An XRPL developer’s plan to sell XRP at $27 sparked debate about profit-taking versus holding. This discussion occurs amid broader market uncertainty and varying investment strategies.

What to Know:

- An XRPL developer’s plan to sell XRP at $27 sparked debate about profit-taking versus holding.

- This discussion occurs amid broader market uncertainty and varying investment strategies.

- It highlights the tension between short-term gains and long-term belief in XRP’s potential, relevant for institutional portfolio management.

A recent discussion within the XRP community has brought the age-old debate of profit-taking versus long-term holding back into focus. An XRPL developer, known as Bird, shared his strategy to gradually exit his XRP position at target prices of $10, $27, and higher. This has ignited a flurry of responses, underscoring the diverse approaches investors take in the digital asset space, especially concerning XRP and its future prospects.

XRPL Developer Outlines Exit Strategy

Bird’s rationale for taking profits centers on rebalancing his life after dedicating five years to crypto. He aims to diversify his gains into tangible assets and real-world pursuits, such as buying a home and supporting his family. He openly stated that his biggest regret was not securing gains earlier, adding that taking profits is not a sign of wavering belief, but rather a disciplined approach to wealth management.

XRP’s Current Market Position

Currently, XRP is trading around $1.43, a price point that makes Bird’s $27 target seem ambitious to some. This gap has led to questions about the timing of discussing exit strategies when previous highs have yet to be reclaimed. However, others see Bird’s approach as a pragmatic reminder of the importance of risk management in a volatile market.

Balancing Long-Term Vision with Pragmatism

Community figure Arthur voiced his support for profit-taking, even while maintaining a bullish outlook on XRP’s long-term potential.

Taking profit at $10 makes sense to me.

I believe $XRP will be $100 in the next 5-10 years.

Taking profit along the way doesn’t change my conviction in the long run.

I’m just not going to be stupid and watch my bags go to zero.

HODL isn’t a strategy, it’s a cope.

— Arthur (@Arthur_0x) February 9, 2024

He argues that securing profits along the way doesn’t negate a long-term conviction. User Majiq Mat pointed out recent market retracements, advocating for tiered profit-taking to allow investors to rebuy tokens at lower prices if opportunities arise.

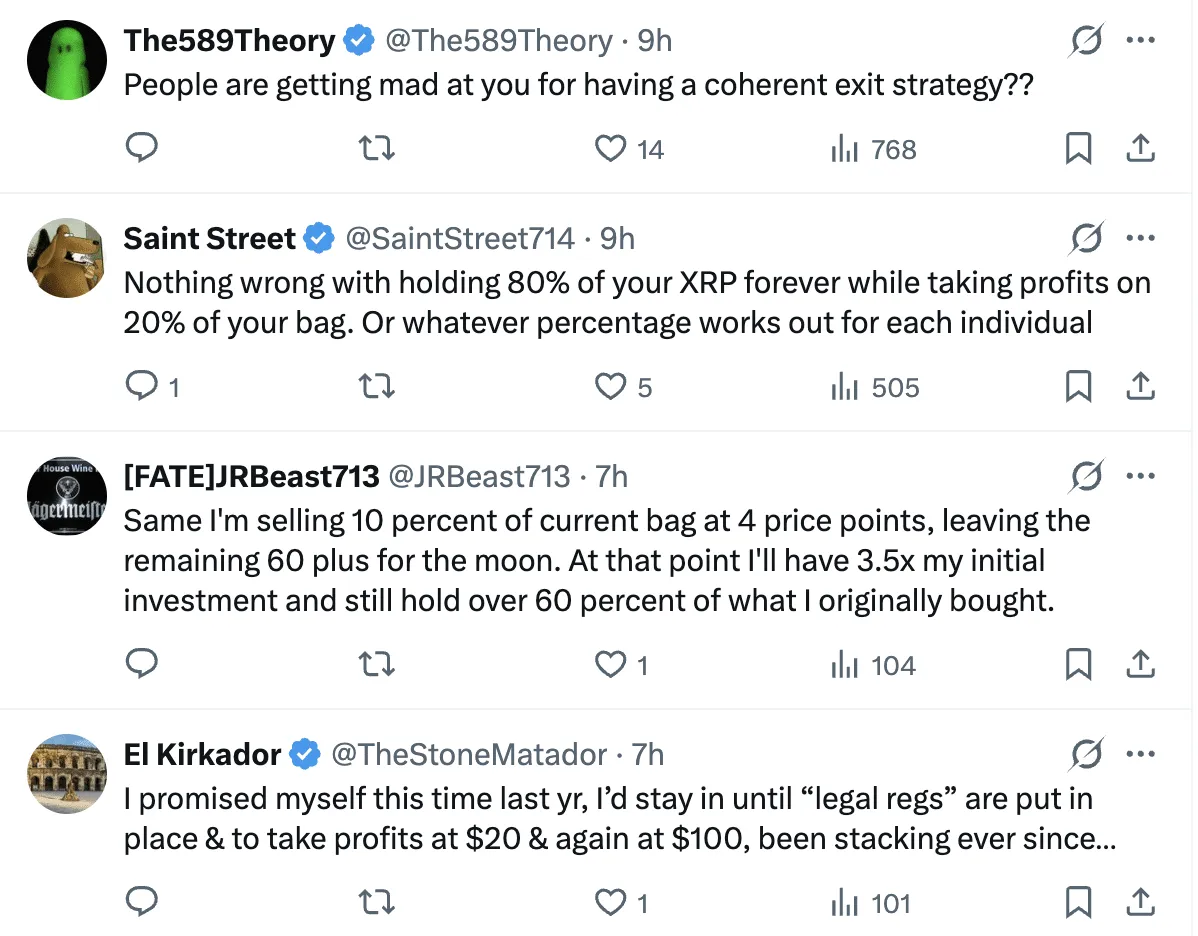

Diverse Strategies: Selling Small, Holding Big

Many in the XRP community appear to favor a balanced approach. JRBeast outlined a strategy to sell 10% of his XRP holdings at four different price levels, while retaining over 60% for the long haul. This approach allows him to realize a significant return on his initial investment while maintaining a substantial position in XRP. Saint Street echoed this sentiment, suggesting that holding 80% of XRP indefinitely while taking profits on the remaining 20% is a sound strategy.

The Impact of Yield on Holding Strategies

The discussion also touched on the potential impact of yield-based services on holding strategies. User @naivetyisbliss raised the idea that earning a 3% annual return on 10,000 XRP held at $25 could diminish the need to sell. Higher price levels, such as $50 and above, could further incentivize long-term holding through yield generation, potentially reshaping how investors approach profit-taking in the future.

The debate sparked by the XRPL developer’s exit strategy underscores the multifaceted nature of investing in XRP. While some advocate for unwavering long-term holding, others emphasize the importance of securing profits and rebalancing portfolios. Ultimately, the optimal approach depends on individual risk tolerance, investment goals, and the evolving landscape of the digital asset market.

Related: XRP Buy Signal: Derivatives Data Turns Bullish

Source: Original article

Quick Summary

An XRPL developer’s plan to sell XRP at $27 sparked debate about profit-taking versus holding. This discussion occurs amid broader market uncertainty and varying investment strategies. It highlights the tension between short-term gains and long-term belief in XRP’s potential, relevant for institutional portfolio management.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.