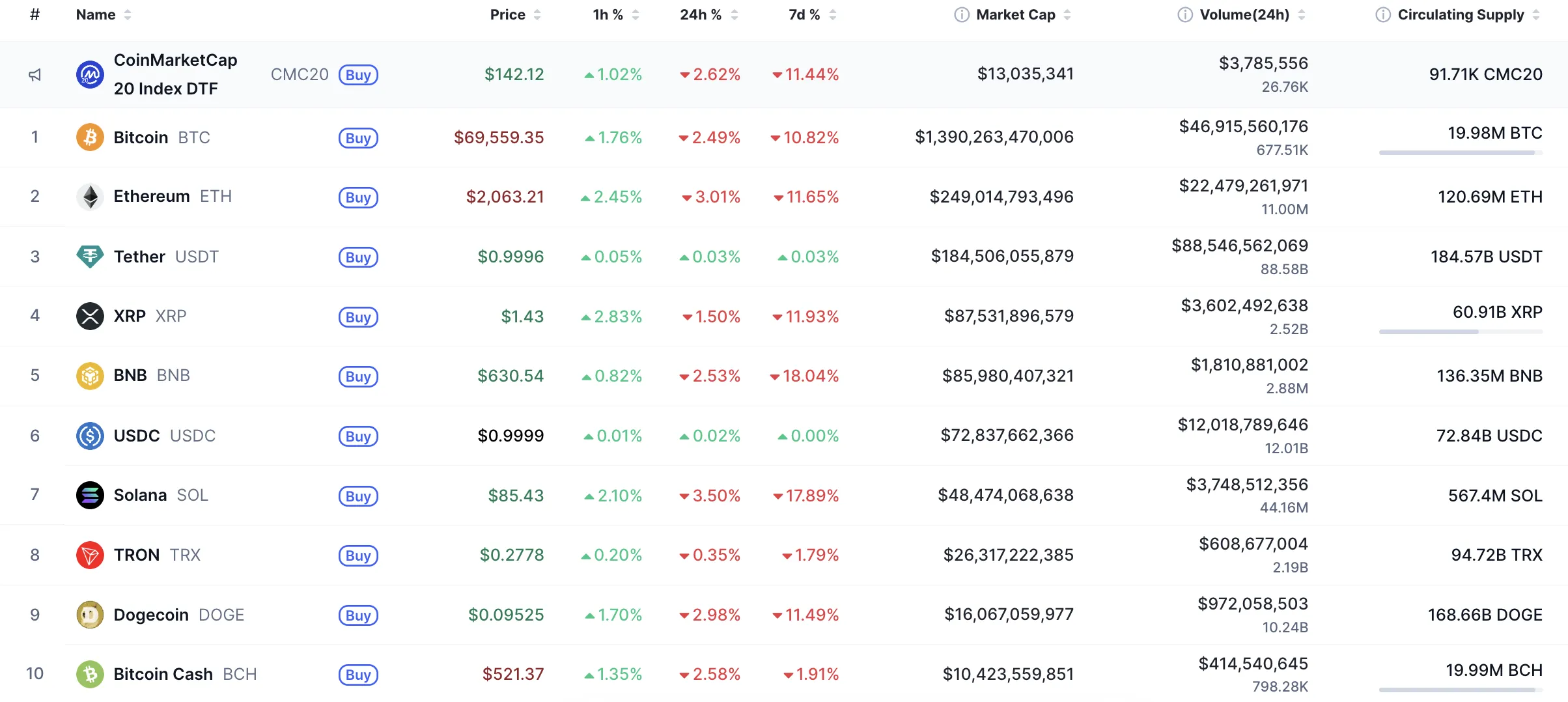

Current Market Overview

The broader crypto market has shown signs of fatigue, with many assets experiencing pullbacks after recent gains. According to CoinMarketCap data, this indicates a cooling-off period as the market seeks direction. Such corrections are typical after periods of rapid growth, allowing the market to consolidate and reassess valuations. Institutional investors often use these periods to rebalance portfolios and evaluate new entry points.

XRP’s Price Action

XRP has experienced a slight decline, mirroring the overall market trend. The short-term technical analysis suggests a potential move towards local resistance levels, but the longer-term view indicates possible further correction. This divergence highlights the importance of considering multiple time frames when assessing potential investment strategies. Traders should monitor these levels closely.

