Ethereum is exploring a shift toward validating blocks using zero-knowledge proofs instead of re-executing every transaction. This move aims to decouple execution complexity from validation costs, potentially leading to higher throughput on layer-1.

What to Know:

- Ethereum is exploring a shift toward validating blocks using zero-knowledge proofs instead of re-executing every transaction.

- This move aims to decouple execution complexity from validation costs, potentially leading to higher throughput on layer-1.

- The success of this transition could redefine the value proposition for layer-2 blockchains, pushing them toward specialization and interoperability.

Ethereum is quietly prototyping a fundamental shift in its architecture, moving towards validating blocks with zero-knowledge proofs, a move that could redefine its role in the blockchain ecosystem. This transition aims to change Ethereum’s layer-1 function from primarily settling and providing data availability for rollups to enabling high-throughput execution while keeping verification costs low for home validators. The project is not about adding ZK as a feature, but rather prototyping an alternative validation path.

The Ethereum Foundation’s zkEVM team recently published a roadmap outlining key areas of focus through 2026, including standardization of execution witnesses and guest programs, consensus layer integration, and security measures. EIP-8025 specifies the mechanics, stating that it does not require a hard fork and remains backward compatible, while nodes can still re-execute as they do today. The end-to-end pipeline involves an execution-layer client producing an ExecutionWitness, which is then consumed by a standardized guest program and validated by a zkVM.

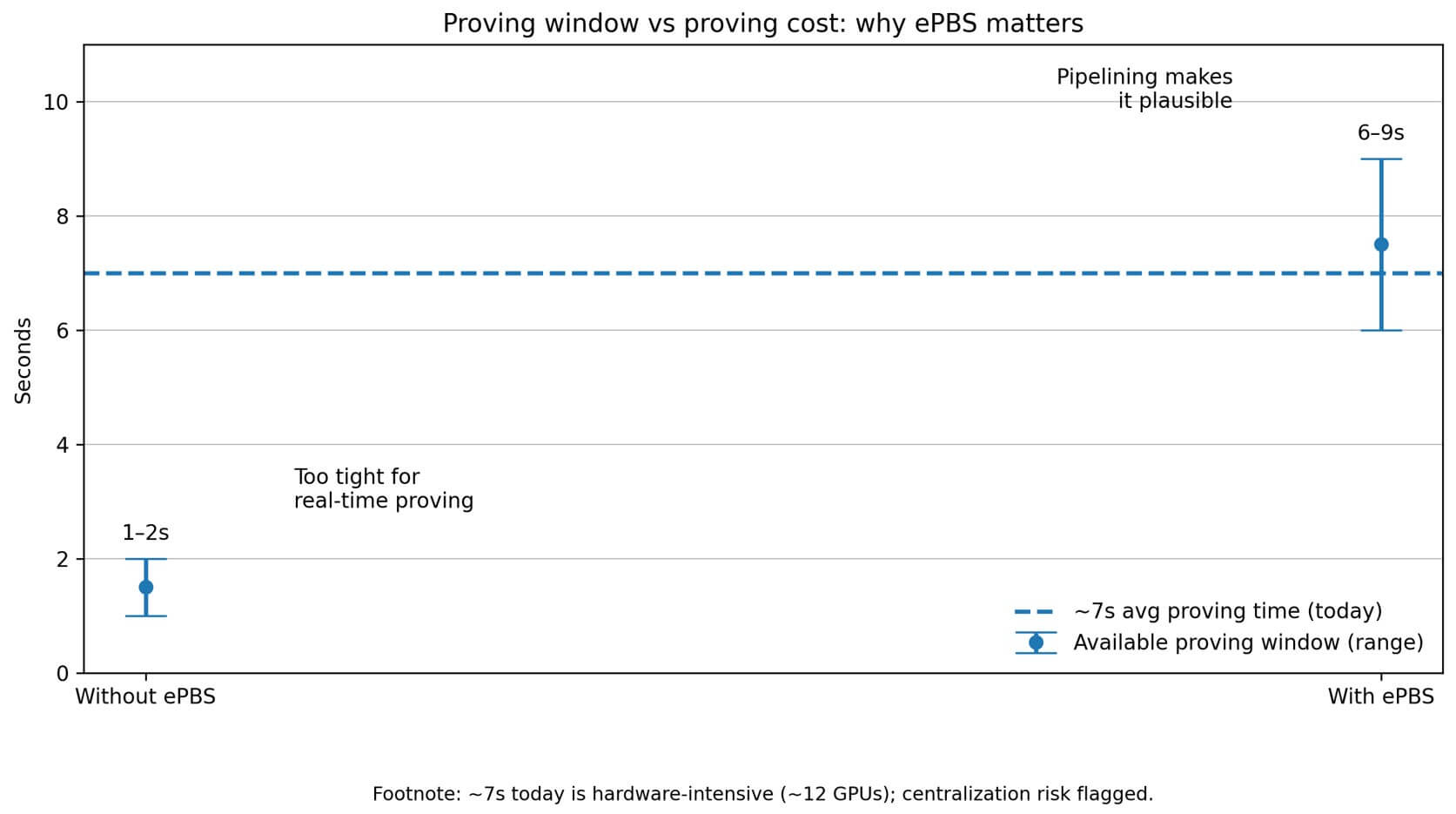

A critical dependency for this transition is ePBS (Enshrined Proposer-Builder Separation), targeted for the upcoming Glamsterdam hardfork, which extends the proving window. Without ePBS, the proving window is roughly one to two seconds, which is too tight for real-time proving, but with ePBS providing block pipelining, the window extends to six to nine seconds. The design aims to address centralization by introducing client diversity at the proving layer.

This shift opens the door for more home validators to participate without maintaining full execution layer state, potentially raising gas limits as validation cost decouples from execution complexity. However, it also introduces the risk of centralization in proving, as generating proofs can be hardware-intensive. The most honest framing is that Ethereum is shifting the decentralization battleground.

Optional execution proofs and witnesses are the concrete mechanism that makes stateless validation practical. A stateless node requires only a consensus client and verifies proofs during payload processing. This matters for gas limits because if validators can verify proofs rather than re-executing, the verification cost no longer scales with the gas limit.

If Ethereum can scale to high throughput while keeping verification costs low, rollups can’t justify themselves on the basis of “Ethereum can’t handle the load.” The new differentiation axes are specialized virtual machines, ultra-low latency, preconfirmations, and composability models like rollups that lean on fast-proving designs. Layer-1 becomes the high-throughput, low-verification-cost execution and settlement layer. Layer-2s become feature labs, latency optimizers, and composability bridges.

Ethereum’s exploration of zero-knowledge proofs for block validation marks a significant step toward enhanced scalability and efficiency. While challenges remain, particularly regarding potential centralization risks, the long-term implications for Ethereum and the broader layer-2 ecosystem are substantial. This move could pave the way for a more robust and versatile blockchain environment, fostering innovation and broader adoption.

Related: Bitcoin Stalls: Derivatives Data Signals Caution

Source: Original article

Quick Summary

Ethereum is exploring a shift toward validating blocks using zero-knowledge proofs instead of re-executing every transaction. This move aims to decouple execution complexity from validation costs, potentially leading to higher throughput on layer-1.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.