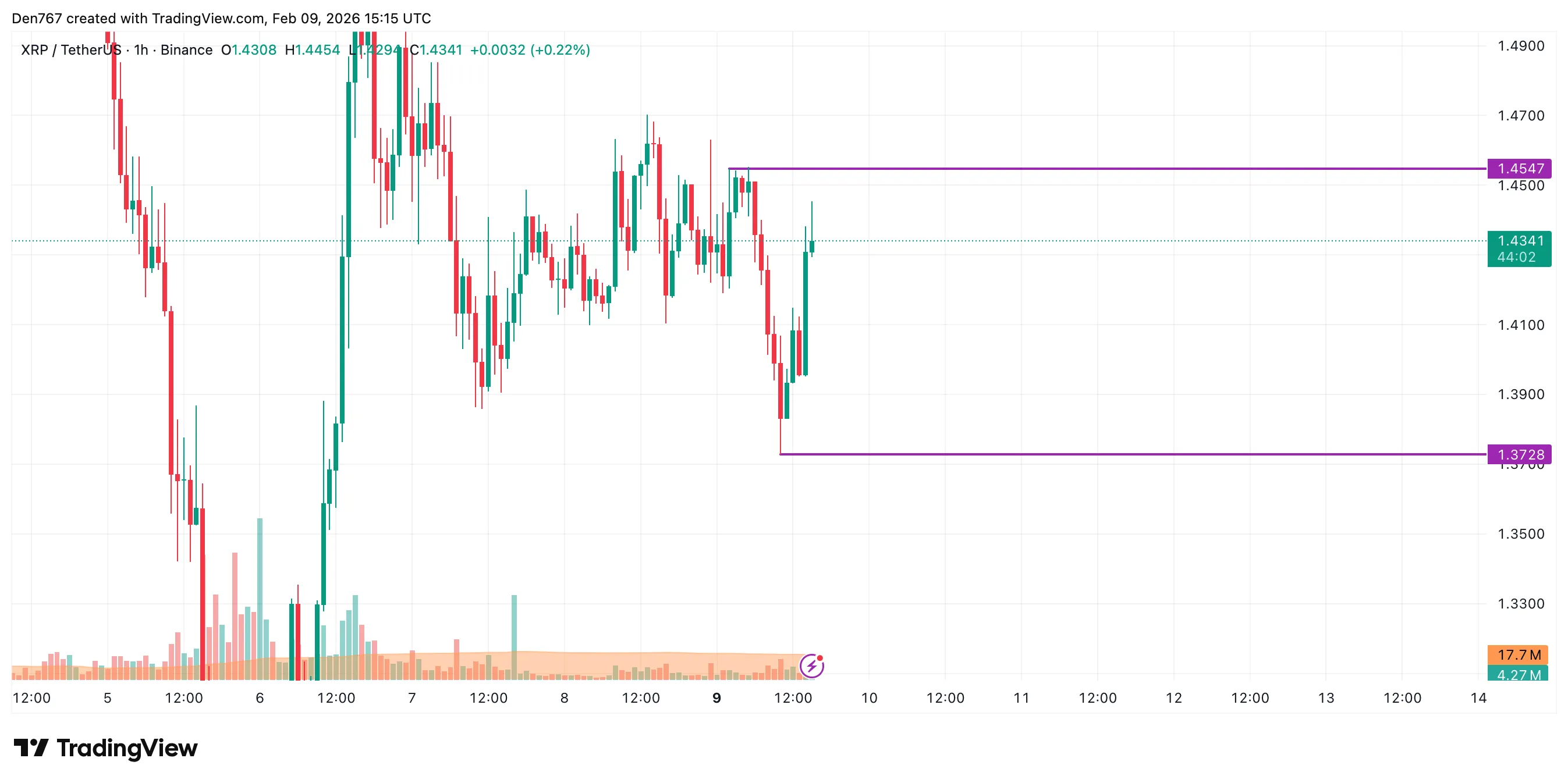

Hourly Chart Analysis

The hourly chart shows XRP’s price attempting to reach a local resistance level of $1.4547. Continued buyer pressure could lead to a test of the $1.47 zone. Successful breach of this resistance could signal renewed bullish momentum, attracting further investment. However, failure to break through might indicate a continuation of the sideways trading pattern.

Sideways Trading Range

Currently, XRP appears to be trading sideways between $1.40 and $1.45. This consolidation phase is typical after a false breakout, allowing the market to establish a new equilibrium. Institutional traders often exploit these ranges, using sophisticated strategies to profit from small price movements while accumulating larger positions. Range-bound trading can persist until a significant catalyst breaks the pattern.

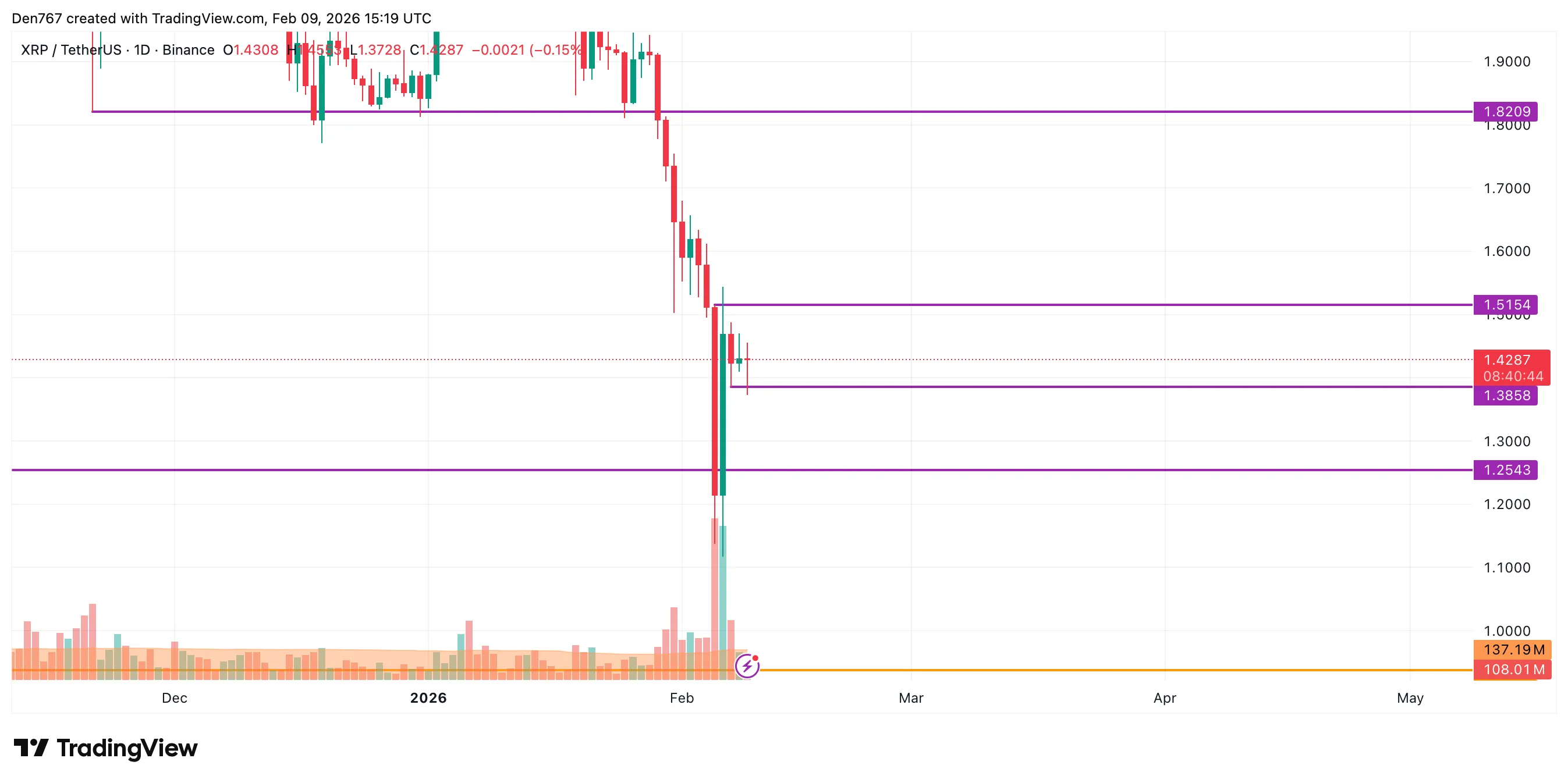

Midterm Bearish Pressure

Despite short-term fluctuations, the midterm outlook suggests that sellers still have the upper hand. A weekly close near the $1.2543 support level could trigger a further correction down to the $1.20 zone. This scenario would likely test investor confidence and could lead to increased volatility. Prudent risk management is essential during such periods.

Potential for Further Correction

The potential drop to $1.20 represents a significant level that could attract both buyers and sellers. A strong bounce from this level might indicate renewed bullish sentiment, while a break below could signal deeper corrections. Institutional investors will be closely watching how XRP reacts to this level, as it could influence their long-term investment decisions. Understanding these potential outcomes is crucial for developing robust trading strategies.

In conclusion, XRP’s current market position reflects a mix of short-term bullish attempts and underlying bearish pressure. The key levels to watch are the $1.4547 resistance and the $1.2543 support. How XRP interacts with these levels will likely dictate its price trajectory in the coming weeks, influencing institutional and retail investor behavior alike.

Related: Ethereum Price Targets Key Level

Source: Original article

Quick Summary

XRP faces near-term sideways trading but longer-term bearish pressure. A weekly close near $1.2543 support could signal further correction to $1.20. Monitor buyer pressure at $1.4547 for a potential test of the $1.47 resistance zone. XRP’s recent price action reflects the broader choppy conditions in the digital asset market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.